S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Jan, 2023

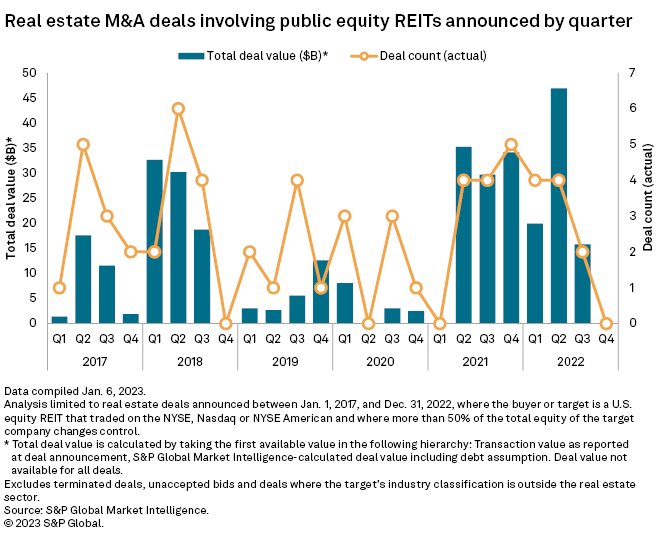

After a strong year in 2021, real estate M&A activity involving public U.S. equity real estate investment trusts remained high in 2022.

Ten deals were announced in 2022 for a combined $82.63 billion in transaction value, down only 16.6% from the sky-high $99.09 billion aggregate transaction value announced in 2021, according to S&P Global Market Intelligence data.

The analysis included real estate deals where either the buyer or target is an equity REIT that trades on the Nasdaq, NYSE or NYSE American.

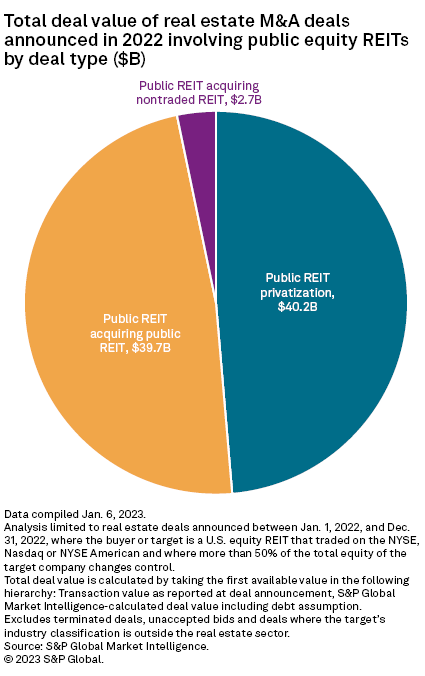

Large REIT privatizations comprise nearly half of total transaction value

|

Public REIT privatizations accounted for $40.20 billion of the 2022 total.

The most recent deal came in September with Oak Street Real Estate Capital LLC and GIC Pvt. Ltd. agreeing to acquire STORE Capital Corp. for $14 billion.

Subsidiaries of Blackstone Inc. took three REITs private during the year, the largest being the $12.80 billion acquisition of American Campus Communities LLC. Blackstone also acquired PS Business Parks Inc. for $7.60 billion and Preferred Apartment Communities Inc. for $5.80 billion.

Deals with public REITs acquiring other public REITs accounted for $39.73 billion of the aggregate transaction value figure.

A huge industrial sector deal was the largest transaction of the year as Prologis Inc. purchased Duke Realty Corp. for roughly $25.60 billion.

Another large deal came from the healthcare sector with Healthcare Trust of America Inc.'s reverse merger with Healthcare Realty Trust Inc., a deal valued at $11.15 billion.

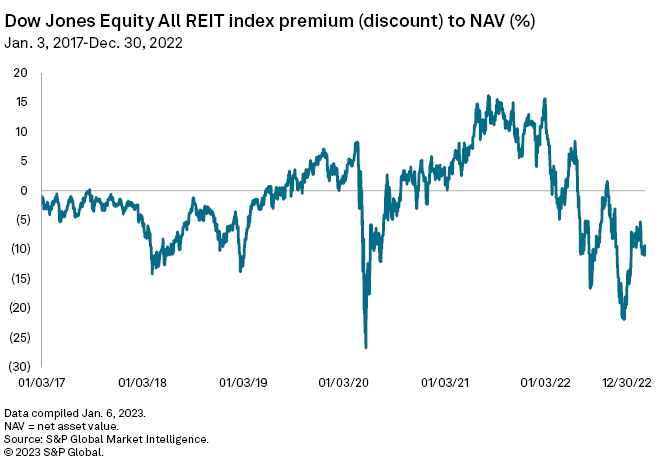

REIT index ends 2022 at discount to net asset value

The Dow Jones Equity All REIT Index finished 2022 at a market-cap-weighted 10.1% discount to net asset value. Within the REIT sector, office and hotel REITs traded at the steepest discounts to NAV, followed by the regional mall and timber REITs. On a median basis, the casino and communications sectors were the only property sectors trading at premiums to NAV at the end of 2022.