S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Aug, 2022

By Deza Mones and Rehan Ahmad

Green bond issuance in Europe recovered in the second quarter, driven by strong activity in Germany and France that looks set to continue.

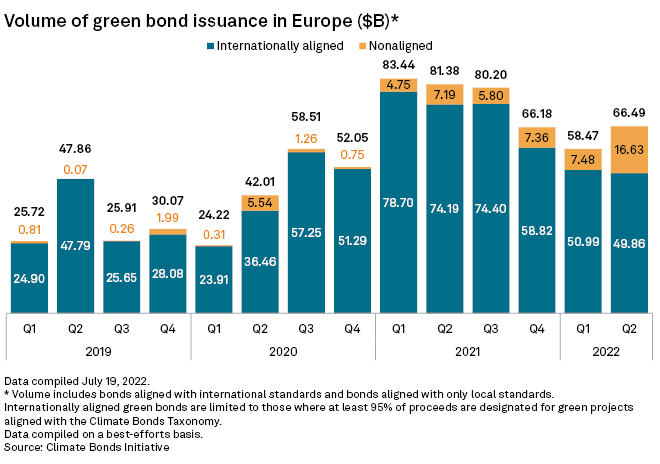

The region sold $66.49 billion of environmentally focused debt in the three months to June-end, an increase from $58.47 billion in the first quarter. On a yearly basis, second-quarter issuances were down more than 18% from $81.38 billion, according to data from the Climate Bonds Initiative, during a period marked by market volatility, rising interest rates and Russia's ongoing war in Ukraine.

Of the total for the second quarter of 2022, internationally aligned green bonds amounted to $49.86 billion, a small decrease from $50.99 billion in the previous quarter. Issuance of green bonds aligned with only local standards, however, reached $16.63 billion, its highest quarterly level since 2019. The previous peak was $7.48 billion, recorded in the first quarter of 2022.

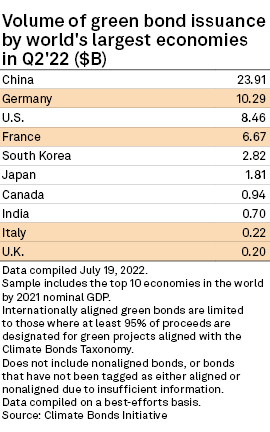

Germany and France led the issuance of green bonds in Europe during the second quarter and are expected to continue their streak in the second half, with Germany eyeing 5-year and 30-year syndications in September and October, respectively, according to Trevor Allen, head of sustainability research at Markets 360, BNP Paribas' market strategy and economics division.

The growth of issuance from the Netherlands, which was supported by sovereign issuance, is also notable, said Sam Morton, head of European investment grade research at Invesco.

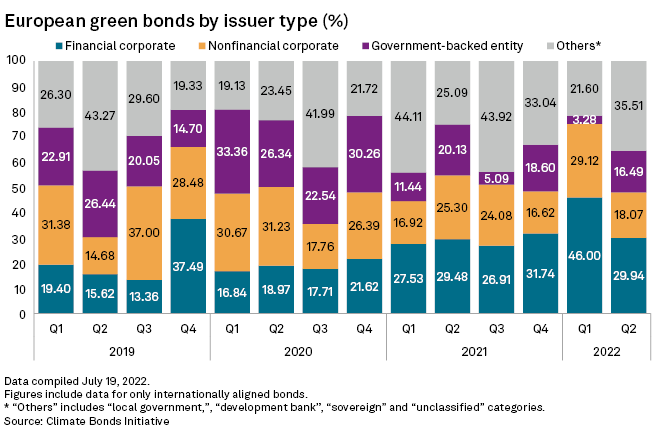

Sovereign issuance has lagged in the first half compared to a year earlier. New sovereign issuers this year, including Austria and Denmark, were smaller in size compared to the U.K., Italy and Spain in 2021, Allen said. "In addition, the latter [countries] have been smaller than expected in terms of taps. The U.K. is planning only small taps of existing green gilts this year," Allen said.

Issuance in the second half is set to roughly equal that of the previous six-month period, putting European issuances at around $140 billion, according to BNP Paribas Markets 360. By the end of the year, it could reach around $550 billion if there are more sovereign issuances — with Greece and Belgium already in the pipeline — in the coming months, lifted by the halo effect of the United Nations' COP27 climate conference in November, Allen said. BNP Paribas Markets 360's totals differ somewhat from those of the Climate Bonds Initiative due to differences in methodology.

Broadly, green bond issuance volumes are likely to remain depressed while interest rates and credit markets remain volatile due to rising geopolitical risk. But a phase of market stability will make the sustainable debt market active as these instruments have become core components of the fixed income investor toolkit, Invesco's Morton said.