Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jul, 2023

By Zack Hale and Molly Christian

|

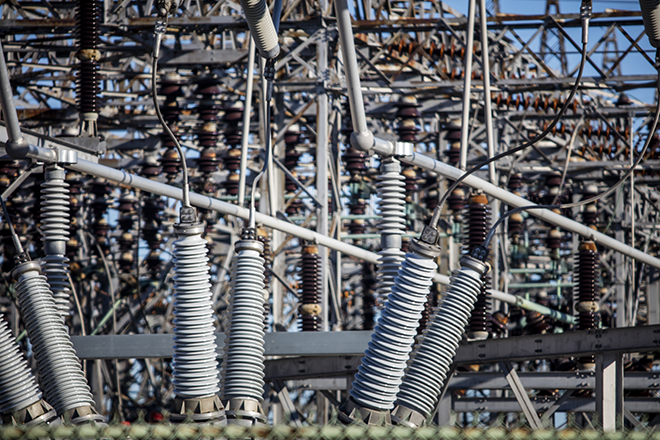

An electric substation. A new federal rule is designed to bring more speed and certainty to the US power grid interconnection process. |

The Federal Energy Regulatory Commission issued a sweeping final rule aimed at easing a nationwide backlog of clean energy and storage resources seeking to interconnect to the US power grid.

The draft final rule (RM22-14), approved unanimously at the agency's July 27 monthly open meeting, is designed to ensure that power generation projects closest to commercial operation are prioritized in a way that also weeds out more speculative projects from clogged interconnection queues.

"Today is a historic day," FERC Chairman Willie Phillips said during a press briefing after the commission meeting. "This rule will ensure that our country's vast generation resources are able to interconnect to the transmission system in a reliable, efficient, transparent and timely manner."

At the end of 2022, more than 2,000 GW of generation and storage — equal to all existing US generating capacity — were waiting in interconnection queues, Phillips said, and successful projects can face wait times of up to five years to connect to the grid.

Research presented by Lawrence Berkeley National Laboratory in June underscored how renewable energy developers, who often lack insight into the cost responsibility they face for related transmission network upgrades, drop out of queues when those upgrade costs are unexpectedly high. That can cause cascading restudies for remaining projects, which in turn have contributed to an average wait time of nearly four years for successful power generation projects built between 2018 and 2022, Lawrence Berkeley researchers found.

The problem has caused grid operators such as the 13-state PJM Interconnection LLC, the nation's largest wholesale power market operator, to impose a roughly four-year pause on processing new interconnection requests so that it can work through a backlog of approximately 2,700 proposed projects totaling 260 GW in generating capacity.

Navigating the grid study process, as well as boosting interconnection capacity, now represent two of the greatest hurdles for the US clean energy transition.

Final rule

Phillips said the final rule, which was not immediately available July 27, is "one of the largest in FERC's history" and the "most significant set of interconnection reforms since the pro forma interconnection procedures were created two decades ago."

The rule, named Order 2023, raises financial commitments for interconnection customers seeking to enter and stay in the queue. Interconnection customers must pay increased study deposits, meet more stringent site control requirements, and pay commercial readiness deposits as part of that process, according to a FERC staff presentation.

In addition, project developers will face penalties if they withdraw their requests from the interconnection queue.

"These reforms will discourage speculative, commercially non-viable interconnection requests and allow transmission providers to focus on processing interconnection requests that have a greater chance of reaching commercial operation," the staff presentation said.

Under the final rule, transmission providers must use a cluster study process, where they will evaluate numerous proposed generating facilities at the same time. The commission said that approach will be more efficient than the current "first-come, first-served" study process, in which each individual interconnection customer's request is studied separately and serially.

Conducting a single cluster study and cluster restudy each year can "minimize the risk of cascading restudies when a higher-queued interconnection customer withdraws its request," the presentation said.

As with the proposed rule, transmission providers will have 150 days to complete the cluster studies and 150 days for a restudy. The final rule also did not modify a 90-day facilities study timeline, which can be extended to 180 days upon request.

Under the final rule, transmission providers must also use a standardized and transparent affected system study process that includes uniform modeling standards. Affected system studies evaluate the impact of proposed interconnection requests on neighboring transmission systems.

The rule imposes firm deadlines and establishes penalties if transmission providers do not complete interconnection studies on time.

Penalties for delayed cluster studies are $1,000 per business day, rising to $2,000 per business day for cluster restudies or affected systems studies that go beyond their deadlines. Facilities studies that are behind schedule will face penalties of $2,500 per business day.

However, transmission providers may appeal penalties at the commission.

To support hybrid resources such as a solar power-plus-energy storage facility, the final rule would require transmission providers to allow more than one generating facility to co-locate on a shared site and share a single interconnection request.

Transmission providers must also evaluate specific alternative technologies in their cluster studies. The final rule expanded the list of those technologies from five to eight.

During the July 27 meeting, Commissioner Allison Clements said those technologies are static synchronized compensators, static var compensators, advanced power flow control devices, transmission switching, synchronous condensers, voltage source converters, advanced conductors and tower lifting.

Phillips said the final rule incorporated the "vast majority" of FERC's June 2022 proposal. But the final rule left out proposals pertaining to informational interconnection studies and nonfinancial commercial readiness demonstrations.

To ease the transition to the new rule, FERC will allow interconnection customers that already have facility study agreements with transmission providers to do a transitional serial study or transitional cluster study. Project developers already in the queue but that do not have a facilities study agreement will also be eligible for a transitional cluster study.

Compliance filings are due 90 days after the rule is published in the Federal Register.

Rule draws applause

Clean energy groups welcomed the rule, saying its deadlines and penalties will help reduce the massive backlog in projects waiting to connect to the grid.

The Solar Energy Industries Association (SEIA) also applauded the exclusion of the commercial-readiness portion of the proposed rule. That proposal "would have required clean energy project developers to have an offtake contract in place before entering the interconnection queue, an impossible standard to meet," SEIA director of energy markets and counsel Melissa Alfano said in a statement.

But FERC's final rule is not expected to immediately solve all interconnection challenges. Projects representing 50 GW of new generating capacity in the 15-state Midcontinent ISO region have requested three-year delays despite holding signed interconnection agreements, MISO CEO John Bear noted July 27. Approximately 60% of those projects are experiencing some type of supply chain issue, Bear said.

"The things that worry us the most are supply chains, siting and permitting," Bear said during an event hosted by the industry trade group WIRES.

The interconnection order is part of a broader effort to update FERC's transmission policies to reflect a shifting resource mix increasingly made up of intermittent renewable resources and energy storage.

Phillips said FERC plans "in the months ahead" to finalize an April 2022 transmission planning proposal (RM21-17).

The interconnection rule, together with the planning proposal and other efforts underway at the commission, will represent "the greatest transmission reforms in a generation to come out of FERC," the chairman said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.