S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2022

By John Atkins

Outsized December issuance in the high-grade bond market capped the second-highest annual issuance amount on record in 2021 as mounting volume backing mergers and acquisitions — and a torrent of issuance from emboldened financial-sector issuers — helped offset a year-over-year downshift in the pace of pandemic-era refinancing efforts.

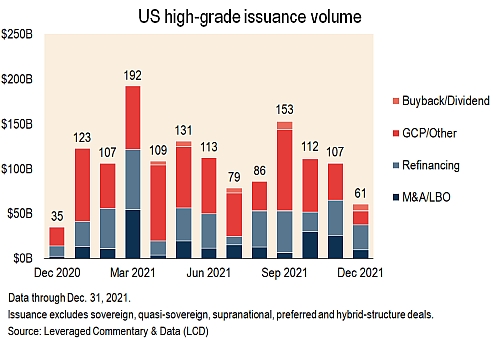

December 2021's $60.9 billion of U.S. high-grade corporate issuance was the highest of the last decade for that calendar month, marking a rise from $35.4 billion in December 2020, less than $20 billion in December 2019 and just $8 billion in December 2018, according to LCD. The totals exclude deals from sovereign/state-controlled, supranational and agency issuers as well as hybrid debt/equity structures, such as preferred stock and convertible notes.

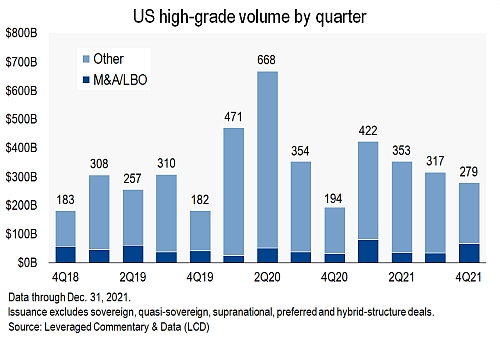

The fourth-quarter high-grade issuance total, $279.5 billion, was the lightest across 2021's four quarters, but it nevertheless reflected heady seasonal issuance in the context of a $194.1 billion total in the fourth quarter of 2020 and totals of roughly $182 billion for the final quarters in 2019 and 2018.

With that strong late kick, 2021's $1.37 trillion annual total rests comfortably as the second-highest amount on record, if down 18.7% from 2020's unprecedented $1.69 trillion total. The pre-pandemic peak was $1.24 trillion, recorded in 2017.

Among notable drivers of strong 2021 volume, financial-sector issuance soared to a record-setting $563 billion, or 41% of the year's total volume. In 2020, the $499 billion of financial-sector issuance accounted for less than 30% of the year's total. The pre-pandemic peak level for the carve-out, $512 billion in 2017, also accounted for about 41% of that year's volume.

Money-center banks led the charge, spurred by bristling recovery dynamics across the global economy and looser Fed restrictions on how banks can deploy capital to shareholders. The top four single issuers on the U.S. high-grade market in 2021 were bulge bracket banking majors, including The Goldman Sachs Group Inc. ($42.05 billion), Bank of America Corp. ($41.25 billion), JPMorgan Chase & Co. ($39.25 billion) and Morgan Stanley ($34.5 billion). Again, those totals exclude hybrid deals, including preferred stock.

Goldman Sachs did not rank among the top 10 issuers in 2020, and Bank of America built on its $35.75 billion total in 2020, when it was the top single issuer.

Aggressive financial policy drove the issuers in the fifth and sixth slots in the top 10. Verizon Communications Inc.'s $26 billion issuance total in 2021 included a $25 billion print in March as it backed its mammoth outlays at an FCC auction for 5G spectrum assets. AerCap Holdings NV's $22 billion annual total included a $21 billion placement in October to fund its blockbuster acquisition of GE Capital Aviation Services Inc.

Overall, the $217.4 billion of M&A-driven issuance in 2021 marked a substantial 48% increase from 2020, when issuers were more focused on bolstering general liquidity and addressing upcoming debt maturities.

Meanwhile, refinancing efforts declined year over year, but they continued at a high pace. The $414.8 billion of explicitly refinancing-driven offerings for the year tumbled from $697.3 billion in 2020. However, the total was above the $402 billion for the carve-out in 2019 and totals of $259 billion in 2018 and $367 billion in 2017.

With two jumbo prints in 2021, Apple Inc. was the year's seventh-biggest issuer at $20.5 billion. Apple stepped back from the bond markets in 2018 and most of 2019 after tax reform enacted in the closing days of 2017 allowed it to fund its ambitious shareholder return plan without adding new debt to its balance sheet. However, the company has tapped the markets more frequently in the pandemic era as plunging borrowing costs allowed it to lock in its lowest-ever funding costs in aid of debt servicing even as it furthers its goal of equalizing its debt and cash levels over time.

As well, the No. 8 and 10 issuers on the top 10 list, Amazon.com Inc. and Oracle Corp., reflected sprawling refinancing efforts at attractive costs.

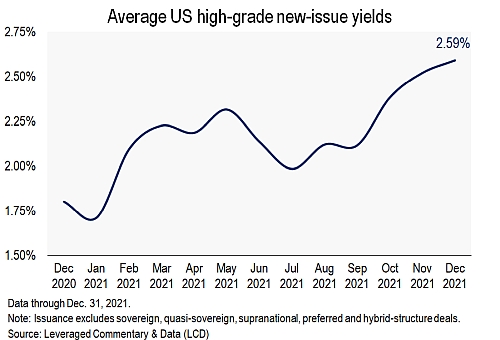

Issuers scrambled to lock in funds as inflation risks prodded rates higher and as the Fed girds for battle against price risks in 2022. High-grade issuers paid at average 2.59% at issuance in December 2021, a high since July 2020 and up from the pandemic-era low at 1.71% in January 2021 and a sub-2% average as recently as July 2021.

At the broad index level, the yield to maturity for the S&P U.S. Investment Grade Corporate Bond Index ended 2021 at 2.26%, up more than half a percentage point from the 1.73% reading Dec. 31, 2020. That yield level touched a 2021 high at 2.31% on Dec. 29.

Corporate spreads, meanwhile, were in bend-but-don't-break mode as 2021 closed out with pandemic headwinds again challenging the recovery narrative. The T+93 level for the index on 2021's final session was little changed from T+94 a year earlier, leaving the index favoring the wider end of 2021's range from T+79 on June 25 to T+100 on Dec. 3.

For now, syndicate officials project issuance continuing at a high level in advance of tangible Fed actions. The midpoint projection for January issuance, per a syndicate survey conducted by Mischler Financial's Ron Quigley, is $137 billion, including high-end estimates ranging up to $150 billion. For reference, issuance under LCD's criteria was $123 billion in January 2021 and $128 billion in January 2020.