Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Dec, 2021

By RJ Dumaual

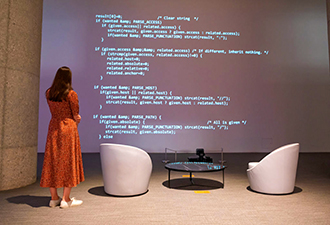

The source code for the World Wide Web, depicted in an NFT, is auctioned off at Sotheby's on June 29, 2021.

Nonfungible tokens have grown in popularity in 2021, generating millions in sales, but there is very little insurance for this burgeoning market.

Auction house Christie's Inc. said in late September that it surpassed the $100 million mark in nonfunigible token, or NFT, sales worldwide in less than a year, headlined by an NFT by the digital artist known as Beeple selling for $69 million in March. A sale of virtual sneakers also generated $3.1 million, while an image of a Gucci ghost is selling for thousands.

There is currently no comprehensive insurance policy covering NFTs, which are pieces of unique digital art certified as authentic by blockchain. That is due to a number of factors, including the need for NFTs to hit "critical mass," said Mary Pontillo, senior vice president and national fine art practice leader at Risk Strategies.

"Underwriters will need to see consistent values and at a higher level in order to contemplate a viable insurance solution," said Pontillo, whose company can insure either a physical part of the NFT or the physical key, but only if held by a third party.

Other challenges include the nonphysical nature of NFTs, which prevents underwriters from providing coverage under their current reinsurance agreements and policy language structures, and the ever-changing valuations of cryptocurrencies and thus NFTs.

The lack of insurance policies for NFTs is "inexcusable," according to lawyers for Pillsbury Winthrop Shaw Pittman LLP, given insurers already know that physical collectibles and personal items are assets with great value to their owners.

They pointed to a number of reasons for the lack of coverage, including the NFT market being less valuable than the cryptocurrency market and insurers possibly not yet having enough information to understand how to price the risks associated with NFTs.

Adoption in insurance

While a comprehensive insurance solution for NFT protection has yet to be introduced, an insurtech company has made the smart contracts that assign ownership and manage the transferability of NFTs a centerpiece of its product offering.

Arbol Inc. built a model using smart contracts in the blockchain that define the parameters of when an event-driven insurance policy pays out, which received an "overwhelming" response from clients, co-founder and chief data scientist Osho Jha said.

Arbol's original policies were structured and stored as NFTs, and the insurtech had refined that technology but were unable to release it because of regulations, Jha added.

As with any new asset class, not all NFTs are good investments. Because many tokens are blockchain native, they have many potential applications in decentralized finance, including being used as collateral for loans and as a means to digitize analog assets.