Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Mar, 2021

By Peter Brennan and Polo Rocha

Central banks are committed to pumping liquidity into financial markets in order to keep borrowing costs low, but events are beginning to run away from them.

Investors have been selling Treasurys, partly in the expectation that the

The sharp climb in yields evoked memories of the "taper tantrum" in 2013 when then-Fed Chairman Ben Bernanke spooked the market by hinting at quicker-than-expected tightening. This time around, it is the market's expectation of improving economic growth sparking a rise in inflation that is behind investors' demand for higher yields.

For now, the Federal Reserve is unmoved, but a renewed spike in yields could become an issue as the Fed seeks to keep borrowing costs low to grease the wheels of the economic recovery. Investors are warning that the correction has the potential to develop into a repeat of the 2013 tantrum, which saw corporate borrowing costs surge.

"If market technicals push yields higher and central bank comments fail to calm price action, then we could be in for another bumpy March," said Mark Dowding, chief information officer at BlueBay Asset Management. A rapid rise in yields toward 1.75% on the 10-year U.S. Treasury could spark a drop in the S&P 500 of 5% and a spike in yields in corporate bonds and emerging markets, according to Dowding.

Liquidity is already an area of concern. The yield on 10-year Treasurys briefly hit a 12-month high 1.61% on Feb. 25 after a weak auction of 7-year Treasurys, showing reduced demand for American debt.

"This is very worrying," Althea Spinozzi, fixed income strategist at Saxo Bank, wrote in a market commentary Feb. 26. "The Treasury will need to continue to issue more Treasurys to finance Biden's $1.9 trillion stimulus package, leaving the market wondering whether demand will be able to match the supply. If it doesn't, we might see an acceleration of the selloff in Treasurys."

Taper tantrum

Inflation is still nowhere near the Fed's 2% target, with the central bank's preferred inflation gauge rising by 1.5% year over year in January. But the Fed's narrative that it will be patient in tightening policy is increasingly being discounted by investors who expect a return of consumer spending to bolster inflation.

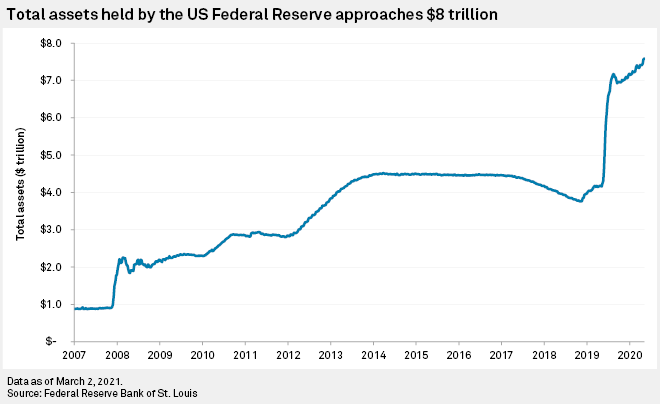

Fed officials expect such inflationary pressures will be temporary and plan to provide support to the U.S. economy for some time. The central bank has indicated it will keep buying $120 billion in bonds each month until it sees "substantial further progress" in the recovery, and its interest rate forecasts suggest it could keep short-term rates at rock bottom through 2023.

But the events of previous taper tantrum is playing on the minds of Fed governors such as Lael Brainard, who said at a March 2 Council on Foreign Relations event, "I would be concerned if I saw disorderly conditions or persistent tightening in financial conditions that could slow progress towards our goal."

Improvement in the economic outlook in 2013 led Bernanke to hint in testimony to Congress that the Fed would begin to slow its pace of bond purchases that it began in response to the 2007-2009 financial crisis. Bond yields spiked immediately, climbing from 2.03% on May 22, 2013, when Bernanke made the comments to a peak of 3.04% on Dec. 31, 2013, forcing the Fed to adopt a more dovish policy.

The sell-off of Treasurys bled into corporate bond markets with the yield on the S&P U.S. High Yield Corporate Bond Index surging from 4.56% to 6.53% in just over a month.

In 2021, the Fed is doing its utmost to communicate that it has no plans to taper, yet some analysts warn the 2013 tantrum is poised for a sequel unless the Fed acts. The likely course of action would see the Fed express concern over rising long-term yields harming the recovery at some point, followed by a shift in its bond purchases toward longer-dated bonds or even some form of yield curve control, analysts say.

Yield curve control

Similar pressures have already forced the Reserve Bank of Australia, or RBA, into an unscheduled A$3 billion purchase of government bonds to bring the yield on three-year bonds back in line with their 0.1% target.

"Central banks will soon be forced into action — the RBA and Bank of Korea have already intervened — potentially pushing real yields down to depressed levels," Salman Ahmed, global head of macro at Fidelity International, wrote in a market commentary on Feb. 26. "The cost of capital matters, and eventually leads to tighter financial conditions that central banks just can't ignore. Lower real yields are the only way for the system to clear, and markets are now testing central banks' resolve."

So far, the rise in Treasury yields has not had a dramatic effect on corporate borrowing costs. The yield on the high yield index was just 1.95% as of March 1, only seven basis points higher than on Oct. 1, 2020, when the Treasury sell-off began.

As a result, the Fed has not blinked yet. Chairman Jerome Powell previously stressed in January that with regards to bond-buying, "now is not the time to be talking about an exit" and reinstated that position Feb. 25, resulting in the yield coming off from its recent high.

Morgan Stanley is calmer about the possibility of a repeated tantrum experience but warned that there would be cause for concern should underlying inflation threaten 2.5% and the rate of unemployment drop.

"Following the 2013 taper tantrum experience, the Fed is committed to being more transparent on its forward guidance and policy path. Moreover, the Fed has also raised the bar for tightening with its new focus on generating a high-pressure economy," Morgan Stanley analysts led by Chetan Ahya, chief economist and global head of economics, wrote in a Feb. 28 research note.

"We expect the Fed to use the June [Federal Open Market Committee] meeting to guide markets towards expecting a gradual tapering from January 2022 onwards, with actual rate hikes still further behind," the analysts wrote. The bank does not expect the Fed to hike rates until the middle of 2023.

James Lynch, fixed income investment manager at Aegon Asset Management, believes central banks "are not going to rock the boat," writing in a market commentary on March 1 that he does not expect the Fed or other developed market central banks to be unduly concerned if inflation is between 2% and 3%. The Fed has said it is happy to allow inflation to run above target in the near term.

But for Ahmed, Powell's verbal interventions will only be able to keep a lid on investors for so long. "Ultimately, we will need credible evidence that the central bank is indeed targeting negative real rates as a policy."