S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2021

By Jiayue Huang, Yuzo Yamaguchi, and Rehan Ahmad

Europe, home to the world's largest green bond market, will likely lead global issuance to another record this year, while the climate-friendly administration in the U.S. and more Asian countries joining the race to zero emissions will give the market another boost.

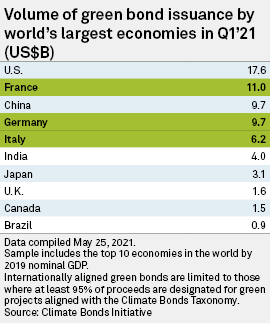

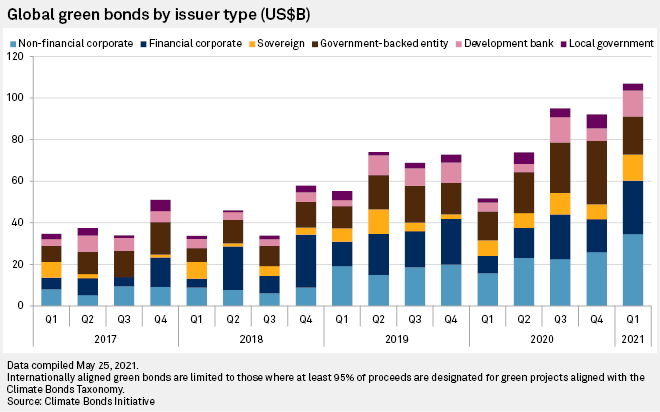

The world issued $106.86 billion of green bonds in the three months ended March 31, the strongest quarter on record, according to U.K. nonprofit Climate Bonds Initiative, which tracks and promotes green investment. More than half of the volume came from five countries: the U.S., France, China, Germany and Italy.

Sovereign and corporate issuance in Europe, led by France and Germany, totaled $53.57 billion in the first quarter, more than double the volume of $23.41 billion a year earlier. Asia-Pacific came in second, issuing $27.13 billion of green debt, sharply higher than $9.15 billion in the first quarter of 2020 when the region was grappling with the first wave of the COVID-19 pandemic. The data only includes green bonds that are compliant with international standards.

"Now is the time for those countries to take action to move toward zero emissions," Mana Nakazora, ESG strategist at BNP Paribas, said. "Given that, there is almost no doubt that green bonds issuance will reach a new high this year," Nakazora added.

The EU has been ahead of other regions in tackling climate change through regulations, such as the green taxonomy and stricter disclosure requirements for financial institutions, which analysts say will help cement the bloc's leading position in the green bond market.

Other regions are also contributing to global issuance growth, with the Biden administration pushing a green agenda and Asian countries, such as China, Japan and South Korea, recently pledging to go carbon neutral over the next several decades. Analysts expect these moves will help grow a strong base of investors for decarbonization projects that need funding.

Another record year in sight

Many analysts expect global issuance in 2021 to exceed the $312.70 billion issued in 2020, the strongest year on record.

"In 2020 there was strong issuance across the EU, U.S., and Asian markets, and we expect each of these markets to continue to expand in 2021, with EU issuances leading the way," said Maressa Brennan, associate director on the innovative finance team at U.S.-based Milken Institute.

BNP Paribas' Nakazora expects issuance to "top $450 billion" this year, while Nordic Bank SEB pencils in a slightly higher estimate of close to $500 billion. Meanwhile, HSBC expects volumes to be between $310 billion and $360 billion, and NN Investment Partners from the Netherlands expects €400 billion of green bonds will come to the market this year.

"More issuers want to prove and show how they are greening their activities," Bram Bos, lead portfolio manager of green bonds at NN Investment Partners, said. "At the same time, more and more investors want to make their portfolio greener." Bos expects second quarter issuance to also be the highest ever.

EU to stay in lead

In April, the European Commission published the first set of criteria for companies to be labeled as green under its sustainable finance taxonomy regulation, which is due to come into practice from 2022.

Meanwhile, the Sustainable Finance Disclosure Regulation that came into effect in March imposed more stringent requirements on sustainability-related disclosures for financial institutions to target "greenwashing," or the misrepresentation of sustainability risks in their investment processes and products.

"The strict regulations will help expand the [bond] market by making companies transparent to investors," BNP Paribas' Nakazora pointed out.

China, US to drive growth

China, the world's largest carbon emitter, aims for carbon emissions to peak before 2030 and carbon neutrality before 2060, while other countries including Japan and South Korea seek a zero-emissions society by 2050. India, another major emitter, is also reportedly considering a decarbonization target.

"China's pledge of net-zero emissions by 2060 is expected to create huge demand for green financing in the next decades as enterprises and local governments align with this goal, deepening the domestic green bond market which is already the biggest in Asia and one of the world's largest. This could potentially have a multiplier effect on countries that are recipients of Chinese investments," said Arthur Lau, co-head of emerging markets fixed income at PineBridge Investments.

Biden, who brought the U.S. back to the Paris Agreement in February, set a lofty goal, at the April climate summit, of reducing carbon emissions by more than 50% by 2030, nearly doubling the previous target and putting pressure on other countries to accelerate their transition to clean energy. The U.S. SEC is also considering disclosure rules for companies on the environmental and social impact of their operations.

"Improving the regulation around data quality and availability will be key in sustainably growing the green bond market," said Milken Institute's Brennan.