S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Nov, 2024

By Tim Siccion and Shambhavi Gupta

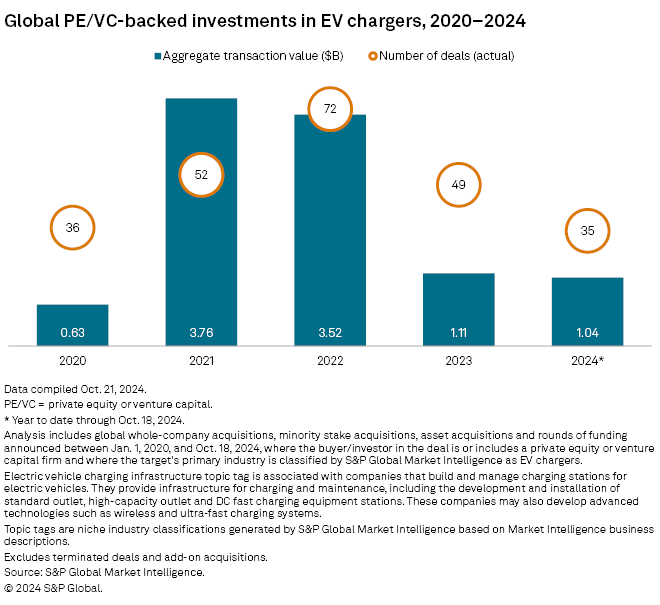

Private equity deal value in electric vehicle charging infrastructure from Jan. 1 to Oct. 18 reached $1.04 billion, nearing the $1.11 billion the sector received in full year 2023, according to S&P Global Market Intelligence data.

Nonetheless, the amount is less than one-third of the annual capital raised in both 2021 and 2022.

Investment in charging infrastructure is crucial to support the growing demand for EVs, according to a report from S&P Global Market Intelligence 451 Research, a technology research group within Market Intelligence. The limited number of charging stations remains a major hurdle for EVs, and costly installations hinder rapid infrastructure expansion.

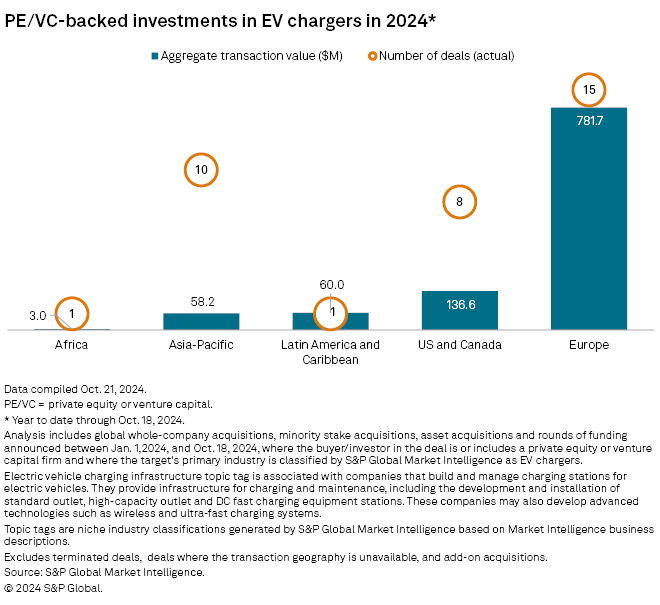

EV charging companies in Europe, including the UK, are far ahead of the rest of the world in attracting private equity capital in 2024, with 15 deals amounting to $781.7 million.

At the start of 2024, Europe had over 632,423 EV charging stations, according to the European Automobile Manufacturers' Association. The association's count is only 18% of the 3.5 million public EV charging points the European Commission has targeted by 2030.

The US and Canada recorded the second-largest deal value with eight deals totaling $136.6 million. The US had 200,000 public EV charging points in October, according to the Joint Office of Energy and Transportation. The Biden administration has targeted 500,000 EV chargers in the US by 2030 through a $5 billion US Transportation Department initiative.

Asia-Pacific had 10 transactions totaling $58.2 million, placing the region slightly below Latin America and the Caribbean, with a lone $60 million deal.

– Download a spreadsheet with data featured in this story.

– Read up on private equity activity in metals and mining.

– Check out private equity investments in micromobility.

Funding rounds rank as largest private equity deals in sector

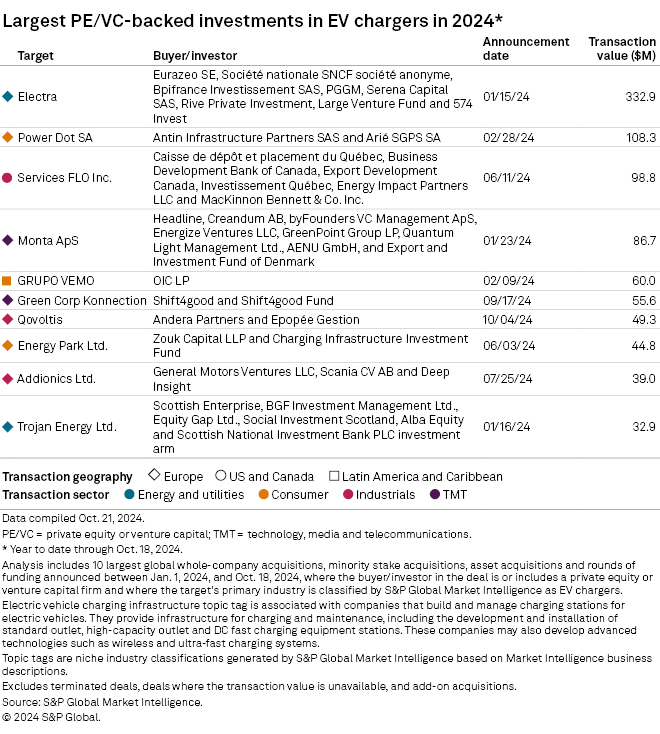

The largest deal in the charging industry is a $332 million series B round for France-headquartered Electra involving Eurazeo SE and Bpifrance Investissement SAS. Electra said it will use the funds to expand its charging station deployment and other developments.

Antin Infrastructure Partners and Arié SGPS SA's $108 million investment in Power Dot SA is the second-largest transaction. The Portuguese charging station operator said it will use the funds to expand its charging infrastructure for the electric mobility sector.

Private equity firms pass on IRA chargepoint incentives

Private equity inflows to US renewables have dwindled despite the Biden administration's 2022 Inflation Reduction Act, which provides $369 billion of tax credits and subsidies to investors in clean energy projects, including EV charging infrastructure.

Investments in US renewable energy in general have been declining due to inconsistent and relatively low returns, J.P. Hanson, global head of oil and gas at Houlihan Lokey, told Market Intelligence.

"The alternative energy universe broadly has been a difficult arena to make consistent returns," Hanson said.

"For private equity, you're talking 25% money-on-money, cash-on-cash returns," Hanson added. "That's difficult in alternative energy, where most investments are at best low double-digit, south of 15% returns."