S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Aug, 2021

By Tom DiChristopher, Bill Holland, Tim Siccion, and Dyna Mariel Bade

|

Renewable natural gas has emerged as a critical, mature pathway for gas utilities to decarbonize their distribution systems. |

Gas utilities are ramping up renewable natural gas programs as more states provide a pathway for recovering costs and supporting investment in the low carbon fuel.

During earnings conference calls for the quarter that ended June 30, executives discussed plans to secure RNG supplies and invest in production plants, which process methane waste from sources like farms and landfills into pipeline-quality fuel. Local distribution companies could soon face challenges, as rising demand for RNG production equipment potentially strains the supply chain.

RNG expansions underway amid supply chain issues

Atmos Energy Corp. President and CEO Kevin Akers said new supply capacity would soon enable the company to increase RNG volumes on its distribution systems and help customers reduce their carbon emissions.

One of the company's largest RNG suppliers recently announced plans to expand and modernize its facilities starting in early 2022, putting it on pace to increase production by about 1 Bcf per year, Akers told analysts on Aug. 5. Another RNG location in the Dallas-Fort Worth area has indicated that it too can soon add 1 Bcf per year of RNG to Atmos' system, Akers said.

Atmos expects the projects to increase RNG volumes on its system from 7 Bcf to 9 Bcf, or 3% of its distribution sales volumes, according to Akers.

Meanwhile, UGI Corp. announced plans on Aug. 4 to expand its growing RNG operations with a partnership to process the fuel from food scraps, a less mature application than producing RNG from manure at dairy and hog farms.

South Jersey Industries Inc. said its plan to place eight RNG facilities at dairy farms into service by 2022 remains on schedule. The company now expects an additional two facilities to be online in 2022, with the "vast majority" of its remaining RNG project portfolio entering construction that year and starting up in 2023, SJI President and CEO Michael Renna said on Aug. 5. In May, the company outlined a five-year plan that includes investing $280 million to develop RNG facilities at up to 25 U.S. dairy farms outside of New Jersey.

Renna said increased demand for anaerobic digesters, which break down organic matter into biogas, is creating supply chain issues. However, he did not expect those issues to have a meaningful impact on SJI's 2022 start-up schedule. He noted that most RNG equipment manufacturing is located in Europe, and SJI has mitigated supply chain pressure by locking in delivery dates for items with long lead times.

"There are some supply chain issues that I think everybody is dealing with right now regardless of what sector you're in," Renna said. RNG is "pretty hot right now, so there are a lot of ... projects in the development queue across the country."

Gas utilities make progress in rate-basing, recovering RNG costs

Fellow Garden State utility operator New Jersey Resources Corp. is exploring RNG investment opportunities within its service territory, alongside a green hydrogen blending pilot project, according to NJR President and CEO Stephen Westhoven. The comments came as New Jersey implements a climate plan that calls for maximum building electrification, creating risk for future gas consumption.

"As RNG and hydrogen technologies continue to scale, we expect that our existing natural gas distribution system will deliver more decarbonized fuel, dramatically reducing emissions without the need for a massive build-out of costly infrastructure required for full electrification," Westhoven said during an Aug. 5 conference call.

The company believes that it has regulatory authority to invest in RNG processing plants under 2005 legislation that allowed energy efficiency and renewable energy investment, NJR Senior Vice President of Regulatory Affairs Mark Kahrer said. However, the company is in talks with regulators to make sure everyone is on the same page, Kahrer added. The executive also noted that New Jersey Senate Bill 3526 would establish a program allowing utilities to recover costs for procuring RNG and investing in production facilities.

Similar legislation, based on a nation-leading Oregon law, passed this year in states including Florida, Minnesota and Missouri.

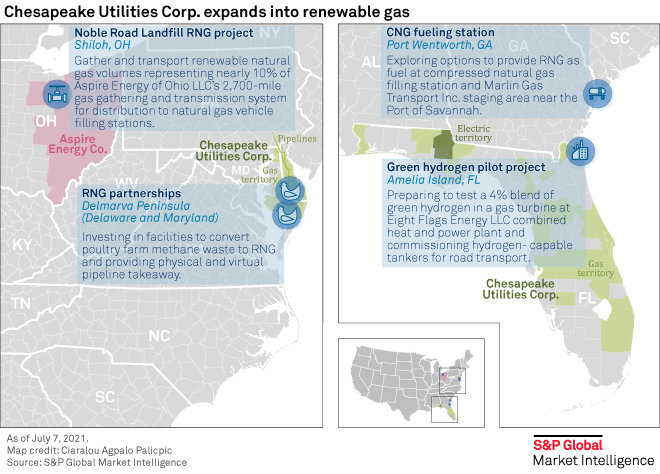

The Florida law would provide a mechanism for RNG to be a viable part of energy portfolios throughout the state, Chesapeake Utilities Corp. Chief Policy and Risk Officer James Moriarty said on Aug. 5. Chesapeake, which authored and sponsored the bill, has begun integrating RNG into its gas distribution, transmission and trucking businesses.

Spire Inc. Treasurer Adam Woodard said the company is strategizing around the Missouri legislation, but said it was premature to discuss the opportunities that the law could present to its service territories in the St. Louis and Kansas City areas. Spire is also exploring non-regulated RNG opportunities, he said on Aug. 5.

Asked about the potential for legislation allowing cost recovery for RNG investments in Atmos' jurisdictions, Akers said the company is in ongoing discussions with key stakeholders about RNG project opportunities. "We continue to work with our legislators and regulators in Colorado, as they're probably the closest to ... putting legislation on the books right now," Akers added.

Ore. illustrates RNG cost recovery in action

Northwest Natural Holding Co.'s Oregon gas utility continues to make progress utilizing the state's pioneering law to recover the cost of RNG investments and purchases, according to President and CEO David Anderson. The law allows Northwest Natural Gas Co. to make investments in RNG projects and procure third-party RNG supplies that meet up to 5% of the utility's total annual gas purchases through 2024.

To date, the company has signed agreements with options to purchase RNG or develop RNG projects that equal roughly 2% of its annual sales volumes in Oregon, Anderson said on Aug. 5. Northwest Natural on Aug. 4 announced a deal to buy renewable thermal certificates generated by New York City and Wisconsin RNG projects. The deal was Northwest Natural's second under the legislation. It followed the formation of a partnership that gives the company the option to invest $38 million in four RNG projects at Tyson Foods Inc. facilities.

Northwest Natural launched a request for proposals for additional RNG purchases for investment opportunities in July and expects the RFP to close later in August, Anderson said. Asked about the vetting process, Northwest Natural Vice President for Strategy and Business Development Justin Palfreyman said the company is fairly agnostic about the source and feedstock.

"At the end of the day, we are trying to acquire or procure the most cost-effective RNG for our customers that we can," he said. "We also have and will be looking at wastewater treatment facilities, landfill gas opportunities and other agricultural operations."