S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Jan, 2022

By Shreya Tyagi and Zuhaib Gull

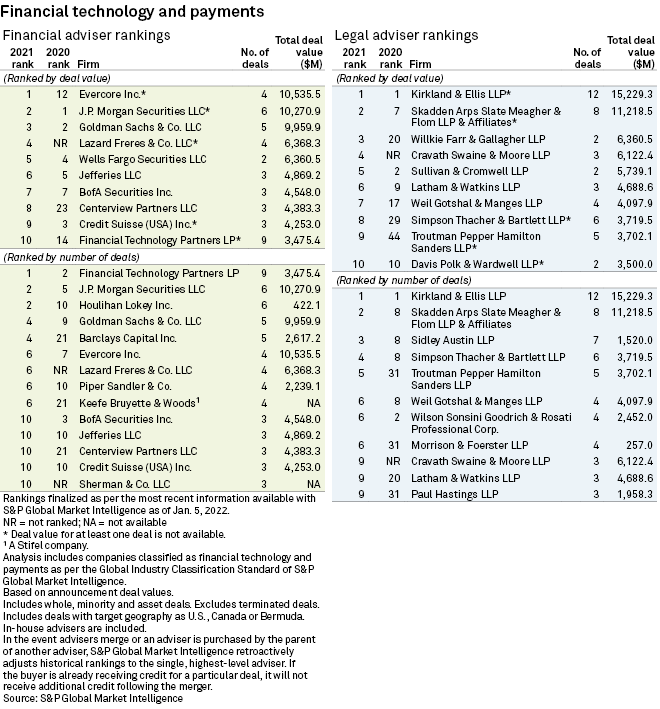

Financial technology and payments

Evercore Inc. ended 2021 as the top M&A adviser by deal value for fintech and payments deals targeting U.S.-based companies, leapfrogging from 12th position in 2020.

Evercore did not advise on any deals in the fourth quarter but still made it to the top by advising on four deals worth $10.54 billion throughout the year.

J.P. Morgan Securities LLC took the No. 2 spot by deal value for the year and placed seventh for the fourth quarter. The company advised on six deals in 2021 worth $10.27 billion.

For both advisers, their largest transaction in the space based on deal value was the $5.86 billion sale of CoreLogic Inc. to an investor group led by Insight Venture Management LLC and Stone Point Capital LLC.

For the last quarter of 2021, the No. 1 position was tied between BofA Securities Inc. and Deutsche Bank Securities Inc., as they advised on one deal valued at $2.57 billion. While BofA was a buy-side adviser on Thoma Bravo LP's pending acquisition of Bottomline Technologies Inc., Deutsche Bank advised the seller.

In terms of number of deals, Financial Technology Partners LP took the lead with 9 deals in 2021.

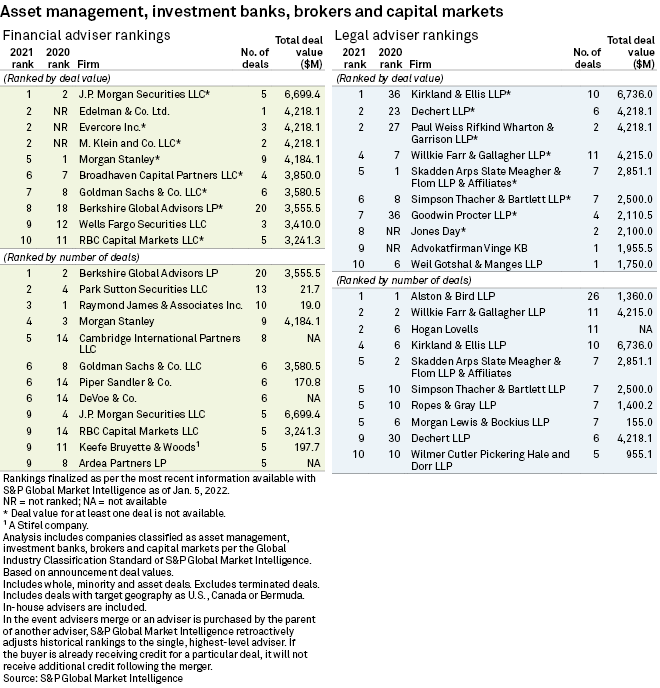

Asset management and investment banks, brokers and capital markets

J.P. Morgan Securities clinched the No. 1 position with five deals worth a total of $6.70 billion in the asset management, investment banks, brokers and capital markets sectors for 2021.

In the quarter ended Dec. 31, 2021, in terms of deal value, the first position was shared by four advisers: Edelman & Co. Ltd., Evercore, J.P. Morgan Securities and M. Klein & Co. LLC. They all had one deal in common, which was T. Rowe Price Group Inc.'s acquisition of Oak Hill Advisors LP.

Berkshire Global Advisors LP worked on the highest number of assignments in the space, with 20 deals in 2021.

Specialty finance and mortgage REITs

Evercore also topped the specialty finance and mortgage real estate investment trust financial adviser M&A league table for 2021 with deal credit of $33.64 billion from three deals.

The investment bank's biggest deal for the year was advising GE Capital Aviation Services Inc. on its $31.15 billion sale to AerCap Holdings NV.

Jefferies LLC secured the top rank in the quarter ended Dec. 31, 2021, followed by Comstock Capital & Advisory Group and Stephens Inc. in the second rank. All three advised in FirstCash Holdings Inc's acquisition of American First Finance Inc.