S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Jan, 2025

By Matt Smith and Annie Sabater

The Gulf Cooperation Council is set to see another strong year of listings after raising nearly $13 billion in 2024, its second-best year since the COVID-19 pandemic, driven by a surge in late-year flotations.

The six-country bloc's significance to global IPO investors will continue in 2025 as regional governments pursue part-privatization programs to bolster state revenues, diversify regional stock markets, and potentially increase their representation in emerging or frontier market equity indexes.

|

"There has been a robust delivery of Gulf IPOs [in 2024], and I'd expect a similar amount to be raised [in 2025]," said Tarek Fadlallah, CEO of Nomura Asset Management Middle East in Dubai.

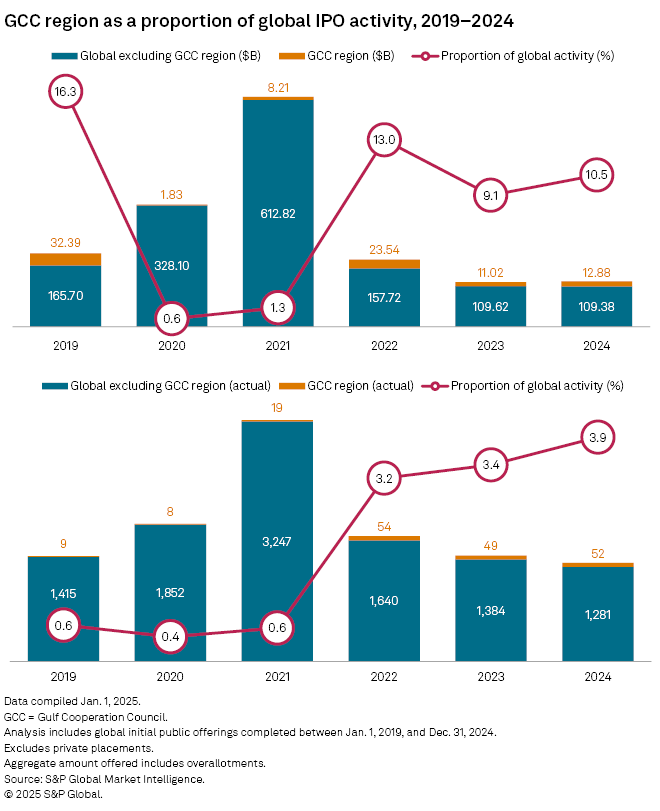

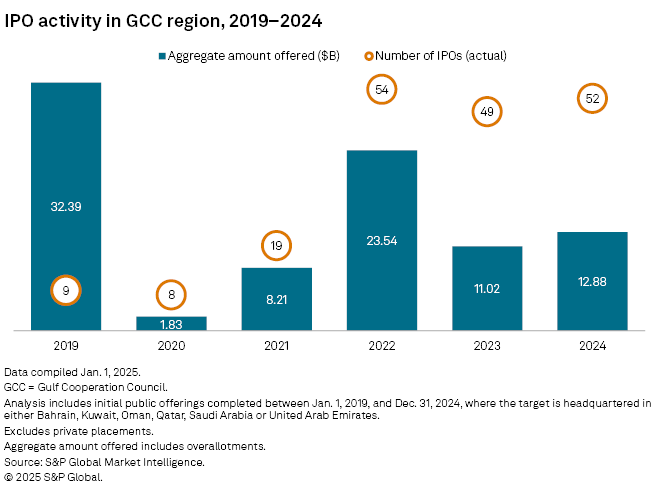

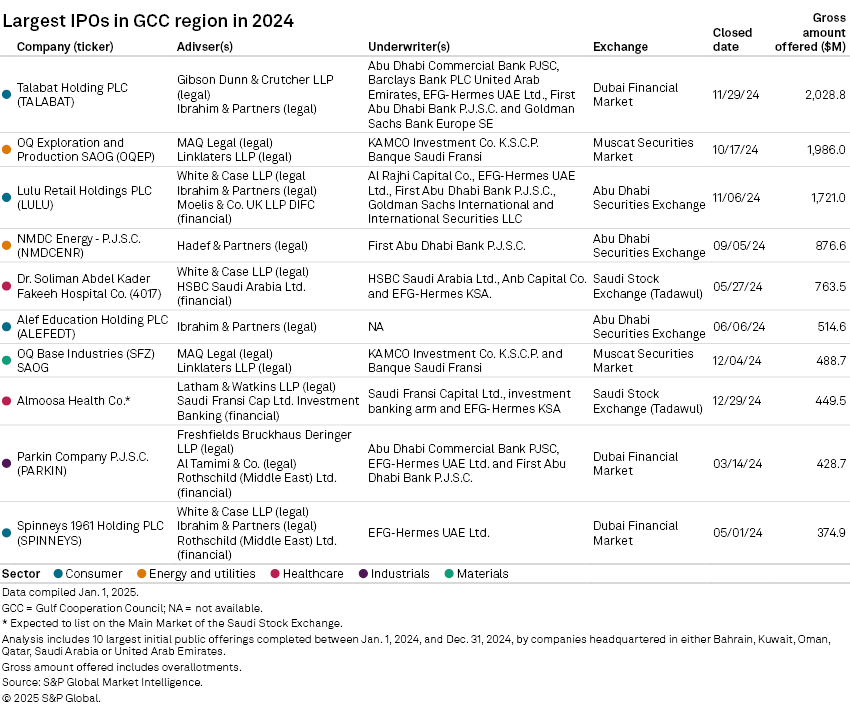

IPOs in the Gulf Cooperation Council (GCC) raised $12.88 billion in 2024, accounting for 10.5% of total global IPO fundraising during the period, S&P Global Market Intelligence data shows. In comparison, GCC IPOs totaled $11.02 billion, or 9.1% of the global total, in 2023 and $23.54 billion, or 13.0% of the global total in 2022.

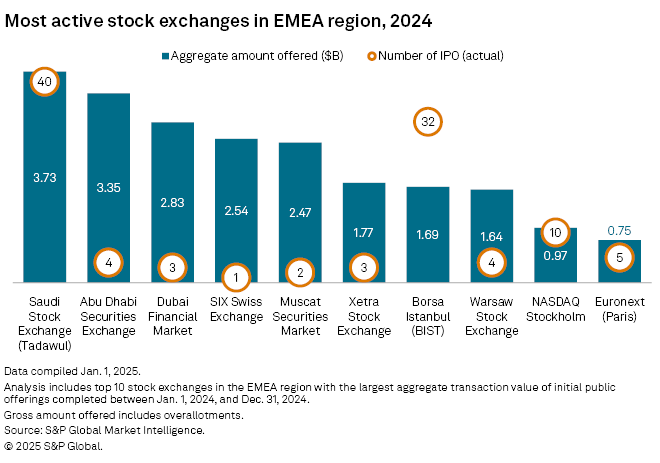

Overall, the GCC had a total of 52 IPOs in 2024. The Saudi Stock Exchange led the way with 40 IPOs, followed by the Abu Dhabi Securities Exchange with four, Dubai Financial Market with three and Muscat Securities Market with two, according to Market Intelligence data.

Gulf governments are prioritizing the flotation of stakes in state-run companies to reduce their involvement in free market economies, Fadlallah said. Additionally, deregulation and economic diversification in the private sector allow companies in various industries, including leisure, healthcare, education, retail, e-commerce and transport, "to come to the market with fresh ideas for investors." Finally, there is ample investor liquidity and enthusiasm for new company listings.

"These storylines seem unchanged going into 2025," Fadlallah said. "It's sustainable because there's a strong pipeline of companies waiting to go public and because the quantum of money being raised is not staggeringly large — it's significant, but it's not overwhelming."

Food delivery company Talabat Holding PLC, a subsidiary of Germany's Delivery Hero, completed the GCC's biggest IPO of 2024, selling 20% of its stock for $2.03 billion.

OQ Exploration and Production SAOG (OQEP), a unit of Omani state oil company OQ, sold 25% of its shares for $1.99 billion. Abu Dhabi-based Lulu Retail Holdings PLC conducted the Gulf's third-largest IPO of 2024, raising $1.72 billion.

Akber Khan, acting CEO of Al Rayan Investment in Doha, said Gulf IPO activity in 2025 will likely mirror 2024 in that Saudi Arabia and the United Arab Emirates dominate, with some activity in Oman, Qatar and Kuwait.

Opportunistic institutional investors, mostly hedge funds, from outside the Gulf are targeting regional IPOs for short-term profits. "These investors aren't necessarily here for the long term, although once they've gone through the process of being eligible to invest and have made some money in the market, you'd hope they develop an appetite to stay and do secondary investments," Fadlallah said.

These investors have faced difficulties subscribing to profitable and accessible IPOs elsewhere and recognize the "healthy and robust activity in the region," according to Fadlallah. Outside of India and the US tech sector, global IPO activity is subdued, particularly in Europe, the executive said.

"So, specialist IPO investors are hunting for where they can find IPOs, and it seems they've identified the GCC as a place where both from the public domain and the private sector there's a continuous need to go to market," he said.

Many international financial services companies are establishing offices in the Gulf, while others are expanding their presence in a region that has proven to be a safe haven since the COVID-19 pandemic.

"There's some talk that once these organizations become more familiar with local markets, they will get more engaged, but IPO underwriting activity remains the preserve of major local banks and the international banks that have been long established in the Gulf," Fadlallah said. "These new arrivals are here to attract sovereign wealth and to tap ultra-high net worth individuals."

Boom in GCC debt issuances

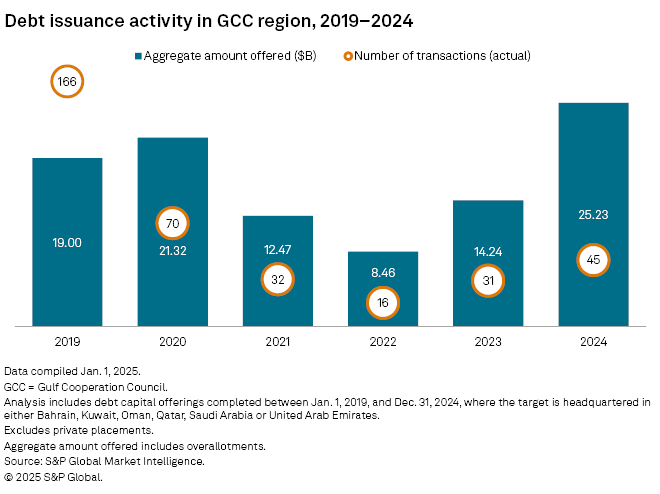

GCC debt capital offerings totaled $25.23 billion in 2024, up from $14.24 billion in 2023, the highest annual regional total since at least 2019, according to Market Intelligence data.

More broadly, Gulf bond and sukuk issuance in 2024 is projected at about $140 billion, a record total, said Abdul Kadir Hussain, head of fixed income at Arqaam Capital in Dubai. Of this, 35%-40% was issued to refinance existing debt, 30%-40% to help various Gulf governments meet budget shortfalls, and the remainder was issued by banks and corporations, Hussain said.

Hussain said budget deficits will persist due to low oil prices, which may increase government funding needs. Few private Gulf companies have the infrastructure to issue debt, relying instead on banks for borrowing.

"The GCC is one of the few regions within emerging markets with high-quality issuers," Hussain said. "It has a relatively deep and big dollar bond market universe. Even though spreads are tight, GCC debt still offers a slightly higher return than Southeast Asian sovereign bonds."

The GCC has high-quality issuers and a significant dollar bond market, offering slightly higher returns than Southeast Asian sovereign bonds despite tight spreads, Hussain noted. The region's dollar pegs make it a safe haven for emerging market investors, with growing demand as Russia and China are seen as less investable due to sanctions and economic instability.

"These factors have pushed the Gulf to the forefront, and the outlook for 2025 is similar," Hussain said. "The only caveats or uncertainties which could change that outlook are geopolitics, interest rate volatility and the new Trump administration."

The US Federal Reserve is expected to maintain a hawkish stance, forecasting only two more reductions in 2025 due to a strong labor market and enduring worries about inflation. US interest rates will likely fall to around 3.9%, whereas the consensus view had been for rates to decline to closer to 3%, Hussain said.

"In this situation, fixed income is a nice place to be because you can clip relatively decent coupons even though spreads are tight in the region," said Hussain, adding that investors can earn about 5.5% on GCC sovereign debt.

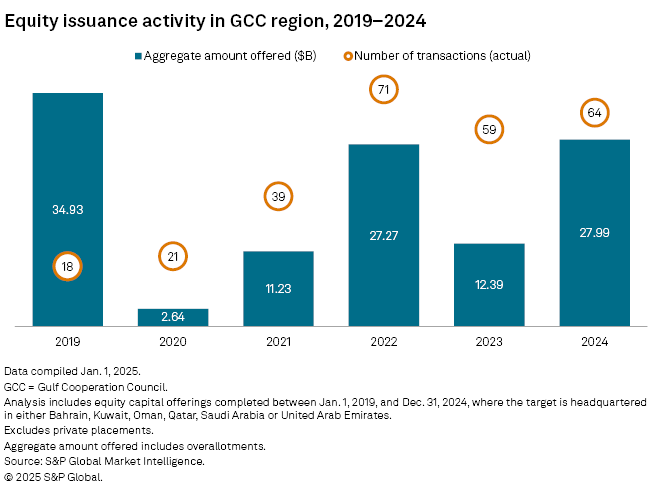

Equity issuance in the GCC also increased in 2024, both in terms of the number of transactions and the total amount raised. There were 64 equity capital offerings in 2024, raising nearly $28 billion, versus 59 transactions with combined proceeds of $12.39 billion a year ago.