S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Jan, 2022

By Arra Czarina Igno, Rebecca Isjwara, and Rehan Ahmad

Small Indonesian banks are likely to sustain their strong stock performance in the new year after besting their regional peers in 2021, as the Southeast Asian nation's economic outlook improves.

Fellow Southeast Asian banks Union Bank of the Philippines and Vietnam Export Import Commercial Joint Stock Bank ranked fourth and fifth on the list, with stock returns of 46.84% and 42.80%, respectively, according to Market Intelligence data.

"We are optimistic on Indonesia bank stocks performance this year, basically on loan growth expectation," said Yulinda Hartanto, an analyst at brokerage PT CGS-CIMB Sekuritas Indonesia. "The better macro condition should boost loan growth to above 10%."

The Asian Development Bank forecast Indonesia's GDP to grow by 3.5% in 2021 and 4.8% in 2022 after a 2.1% contraction in 2020.

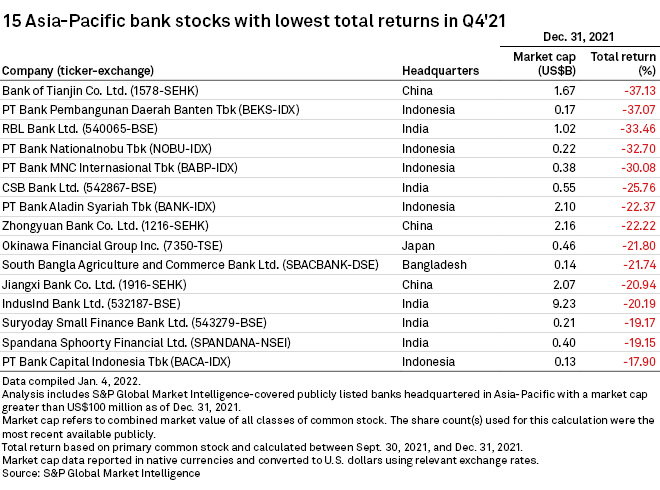

Worst performers

Lenders from China and India dominated the list of worst-performing bank stocks in Asia-Pacific. Bank of Tianjin Co. Ltd. lead the pack with a 37.13% fall. The decline came as the port city of Tianjin, where the bank is headquartered, faces threats of a spike in cases of the omicron variant of COVID-19.

India's RBL Bank Ltd. and CSB Bank Ltd. logged declines of 33.46% and 25.76%, respectively. RBL Bank's shares fell sharply in December as its chief stepped down citing health reasons and the central bank appointed an additional director on the bank's board. Later, the Reserve Bank of India sought to allay investor fears, saying the "bank is well capitalized and the financial position of the bank remains satisfactory."

Zhongyuan Bank Co. Ltd., Jiangxi Bank Co. Ltd., IndusInd Bank Ltd., Suryoday Small Finance Bank Ltd. and Spandana Sphoorty Financial Ltd. also featured on the list of 15 Asia-Pacific bank stocks with lowest total returns in the fourth quarter of 2021.