S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2023

By Yuzo Yamaguchi and Marissa Ramos

Japanese megabanks plan to grow their presence in Asia-Pacific in 2023 via acquisitions despite the risk of recession in key global economies.

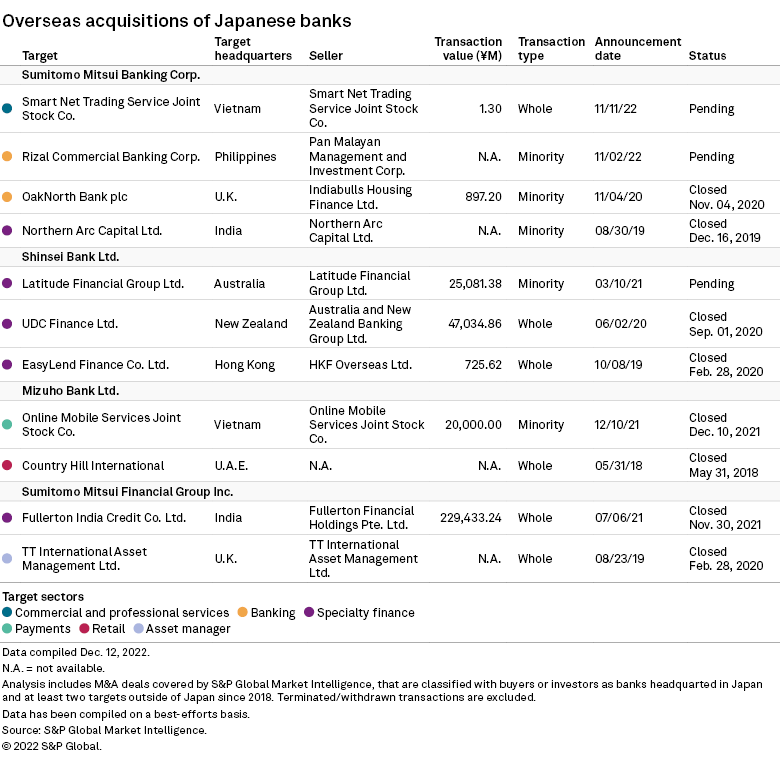

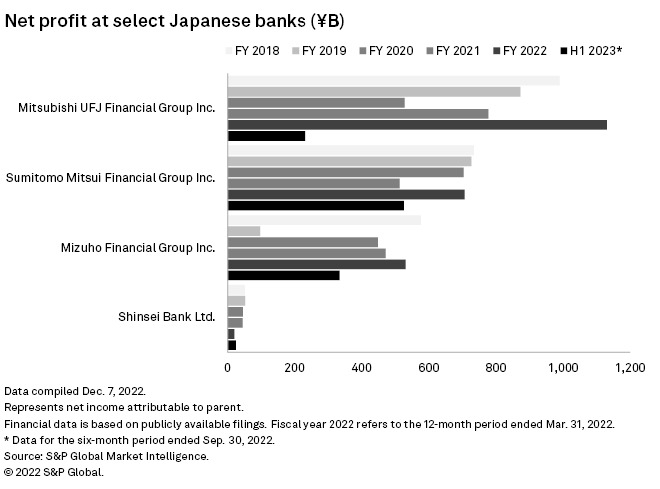

Mitsubishi UFJ Financial Group Inc., or MUFG, which earns about half of its net operating profit from overseas operations, expects to close deals worth at least a combined ¥108 billion in Asia-Pacific in 2023. The bank and its subsidiaries announced plans in 2022 to acquire various consumer finance and securities businesses in the Philippines, Indonesia and Thailand.

Sumitomo Mitsui Financial Group Inc. is considering bigger holdings in some of its existing ventures in India, Indonesia, the Philippines and Vietnam. The megabank is Japan's second-largest lender after MUFG and aims to increase the net profit from those businesses to ¥100 billion in the fiscal year ending March 2026, from about ¥60 billion in the current fiscal year ending March 2023, according to Takashi Masatoki, head of strategic planning group of strategic planning department of the bank's global business unit.

"If the U.S. economy slows down more deeply, that would increase the risk of economic disturbance in Asian countries," Chizuru Tateno, a credit analyst at S&P Global Ratings Japan said. "The risk of tarnishing the bank groups' earnings and assets will likely heighten."

Following years of expansion, Japanese megabanks' risk and earnings profiles are becoming more susceptible to global economic cycles as their revenue from operations abroad increases. While that approach gives Japanese lenders new engines of growth as their home market is dragged by ultralow interest rates and a declining population, it would also lead to higher credit costs and earnings hit when global recession risk rises.

While global economic growth is expected to slow this year, economies in Asia-Pacific are expected to fare better than their U.S. and European counterparts. Asia-Pacific's gross domestic product is projected to grow 4.3% in 2023, led by Vietnam, Cambodia and India, outperforming the average global forecast of 2.7% growth, according to the International Monetary Fund.

Beyond near-term

A softening near-term outlook does not seem to be discouraging the Japanese banks from seeking growth abroad, according to senior executives at the lenders.

"We expect financing [business] to be profitable" in Southeast Asia, given that even the low-income customers are bankable, Ryotaro Suzuki, managing director and head of global planning department at MUFG Bank Ltd., a banking unit of MUFG, told S&P Global Market Intelligence.

MUFG offers more overseas loans than its peers. Its exposure to Thailand, where it owns about 77% of Bank of Ayudhya PCL, represented 4.4% of its global loan book, while Indonesia, where it also holds more than 90% of PT Bank Danamon Indonesia Tbk, accounted for 1.5% of its overall loans, according to estimates from S&P Global Ratings. Exposure to other Asian countries, excluding mainland China, accounted for less than 1% for the two megabanks, the rating agency added.

In Asia, MUFG and Sumitomo Mitsui focus on retail banking, leaving them more exposed to potential slowdown in consumer spending and related defaults should the global economy slow, analysts said. Mizuho, on the other hand, focuses more on transaction finance in the region, which leave it more vulnerable to weakness in trade and corporate investment, they added.

"Asia will be a main battlefield for us as GDP growth is high, interest rates are high and a recession isn't creeping into there," Sumitomo Mitsui's Masatoki said.

While a net overseas operating profit ratio at MUFG — including profits from its U.S. affiliate Morgan Stanley — stood at about 50% in recent years, the ratio from its mainstay operations made up 36.2% of the total for Sumitomo Mitsui for the fiscal first half ended Sept. 30, up from 27.5% for the same period of the previous year.

Mizuho does not provide a profit breakdown by region.

Imminent risk

"They are in the right direction and their fundamentals have been bottoming out after COVID-19 in Asia for now," Koichi Niwa, an analyst at Citigroup Global Markets Japan, said of Japanese banks.

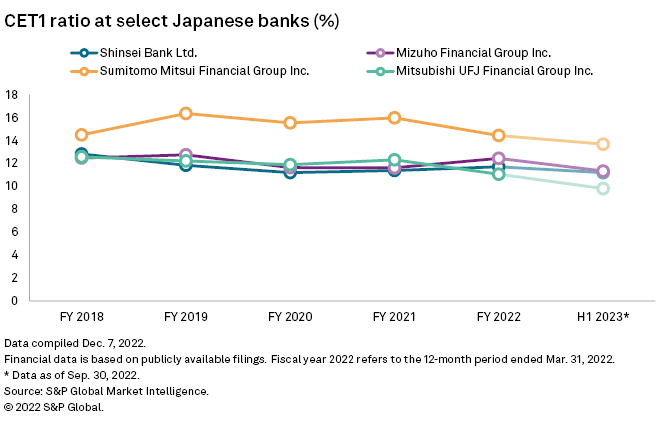

The nonperforming loan, or NPL, ratio at MUFG declined to 1.09% at the end of September from 1.18% in March, while Sumitomo Mitsui saw its NPL ratio drop to 0.99% from 1.08% and Mizuho Financial Group Inc.'s ratio dipped to 0.97% from 1.15% during the same period.

MUFG expects its loan loss provisions for the current fiscal year ending in March 2023 to total ¥800 billion, surging from ¥331.4 billion in the previous fiscal year, while Sumitomo Mitsui estimates that its credit cost will shrink to ¥210 billion from ¥274.4 billion and Mizuho reserved ¥100 billion, down from ¥235.1 billion during the same period.

"If the global economies shrink next year, then their assets will be tarnished, pushing up nonperforming loan ratio and credit costs," said Shunsuke Oshida, head of credit research at Manulife Investment Research Japan.

As of Jan. 4, US$1 was equivalent to ¥132.07.