S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Jul, 2022

By Beata Fojcik

| The proposed tax for 2022 is equivalent to 37% of the Hungarian banking sector's total 2021 profit. Source: Matthew Horwood/Getty Images News via Getty Images Europe. |

A new windfall tax in Hungary will strike a significant blow to banks' profits over the next two years, as the government says key institutions have been making "extra profits."

Hungarian lenders are set to contribute 250 billion forints in both 2022 and 2023 under a two-year windfall tax to be imposed on several sectors that, according to the government, have been generating additional income amid growing energy prices, central bank interest rate hikes and Russia's ongoing invasion of Ukraine. The government is looking to raise roughly 1.8 trillion forints by the end of 2023 via the temporary levy.

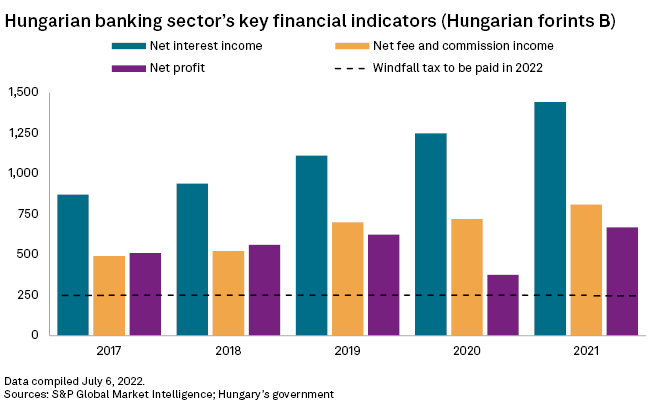

The 250-billion-forint tax payment envisaged for 2022 is the equivalent of about 37% of the Hungarian banking sector's net profit and 11% of its net interest income and net fee and commissions income for 2021, S&P Global Market Intelligence data shows. The new levy is expected to significantly decrease the sector's profitability in the next two years, Jovan Sikimic, senior equity research analyst at Raiffeisen Research, told Market Intelligence.

"It seems that banks could [find]

The banking sector will be the second biggest contributor to the windfall tax after the energy sector. Payments will be calculated based on banks' net revenues generated in Hungary in the preceding year, with a tax rate of 10% applied in 2022 and 8% in 2023.

"The tax base is bottom line revenues instead of profits, which makes it somewhat worse as taxes are not necessarily tied to banks' current economic situation," said Lukas Freund, an associate at S&P Global Ratings.

Measures targeting the banking sector are not new in Hungary. The most recent include a blanket repayment moratorium on all customer loans during the COVID-19 pandemic and a freeze on residential mortgage rates from January 2022. Both measures were recently extended until year-end. Since 2010, Hungarian banks have also been subject to a tax based on the value of total assets, and in 2020 the government imposed a one-off tax on lenders to mitigate the economic implications of the pandemic.

In addition to the 250-billion-forint levy, the government also plans to collect 50 billion forints from banks and financial institutions in 2022 via changes made to the existing financial transaction tax.

Hungary's new tax is the latest initiative by central and Eastern European, or CEE, governments to mitigate the negative effects of monetary policy tightening and macroeconomic pressures on consumers. Poland earlier introduced a borrower support program that will increase banks' costs and reduce their profits. "Spillover effects on other CEE countries cannot be ruled out in our view," said Sikimic.

Lump sum

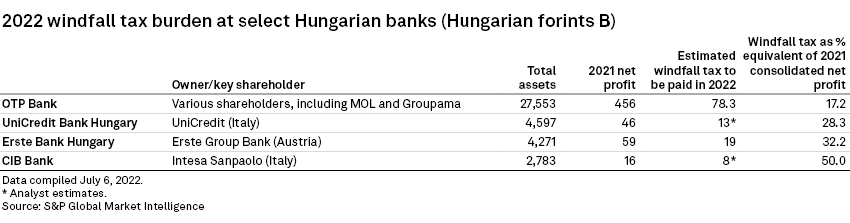

Hungary's largest lender, OTP Bank Nyrt., will contribute 78.3 billion forints to the state budget under the new tax in 2022, more than 31% of the 250-billion-forint total. The payment will be recognized in a lump sum in the lender's financial results for the second quarter. Details regarding the size of the windfall tax payment in 2023 are still under discussion. The bank did not provide comments to Market Intelligence regarding the impact of the tax on its operations.

OTP grew net profit 75.6% year over year in 2021 but reported a net loss for the first quarter of 2022, largely due to the conflict in Ukraine. OTP's net profit for the year is set to reach 189 billion forints, according to analyst estimates provided by the bank, though just three of the eight estimates take into account the implications of the windfall tax.

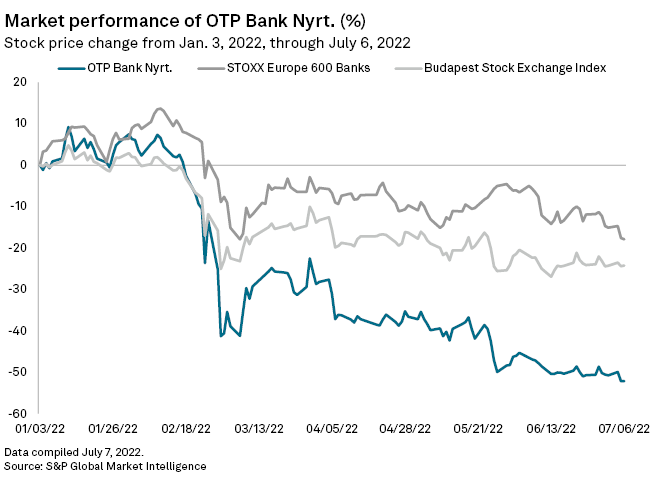

With OTP's share price already suffering from the war in Ukraine, the windfall tax plans pushed its price down even further as investors have been pricing in the potential extension of the levy beyond 2023, according to Raiffeisen Research's Sikimic.

The stock has fallen roughly 50% since January, underperforming the Budapest Stock Exchange Index as well as the STOXX Europe 600 Banks index. As of July 6, OTP shares traded at 8,380 forints per share, significantly below the June 17 mean consensus price of 14,825.23 forints apiece and offering a potential upside of almost 77%, according to Market Intelligence data.

Meanwhile, Erste Group Bank AG's local unit, Erste Bank Hungary Zrt., told Market Intelligence that its contribution under the windfall tax will reach about 19 billion forints in 2022. Other banks refused to disclose the tax burden or did not respond to requests for comments.

Rough 2022 tax payment estimates could amount to about 13 billion forints for UniCredit SpA unit UniCredit Bank Hungary Zrt. and 8 billion forints for Intesa Sanpaolo SpA unit CIB Bank Zrt., according to Raiffeisen Research's Sikimic.

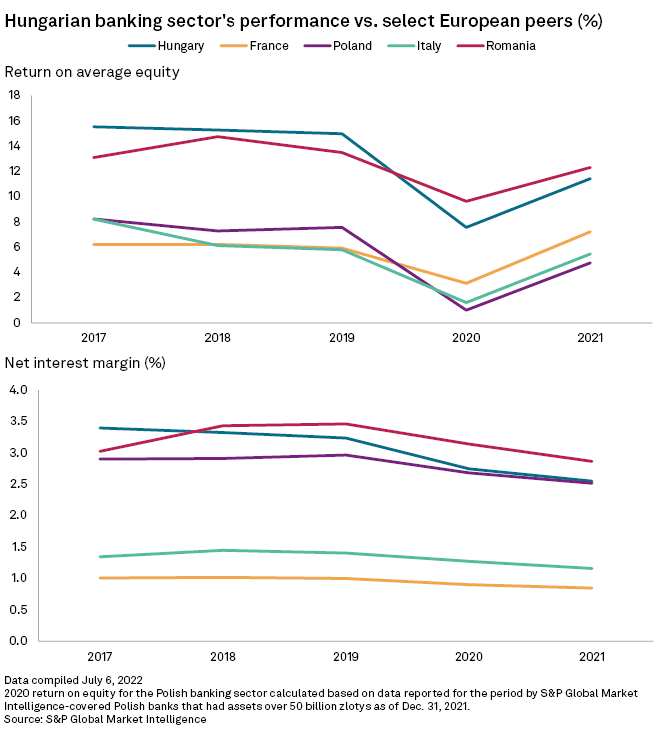

Asset quality could also weaken as vulnerable borrowers struggle with debt servicing amid growing inflation and interest rates, said Freund, though Hungarian banks have sufficient buffers to absorb the costs thanks to historically robust lending margins and sound levels of capitalization.

Long-term promise

Hungary has been a profitable market for banks, with margins and return on equity significantly outperforming many other European markets. The sector's ROE is expected to remain at 10% to 12% over the medium term, including the one-off windfall taxes in 2022 and 2023, according to Freund.

The new tax adds to uncertainty to foreign direct investments in Hungary, but this is already factored in when assessing profitability of banking operations in the country, according to Freund.

Scope Ratings' Boratti also believes that international banking groups are unlikely to leave Hungary due to the new tax, though some groups may reconsider "if the risk/return profile ceases to be attractive." In the event of a sale, domestic lenders would be among the most likely buyers, the analyst said.

As of July 11, US$1 was equivalent to 406.91 Hungarian forints.