Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Jan, 2022

By Hailey Ross

➤ Insurtech companies are facing rising expectations for their technology to drive both lower prices and loss ratios,

➤ There is a strong and growing interest across markets in working with small businesses, a sector that is historically "underserved and overcharged," the CEO said.

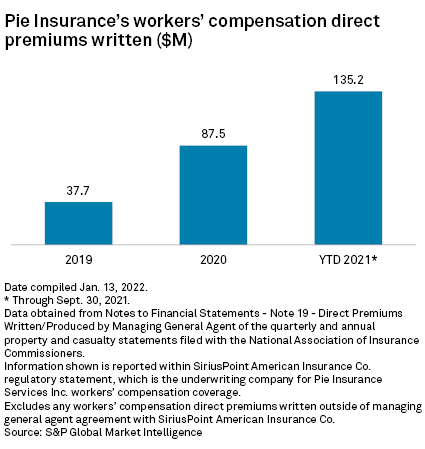

Pie Insurance Holdings Inc. is an insurtech that focuses on using data and technology to provide insurance solutions for small businesses, primarily with workers' compensation coverage. Pie Insurance co-founder and CEO John Swigart caught up with S&P Global Market Intelligence to discuss the executive's view on emerging trends in 2022 from both the traditional insurance and insurtech industries as well as his plans for Pie Insurance in 2022.

The following conversation was edited for clarity.

S&P Global Market Intelligence:

|

John Swigart, co-founder and CEO of Pie Insurance Holdings Inc. |

John Swigart:

For us, we're leveraging technology to make the experience better for small businesses. We think they're generally underserved and overcharged by the traditional insurance industry. At a very high level, the trend of leveraging technology to try to make the insurance process easier simpler, fairer and more accurately priced, as well as provide a better customer experience, those trends are going to continue.

The insurtech market overall is learning that some of the core fundamental realities about operating a viable, sustainable and valuable insurance business are still true. You have to produce quality underwriting results. You need to have good quality retention characteristics inside your customer base. You have to be able to deliver your services at scale efficiently. Those things all matter.

I think there's going to be continued increased focus on the actual underwriting performance. There will be a greater expectation that we should be leveraging our technology in our different distribution models and our different approaches to data and analytics to actually drive a better result for the customer in terms of lower prices and also better results for our shareholders in terms of better loss ratios.

Is that a challenge?

It's very challenging.

There can be an expectation that this industry is so old so it really doesn't leverage technology that well. ... It is a challenging industry to operate and operate profitably. You need to have an approach that uses and leverages data at a granular level with really meaningful, impactful data. You have to be able to properly discern and distinguish risk among and across customers and then be able to efficiently apply a different price level to associate with those risks. Then you have to be really prudent and grounded in your analysis of what those expectations of loss are going to be.

Is there expanding interest in working with small businesses?

I think there is a strong interest and not just across insurtech. Think of businesses like PayPal, Square, Intuit and Gusto, which all serve small businesses. The small business space is the market that is the most receptive to, and is in most need of, data and technology-driven solutions. Large scale businesses, even medium-to-large businesses, are appropriate for bespoke custom insurance solutions that are crafted on a one-off basis. You cannot do that effectively and efficiently for small businesses. So I think it is a very attractive market for traditional insurers and for insurtechs. Insurance companies that are heavily reliant on technology do have an advantage in the small business market.

What are your priorities for Pie Insurance in 2022?

We are growing our business very, very rapidly. We're evaluating all kinds of different opportunities. ... it doesn't mean that we won't consider appropriate acquisitions, where they are going to add real meaningful incremental value to Pie. But we're focused on serving the needs of small businesses and want to help as many small businesses as we can.

Personalized insurance is not the norm with commercial insurance. It really is hard for new business owners, and so we're just excited to be able to contribute a little bit to making their lives better and easier, saving them a little bit of money and helping their businesses be more successful.

What are your expectations in terms of demand for other types of insurance in 2022?

We're not creating a new insurance product, but we think we are creating and delivering a much better experience at a much better price. We'll be expanding beyond workers' compensation and launch our second line in 2022 so that we can serve the broader needs of small businesses. Over time, we think we can create a situation where Pie becomes the first place people go and the first place they shop, whether they are the customers or the agents that serve them when they're shopping for small business insurance.