Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Sep, 2022

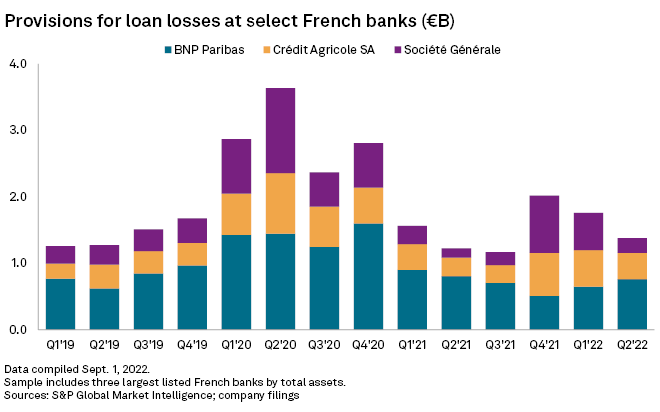

BNP Paribas SA, Crédit Agricole SA and Société Générale SA set aside €1.38 billion for bad loans in the second quarter as they begin to focus provisioning efforts on the impact of inflation and rising interest rates, S&P Global Market Intelligence data shows.

A stronger-than-expected recovery by businesses from the COVID-19 pandemic is allowing France's largest banks to reallocate provisions away from the health crisis. BNP Paribas provisioned €511 million in the second quarter in preparation for the indirect effects of the war in Ukraine, higher inflation and rising interest rates while releasing €187 million in COVID-19 provisions, CFO Lars Machenil said during the bank's second-quarter earnings call in August.

"[Second-quarter cost of risk] is in relation to the current macroeconomic and geopolitical environment, which was partially offset by releases of provisions from the public health crisis," Machenil said.

Energy shortage

Crédit Agricole SA, or CASA, is ready to reallocate provisions made in response to the COVID-19 pandemic to address the impact on businesses of any potential energy shortage this winter, Jérôme Grivet, deputy general manager in charge of finance said on an August earnings call. Gas prices remain near historic highs as fears persist that Russia may cut off its supply to Europe in retaliation for sanctions imposed following its invasion of Ukraine.

A strong rebound in tourism in France in 2022 has fueled a robust recovery from the COVID-19 pandemic in the country's hospitality, tourism and entertainment sectors, allaying many of the earlier fears about a surge in bad loans among such businesses, Grivet said.

The aggregate amount set aside for bad loans in the second quarter by the three banks rose more than 12% year over year, Market Intelligence data shows. Still, second-quarter provisioning by the banks was down more than 20% from the previous three months when the fallout from Russia's invasion of Ukraine, to which the French banks were more exposed than many of their European counterparts, prompted a year-over-year increase.

Loan loss reserves

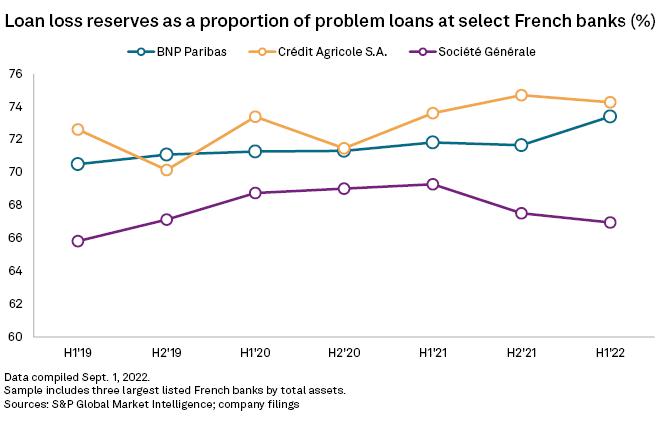

The additional provisioning has kept the banks' loan loss reserves at similar levels to those seen at the end of March 2020, when the outbreak of the COVID-19 pandemic forced banks to set aside large sums to protect against expected loan losses. BNP Paribas and CASA's loan loss reserves as a percentage of problem loans were marginally higher at the end of the second quarter than two years prior, while SocGen's have fallen by 2 percentage points, Market Intelligence data shows.

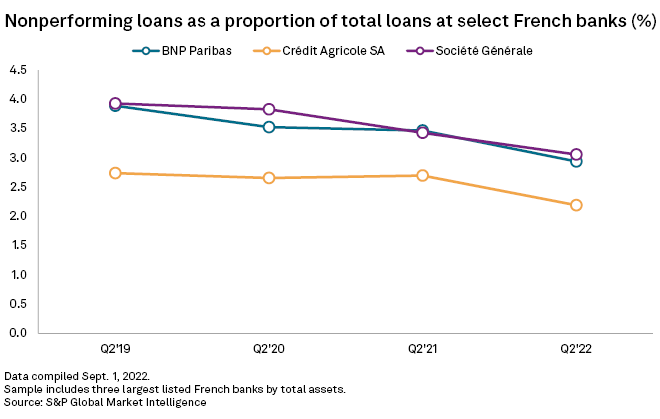

Despite significant macroeconomic risks, asset quality has steadily improved since 2019 at the three banks, Market Intelligence data shows. BNP Paribas' nonperforming loans as a proportion of total loans hit 2.94% at the end of June compared to 3.89% three years earlier, CASA's stood at 2.19% versus 2.74%, while SocGen's was 3.06% against 3.93% in the second quarter of 2019.

Still, the deteriorating outlook for the global economy, and Europe in particular, means any significant writing back of the massive provisioning made by the banks in recent years is unlikely any time soon.

"We maintain a prudent provisioning approach [in] a more uncertain context," SocGen CEO Frédéric Oudéa said during the lender's second-quarter earnings call in August.