S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Dec, 2022

By Brian Scheid

Federal Reserve officials are widely expected to slow their frenetic pace of rate hikes this week, but they also will likely outline plans to boost interest rates next year to highs not seen in more than 15 years.

Following their Dec. 13-14 meeting, the rate-setting Federal Open Market Committee is expected to announce the benchmark federal funds rate will be hiked by 50 basis points. After keeping rates near zero for roughly two years, the Fed has hiked rates by 375 bps since March, including hikes of 75 bps at each of its last four meetings.

The futures market late last week put the odds of a 50-bps hike at this meeting at roughly 75%, with 25% forecasting another 75-bps hike, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market.

The expected 50-bps hike will push the federal funds rate to a target range of 4.25% to 4.5%, but Fed watchers will be watching closely where central bankers plan to go from there.

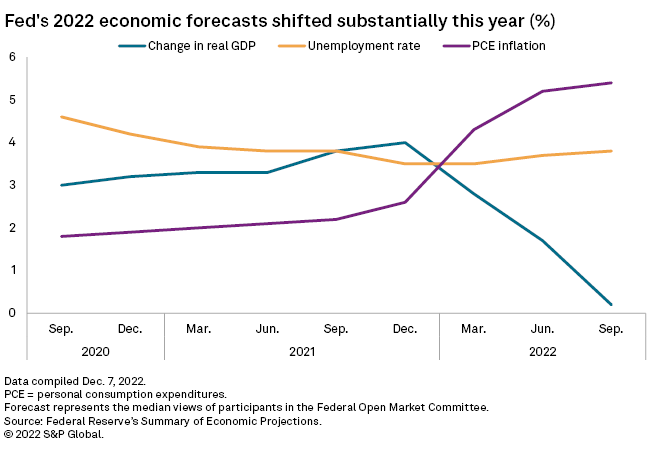

After the meeting, the Fed will release the quarterly summary of economic projections, a rundown of Fed officials' views of inflation, employment and economic growth. It will also update its terminal rate estimate, or the range that officials expect to ultimately bring the benchmark interest rate to.

In September, Fed officials projected a terminal rate of 4.6% in 2023, or a target range between 4.5% and 4.75%, but Fed Chairman Jerome Powell has warned that this projection will likely be raised, and most Fed watchers believe it will rise above 5%.

"This will be a tricky message for Chair Powell and the FOMC as even though they are reducing the pace of rate hikes, they will not want the market to perceive this as a sign they are close to being done with their fight against inflation and there will be more rate hikes next year," said Jason England, global bonds portfolio manager at Janus Henderson Investors. "They will want the overall message to be hawkish as a 50-bps hike is still a large hike and inflation is still way too high."

The consumer price index, the market's preferred measure of inflation, increased 7.7% from October 2021 to October 2022, down from annual growth of 8.2% in September and the peak 9% in June. CPI data for November is scheduled for release Dec. 13 as the FOMC begins its two-day meeting.

While inflation has cooled slightly, it remains well above the Fed's 2% target, and Fed officials have warned that rate hikes will continue as long as inflation remains elevated.

"With the level of inflation we're seeing right now, the last thing the Fed needs to do is send a dovish signal to the market," said Patrick Leary, a senior trader with Loop Capital Markets.

Leary believes the Fed is eyeing a terminal rate of about 5.25%, a level it has not reached since 2007. At the same time, markets have rallied on any hint that the central bank is easing off its aggressive pace of tightening monetary policy, leading to several "false starts," Leary said.

"It's such a strange environment to be in where bad news is good news and good news is bad news," Leary said.

While Fed officials have said their future rate moves will be "data dependent," the market narrative has shifted from one data release to the next. Inflation data might show cooling, but labor data shows persistent wage growth.

Where one believes interest rates ultimately end up may depend on which data is being considered, Michael Harnett, an investment strategist at Bank of America, wrote in a Dec. 9 report.

The recent crash in oil prices means the Fed may hike only another 75 bps, putting the terminal rate at 4.5% to 4.75% by early 2023. But if you look at the red-hot jobs market, where there are nearly twice as many jobs as there are Americans looking for work, the Fed may hike by another 150 bps, bringing the federal funds rate to 5.25% to 5.50% by March with more hikes possible.