Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jan, 2021

By Polo Rocha

The recent jump in U.S. inflation expectations is positive news for the Federal Reserve, but it may only reflect anticipation of a short-term move back to normal rather than the more sustained increase the Fed seeks.

Bond investors have upgraded their outlook on inflation in recent weeks, an encouraging prospect for Fed officials after the COVID-19 pandemic prompted a sharp drop in inflation expectations.

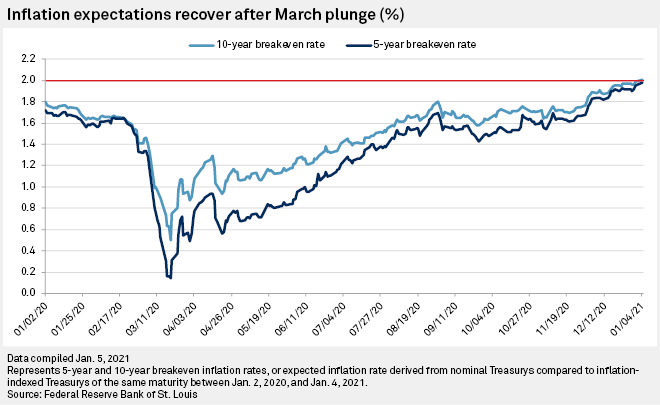

But the increases in the 10-year breakeven inflation rate, which climbed above 2% on Jan. 4 for the first time since 2018, may reflect a near-term rebound in prices instead of the reversal of longer-term disinflationary pressures that Fed officials have worried about.

Inflation expectations will need to keep climbing higher to imply that bond investors are confident the Fed's low-interest-rate policies will produce the inflation results it is aiming for: a temporary overshoot of its 2% inflation goal to make up for years of weak inflation.

"They need to reverse those long-term inflationary trends and get inflation expectations higher," said Tom Graff, head of fixed income at Brown Advisory. "That's going to be a lot harder than just getting one quick burst [of inflation] as the pandemic subsides."

Evidence that inflation expectations currently point more toward short-term, transitory factors can be found in the narrow gap between 10-year and 5-year inflation breakevens, which Graff said indicates investors see inflation rebounding over the next five years before returning to more muted gains for the remainder of the next decade.

A 10-year inflation breakeven rate of about 2% also does not necessarily mean investors see the Fed meeting its 2% inflation target over the next decade just yet. That is because the breakeven rate is based off the consumer price index, which generally trends a bit higher than the Fed's preferred inflation gauge — the core Personal Consumption Expenditures Price Index.

Still, it represents progress for a central bank that has been keenly focused on increasing inflation expectations, given that low expected inflation can put downward pressure on actual inflation.

Fed Chairman Jerome Powell flagged the rebound in inflation expectations at his Dec. 16, 2020, news conference, saying it indicates that investors have found the central bank's brand-new policy framework credible. Fed officials announced in August 2020 that they would look to keep interest rates lower for a longer period, partly to help temporarily lift inflation above 2% and roughly average out the years the Fed has spent below the target.

Markets initially seemed skeptical the Fed's new framework would prompt an average of 2% inflation, but the gradual rise in inflation expectations shows investors are "finally starting to believe" the Fed's messaging, said Aneta Markowska, chief financial economist at Jefferies LLC.

That is partly due to constant reminders from Fed leaders that they will not overreact to near-term inflation increases by tapping the brakes on the economy prematurely. Powell, for example, said in December 2020 an inflation jump tied to pent-up demand for travel and services has "all the markings of a transient" increase the Fed would look past.

Fed officials' forecasts show they could keep their benchmark federal funds rate at effectively 0% through 2023. They have promised to keep buying at least $120 billion in bonds per month until they see "substantial further progress" in their dual goals of maximum employment and stable prices.

Tweaks to the bond-buying program are possible this year, but Fed officials stressed Jan. 4 that a full recovery will take time and that the central bank will be patient in removing its support.

"Monetary policy will need to remain highly accommodative for quite some time because achieving our monetary policy goals is likely to be a journey and not a sprint," Cleveland Fed President Loretta Mester said in a speech, adding that inflation is unlikely to "move up quickly above 2%."

Chicago Fed President Charles Evans also said it "will take a long time for average inflation to reach 2%."

The core PCE index, which strips out food and energy prices, rose by 1.4% year over year in November 2020. That figure should strengthen in the coming months as last spring's shock fades from the annual calculations, but the increases are unlikely to be "long-lasting," Evans told reporters after a panel discussion at the Allied Social Science Associations' annual meeting.

Evans said he would like to see inflation hitting about 2.5% to help average out past underperformance, though he noted that scenario may not happen for years. The public and market participants "should be prepared for a period of very low interest rates and an expansion of our balance sheet," he said in prepared remarks.

Fed officials also added the goal of a "broad-based and inclusive" job market recovery to its framework, an objective that could take time to achieve, and they underlined the Fed's intention to run the job market hot without being overly worried about too-high inflation.

"The Fed is nowhere near to doing anything anytime soon," said Greg Faranello, head of U.S. rates at AmeriVet Securities.