Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Sep, 2021

By Allison Good

This story about pipeline infrastructure projects is the second part of a two-story outlook on U.S. natural gas pipelines. The first story, which covers changes in gas pipeline and storage asset numbers in the last few years, can be found here.

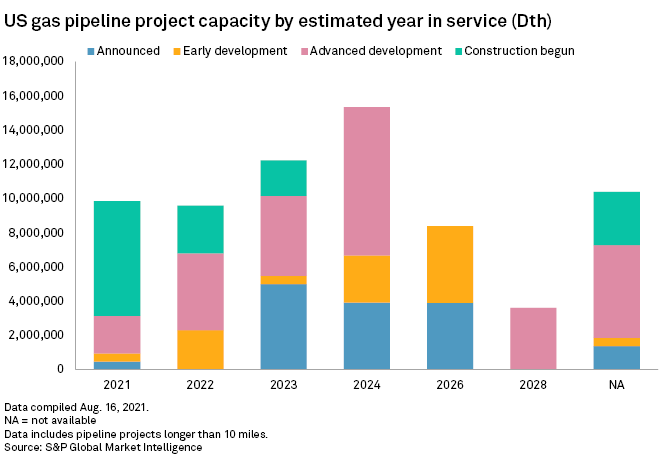

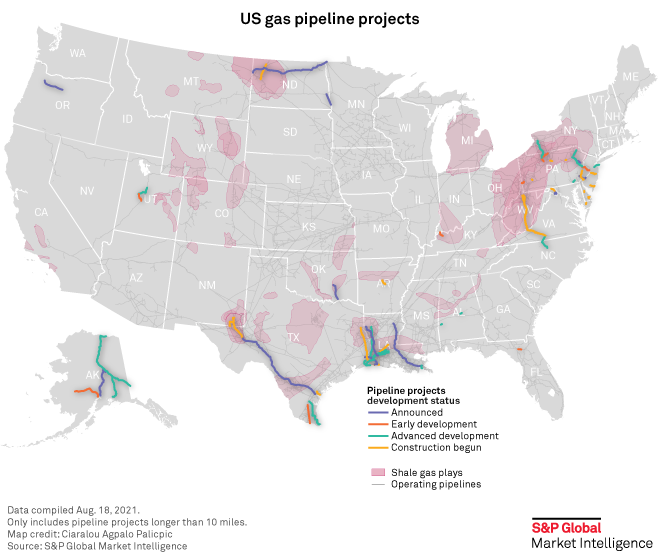

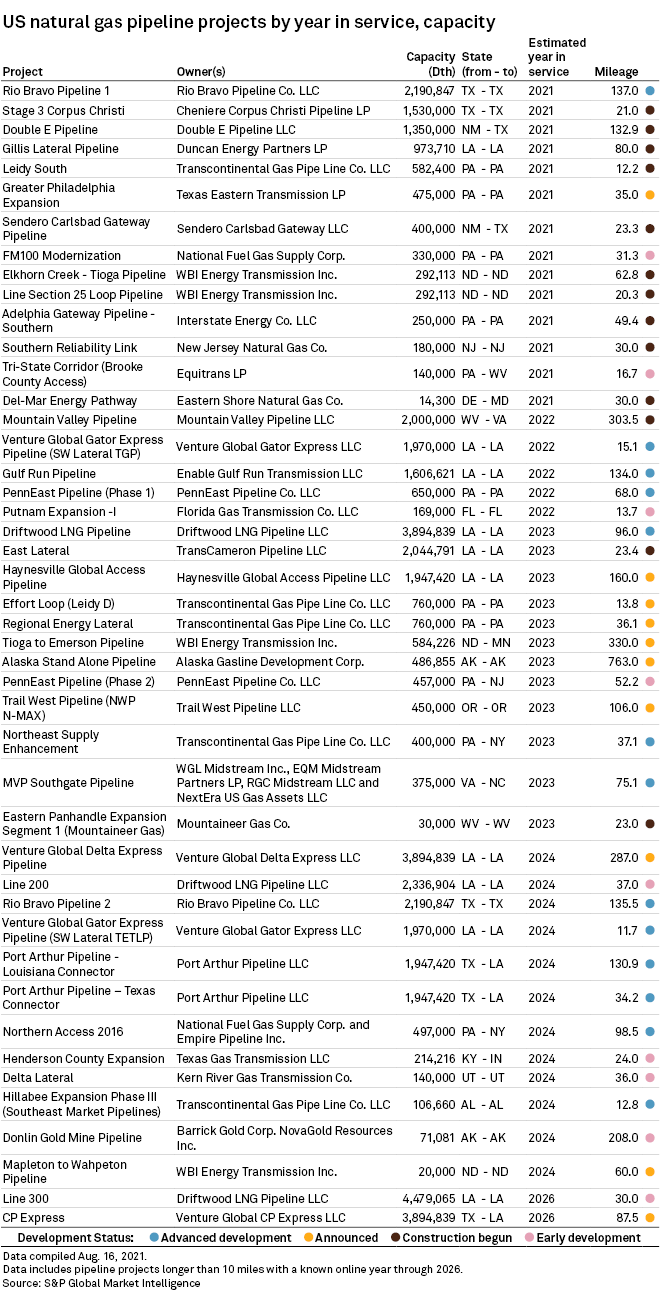

LNG export facilities and their demand for supplies will drive a large portion of U.S. natural gas pipeline construction through 2026, according to an analysis of S&P Global Market Intelligence data.

Of the 45 pipeline projects projected to come online over the next five years, at least 16 are tied to liquefaction terminals that are operating or under development on the Gulf Coast, with six export facilities expected to begin commercial service in 2024 alone. Other pipeline projects are designed to bring gas to utility distribution systems, power generation plants and other end uses.

Venture Global LNG plans to build just over 400 miles of gas pipelines to serve its proposed Calcasieu Pass, Plaquemines and Delta LNG terminals, which would have a combined production capacity of 50 million tonnes per year of LNG.

Tellurian Inc., meanwhile, has 323 miles of pipeline under development for the planned Driftwood LNG LLC terminal, anticipated to begin construction in 2022. The company also said it may buy up more acreage in the Haynesville Shale or enter into a business combination that would allow it to fill out its upstream portfolio.

LNG is the fossil fuel poised to have the biggest earnings advantage as the North American midstream sector's great pipeline build-out cycle winds down, according to a July Sanford C. Bernstein & Co. report. In 2022, capital expenditure for most midstream companies is expected to be minimal, and "in some cases, over 70% lower than 2019 levels for the company," analysts wrote.

With traditional natural gas maintaining a slower growth curve and facing minimal rate reduction risks as hurdles to new infrastructure construction get higher in the U.S., LNG will perform best when it comes to long-term volumes, Bernstein said. Overseas demand for gas supply in Asia and Europe is lifting the prospects for the fuel.

Other LNG projects putting pipe in the ground through 2026 will include NextDecade Corp.'s Rio Grande, Sempra's Port Arthur, and Exxon Mobil Corp. and Qatar Petroleum's Golden Pass. Delays in the development of Port Arthur, however, recently prompted Polish Oil and Gas Co. to end a deal for buying 2 Mt/y of LNG from the facility and to sign similar agreements to purchase the same amount from Venture Global terminals. Sempra executives also confirmed the expiration of a deal with Saudi Arabian Oil Co. to finalize a supply agreement for 5 Mt/y of LNG from Port Arthur LNG terminal and take a 25% stake in the project's first phase.

Several gas pipeline projects scheduled to come online by the end of 2026 have also faced permitting delays, including the Equitrans Midstream Corp.-led Mountain Valley Pipeline LLC and Williams Cos. Inc.'s Northeast Supply Enhancement project out of the Appalachian Basin.

Even though the U.S. Supreme Court in June removed a legal threat to the PennEast Pipeline Co. LLC project, which would run from Pennsylvania to New Jersey, ongoing regulatory challenges forced project partners UGI Corp., New Jersey Resources Corp. and South Jersey Industries Inc. to each book impairments of roughly $90 million for the second quarter of 2021.

Unresolved issues for PennEast include a request to the Federal Energy Regulatory Commission to approve the partners' plan to advance the project in two phases.

For Williams, Transcontinental Gas Pipe Line Co. LLC's Leidy South and Regional Energy Access build-outs to flow more Marcellus and Utica shale supplies "should be fully subscribed," Bernstein said.

A study funded by the INGAA Foundation, the research arm of the trade group representing the interstate gas pipeline industry, found that pipeline companies could add 33 Bcf/d of gas transportation capacity over 2020-2025, but it said permitting and legal hurdles to construction are increasing and forcing some projects to be canceled.