S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Aug, 2021

By Hailey Ross and Jason Woleben

➤

➤ The insurer will not sell LTC products in states where regulators prevent them from annually re-rating.

➤ Genworth's CEO said insurtechs and financial technology companies want to be part of the new business.

Genworth Financial Inc. is looking to reimagine the future of long-term care insurance with a new LTC company to be launched in 2022.

For more than a decade, Genworth CEO Thomas McInerney has been working with regulators and experts to advocate for change around how LTC policies are rated. He recently spoke with S&P Global Market Intelligence about his plans for the new business, which include a fresh regulatory model and benefit and pricing changes.

The following conversation has been edited for clarity.

|

|

S&P Global Market Intelligence: Why has Genworth decided to form a new LTC business now?

Genworth CEO Thomas McInerney:

We have the largest book of business. We have now paid more than 300,000 claims, and we have 45 years of experience. I think we have learned all the lessons as to why it all went wrong and know the right way to go forward. We have had a lot of progress fixing our legacy LTC book, so we are in a position now to launch a new business.

A critical component of the new business and regulatory model is that every year we will look at our pricing assumptions. We will not change anything if there is no need, but if the pricing assumptions and reality on the ground are different ... we will make a change.

With strong demand, very limited supply and a new business regulatory model that allows us to adjust premiums, the way it is in almost every other insurance line, we think this could be a very successful business for us.

Will the regulatory changes you need be in place before the new business launches?

We will not sell in any state where the insurance department is not comfortable with the concept of annual re-rating. We would only do business in states that allow us to review annually.

States cannot continue to do what they have done for the last 40 years, which is wait as long as possible before granting increases. That just does not work. It is a very bad model, a risky model, and it does not work for consumers.

The industry has seen sales of individual LTC policies slow over the past several years. How do you see the industry evolving to ensure prices are affordable but policies still make sense for insurers?

I do think that the policies that we will write in the future will be more heavily capitated than in the past. I would say we are going to end up with a maximum amount of coverage that we would offer over a policy lifetime, which could be $250,000.

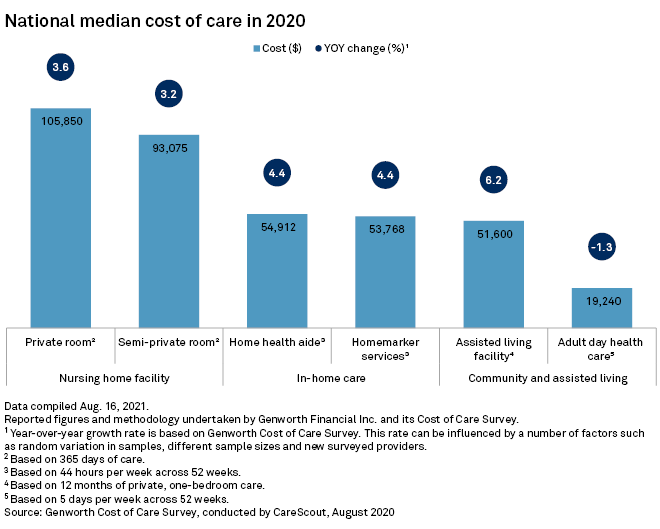

Coverage at $250,000 would cover about 80% of all the claims we have had. I think the premiums on that kind of coverage would be in the $2,000-per-year range. We think that should be reasonably affordable for middle-class Americans. The cap will be for those claims above that amount. There will have to be some other mechanism to support that.

You have sought partners to launch this business. Have other companies been receptive to the idea?

We have a long list of people who want to be our partners. The most important thing for us today is the credit rating or financial strength rating of the new long-term care company. Because of where our ratings are today, we definitely need an A or better-rated insurance or reinsurance company partner, at least in the beginning.

The expectation is that when we launch sometime next year the policies will be substantially reinsured with an A or better-rated reinsurer. Over time, as the new business takes off and grows and becomes profitable ... we should have a better rating. We think all our Genworth subsidiaries will have better ratings over time given the other things we are doing as part of our strategy. At some point, we could then reduce our reliance on a third-party highly-rated insurer.

There are also companies that want to be involved in product distribution. Insurtechs, financial technology companies and big IT companies may want to partner with us and combine their artificial intelligence capabilities and digital technologies and ability to sell direct to consumers.

Do you have a time frame for when you might pick those partners?

I think we'll probably start with one partner that will help reinsure the initial products that we launch. Our plan is to start up in the individual market early next year. The first product is likely to be an individual product heavily reinsured with that capitation limit. As we go through 2022 and beyond, we will likely offer a group product and a series of hybrid products.

I can also see a business where we are not providing insurance, not putting our capital risk. We think there is an enormous opportunity, perhaps bigger than the insurance market, to provide advice and counsel to individuals and families as they deal with relatives who need long-term care.