Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 May, 2023

Earnings metrics for US hotel real estate investment trusts stayed mostly flat on a sequential basis in the first quarter of 2023, according to an S&P Global Market Intelligence analysis.

Same-store occupancy and RevPAR growth

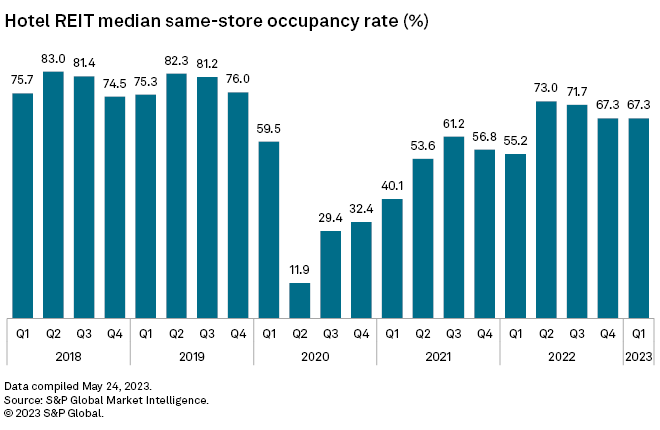

Median same-store occupancy was in line with the quarter prior at 67.3%. Compared with the first quarter of 2022, median same-store occupancy was up 12.1 percentage points, but down 7.9 percentage points compared to the same period in 2019, which was prior to the COVID-19 pandemic.

– For further company research, try the North America Real Estate 2-Page Profile template.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

– Click here to set email alerts for future Data Dispatch articles.

Same-store revenue per available room (RevPAR) followed a similar trend, up 20.7% year over year to $164.95 on a median basis.

Park Hotels & Resorts Inc. reported the highest same-store RevPAR growth for the quarter, up 36.5% year over year. While all demand segments logged year-over-year increases, one standout segment was group demand, Park Hotels CEO Thomas Jeremiah Baltimore said on an earnings call, with revenue up 74% year over year to $124 million.

Sunstone Hotel Investors Inc. reported same-store RevPAR growth of 34.3% year over year, while Host Hotels & Resorts Inc. grew RevPAR by 31.1% year over year on a same-store basis.

In light of its strong first-quarter performance, Host Hotels substantially increased and tightened its full year RevPAR growth guidance range to 7.5% to 10.5%, nearly doubling the midpoint of expected RevPAR growth.

FFO, recurring EBITDA

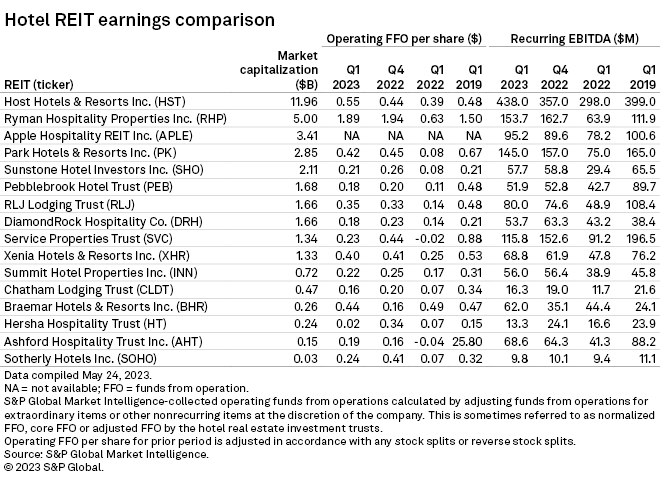

Many hotel REITs reported large year-over-year increases in both operating funds from operations (FFO) and recurring EBITDA for the first quarter but were down on a quarterly basis.

While earnings metrics still sit below 2019 levels for the majority of the sector, FFO and EBITDA for Host Hotels and Ryman Hospitality Properties Inc., the largest hotel REITs by market capitalization, both topped what was reported for the first quarter of 2019.

Market Intelligence defines operating FFO as funds from operations adjusted for extraordinary items or other nonrecurring items at the discretion of the company. Hotel REITs sometimes refer to this as normalized FFO, core FFO or adjusted FFO.

Hotel REITs stocks yet to return to pre-pandemic levels

Share prices for most hotel REITs remain below where they were prior to the COVID-19 pandemic. As of May 23, the Dow Jones US Real Estate Hotels index was down 29.1% compared to the end of 2019, underperforming the more broad Dow Jones Equity All REIT index's 11.8% decline over the same time period.

While the Dow Jones US Real Estate Hotels index started off 2023 with gains, the index has fallen in recent months.