S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jan, 2021

By Hailey Ross and Jason Woleben

With a yearslong planned deal looking increasingly unlikely to go through, Genworth Financial Inc. has been left with limited options as it hopes to meet sizeable near-term debt obligations.

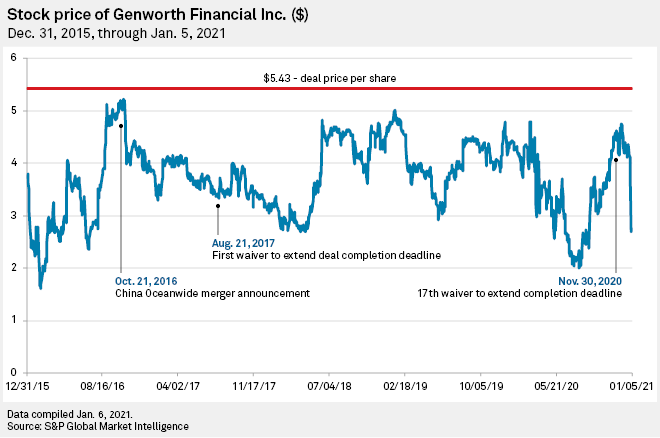

Genworth's planned merger with China Oceanwide Holdings Ltd. was first announced more than four years ago. But following regulatory and financing issues that spurred multiple extension deadlines, the company said Jan. 4 that it would not extend the deal agreement beyond the most recent year-end 2020 deadline and would instead focus on a contingency plan to meet its upcoming debt obligations.

"The situation right now is fluid and troubling," CFRA analyst Cathy Seifert told S&P Global Market Intelligence. "They did lose a lot of credibility in the marketplace as a result of this debacle."

To be sure, investors never seemed to have full confidence that the transaction would come to fruition, Seifert noted. Since the deal's October 2016 announcement, Genworth's closing share price never met the value of China Oceanwide's offer.

The deal is not yet dead — either party can now terminate it at any time, but China Oceanwide is still working toward a completion — and Seifert said she would "not rule out" an attempt to renegotiate the deal.

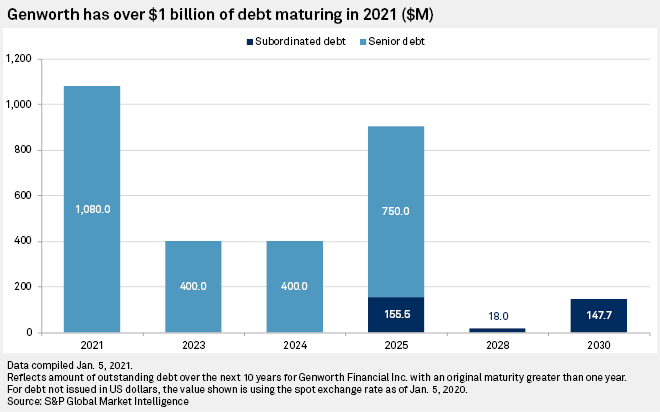

Still, Genworth has shifted its attention to resolving over $1 billion of 2021 debt maturities, with substantial repayments due in both February and September.

Genworth's holding company had about $1 billion in cash and liquid assets at the end of 2020, and the company said it will use about $340 million of those funds to repay the February debt.

"I'm more concerned about the September maturity," Seifert said. "I mean, I have concerns with the overall company longer term — its prospects, the fundamentals of its businesses."

Genworth has other obligations to meet in the coming years, including a £317 million promissory note due in 2022 related to a dispute settlement with AXA SA, as well as $400 million of maturing senior debt in each of 2023 and 2024.

What is more, Genworth could face further financial strain stemming from litigation around the proposed China Oceanwide deal, as the company had expressed a "heightened degree of optimism" in late 2020 that the merger would close, Seifert noted.

"Genworth is going to have some explaining to do [on] what caused the optimism ... when in fact it's been sort of a pretty miserable failure," she said. "How much is that going to come back to haunt them?"

It has happened before: In 2016, Genworth agreed to pay more than $200 million to settle a class-action lawsuit claiming the company painted a misleading picture of its long-term care block.

Potential alternatives

Genworth is "actively taking steps toward raising capital," according to a 10-Q, by readying a partial sale of its U.S. mortgage insurance business through a potential public offering. It also is evaluating the possibility of issuing securities that would replace the senior notes maturing in September.

During a recent conference call, executives signaled that the partial IPO of its U.S. mortgage insurance business could happen during the first half of this year.

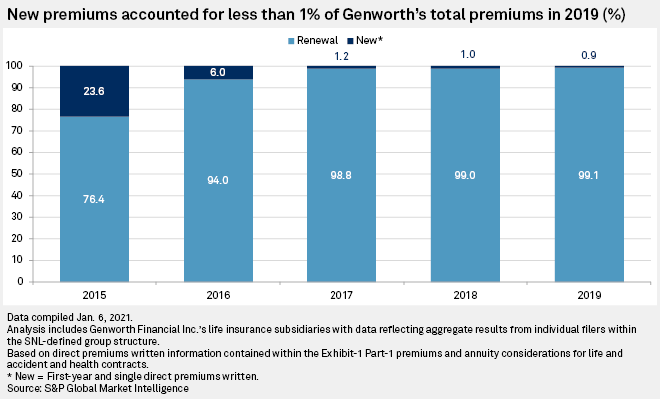

But an IPO of the business also presents longer-term issues for Genworth, CreditSights analyst Josh Esterov noted, as it is the company's "crown jewel" and "the only thing keeping [Genworth's] stock price from zero." Investors, he said, essentially have assigned a "zero to negative valuation" on the life insurance business, which is encumbered with long-term care obligations and is effectively in runoff.

"The IPO kind of braces them over into 2022, but it's not a be-all, end-all, even if they get a fairly favorable valuation ... that could unlock $600 million to $700 million," he said. "The IPO is a necessary step, but it's probably not the only one over the intermediate term."

Among other options, Esterov noted, the company could sell off its ownership stake in Genworth Australia or collateralize its remaining interest in the U.S. mortgage insurance business against a term loan.

"The best case for Genworth is for another buyer to come in, but ... the likelihood of that is not as great as their selling off some of their prime assets," CFRA's Seifert said.

Should Genworth spin off its profitable businesses, it would set up the remaining unprofitable long-term care business to "in effect ... go insolvent," said Birny Birnbaum, who serves as executive director for the Center for Economic Justice, a consumer advocacy group.

"This deal with Oceanwide falling through certainly doesn't help anything," Birnbaum said. "At best it may not make things worse, but it probably will."