Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Oct, 2021

The $1.2 trillion infrastructure bill that Democrats in Congress are struggling to pass could help advance large transmission projects seen as pivotal to the country's clean energy transition.

The bill, which is mired in a battle over a separate budget reconciliation package, seeks to ease permitting and funding challenges for major transmission projects, potentially unlocking thousands of megawatts of additional renewable energy.

But some transmission owners and former energy regulators warn that the measure, named the Infrastructure Investment and Jobs Act, carries unintended consequences that could complicate the development of new power lines.

For instance, the bill would give the Federal Energy Regulatory Commission new power to overrule state regulators on the approval of some interstate transmission facilities. But even if FERC would be willing to use that authority, the commission could face major pushback.

"I think members of Congress are overestimating the federal government's ability to approve transmission lines in a speedy manner while underestimating the controversy this will foment amongst constituents," said Tony Clark, a Republican former FERC chair.

What the bill could do

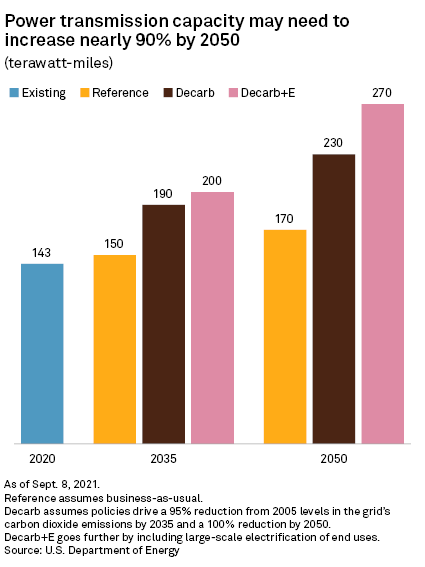

Some studies have estimated the U.S. will need to double or even triple its transmission capacity to decarbonize the country's economy by midcentury, a target that scientists have said must be met to avoid the direst climate change impacts.

The infrastructure bill could facilitate a range of transmission projects. The White House has pointed to a study by Americans for a Clean Energy Grid that estimated roughly 22 high-voltage transmission projects could benefit from the financing and siting reforms included in Biden's American Jobs Plan, many provisions of which were included in the infrastructure bill.

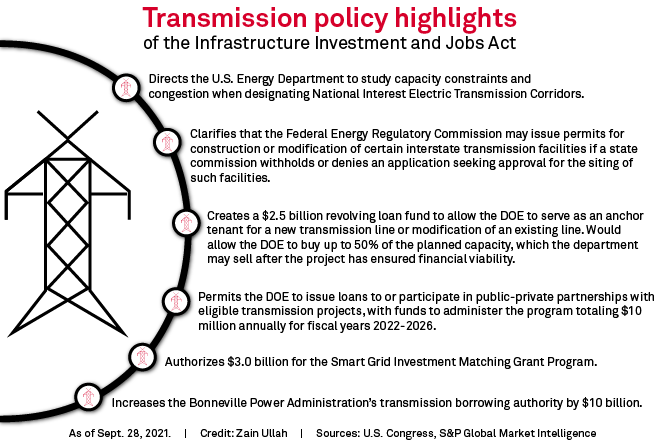

In an effort to overcome state-level permitting challenges, the bill allows FERC to authorize the construction or modification of certain interstate transmission facilities if a state regulator withholds or denies approval. The expanded "backstop" siting authority is aimed at avoiding confusion over whether the Energy Policy Act of 2005 limited FERC intervention to when states have not issued a permitting decision.

The legislation would also let the U.S. Energy Department serve as an "anchor tenant" for new or modified transmission lines. Under a $2.5 billion revolving loan fund included in the bill, the DOE could buy up to 50% of planned capacity for such projects, which the DOE may sell after determining the project has become financially viable.

"This gives [FERC] a little bit more authority than there was in the 2005 Energy Policy Act, and it sort of changes the game," former FERC Chairman Jon Wellinghoff said in an interview.

With U.S. President Joe Biden looking to decarbonize the power sector by 2035 and utilities ramping up their climate commitments, FERC "will try to use this law as much as they can," Wellinghoff said.

The proposed policy change is aimed at removing barriers to long-distance transmission projects that could deliver power from renewable energy-rich areas to more populated parts of the country. Many of those projects have encountered state or local opposition, and past efforts to use federal powers to overcome such resistance have stalled.

But strengthening FERC's hand in permitting may not resolve those issues and could even create new ones, former FERC member Clark said. Intervenors will still be able to challenge new projects at the federal level, according to Clark. And allowing FERC to override states' decisions not to condemn private property in support of a transmission developer's plans could put the agency "in a difficult position."

"It looks to me like a nightmare scenario for FERC," Clark said.

Some market participants have also expressed concern with the anchor tenant program. Transmission developer ITC Holdings Corp. said the Senate improved the proposal by specifying that projects funded through the program should not conflict with projects emerging through the regional transmission organization stakeholder process. But the bill still risks subsidizing uneconomic projects, while overall program funding of $2.5 billion "is small," ITC's vice president of federal and regulatory affairs Nina Plaushin said.

Although support from Congress on transmission is helpful, Plaushin said the "last best hope" for upgrading and expanding the grid are policy changes at FERC regarding cost allocation and regional planning for new projects.

"The bipartisan infrastructure bill is one small piece of the transmission puzzle," Plaushin said.

Obstacles to passage

Despite passing the Senate in August, the infrastructure bill is tied up in the House over a fight about the reconciliation package.

Progressive Democrats in the House have said they will not support the infrastructure bill until they have a guarantee that the more sweeping reconciliation package will pass both chambers. But moderate Democrats, including Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona, have taken issue with the size and scope of the reconciliation measure.

Although the infrastructure bill could help advance new transmission projects, many transmission owners are more eager to see Congress pass an investment tax credit for large transmission projects, which Democrats have included in the reconciliation package. Such a credit could support the installation of an additional 30 GW of renewable energy resources, according to a report released in May by the American Council on Renewable Energy and consulting firm Grid Strategies LLC.

"While backstop siting can help facilitate siting of these projects should additional assistance be needed, the proposed transmission tax credit has even greater potential to help ensure cost-effective construction of these projects," Berkshire Hathaway Energy said in an emailed statement.

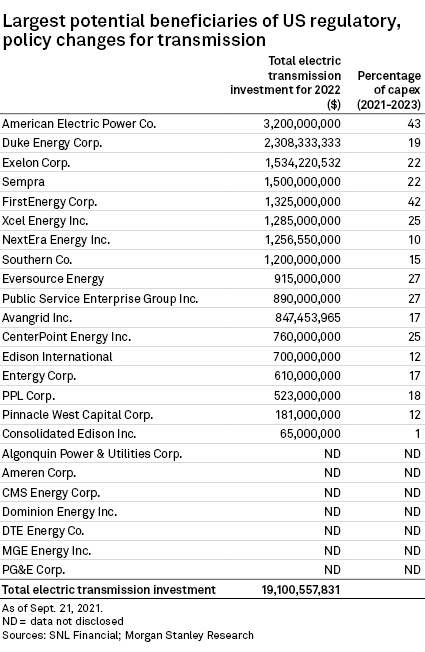

The bipartisan infrastructure bill and reconciliation package, as well as proposed FERC reforms, could benefit transmission-heavy utilities, Morgan Stanley said in a recent research report.

"Utilities with the biggest proportion of transmission in their asset base and that are located in areas with strong renewables growth are optimally exposed to this favorable long-term growth opportunity," the investment firm said.

Morgan Stanley said American Electric Power Co. Inc. has the greatest potential exposure to the proposed policies, with AEP holding the second-largest proportion of transmission in its rate base among the firm's coverage. AEP's total planned electric transmission investment for 2022 totals $3.2 billion, the highest of any utility covered in the report.

Other utilities with significant transmission assets in their rate base include Avangrid Inc., Edison International, Eversource Energy, FirstEnergy Corp., MGE Energy Inc. and Public Service Enterprise Group Inc., all of whose transmission assets exceed 25% of their business, according to Morgan Stanley.