S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Nov, 2022

By Sanne Wass

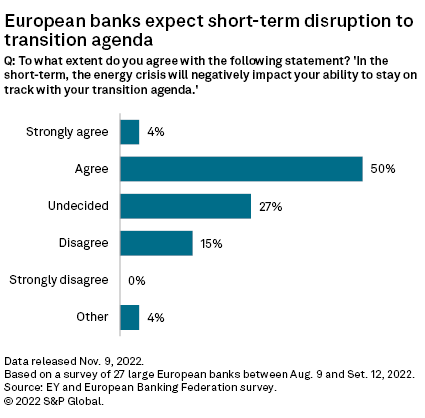

More than half of Europe's major banks expect the current energy crisis to negatively impact their short-term ability to stay on track with their climate transition agenda, according to new research.

Russia's war in Ukraine has "dramatically" increased the energy sector's need for working capital and fresh investment, in part to address an immediate shortfall in fossil fuel availability, according to a study conducted by the European Banking Federation and consulting firm EY, which surveyed 27 large European banks between Aug. 9 and Sept. 12.

Some 42% of banks in the study said the gas supply crisis and increased usage of fossil fuels will put them under pressure to reassess their portfolio mix over the next 12 months. Most banks said the war had already worsened or slowed down their transition agenda.

"We knew the transition was never going to be linear," Gill Lofts, global financial services sustainable finance leader at EY, said in an interview.

Disruptions from the war mean that, in the next two to three years, banks may not be able to reduce their fossil fuel exposure and financed emissions as rapidly as originally planned, Lofts said.

Banks maintain targets

Despite the challenges, European banks remain "firmly committed" to achieving net-zero emissions by 2050, while they also see growing opportunities to finance more renewable energy over the medium term, the research showed. So far, none of the financial institutions covered by the study has made any formal change to energy strategies or targets for emissions reductions, it found.

"We don't change any of our medium-term plans, but we can adapt very shortly to events that are occurring," said Etienne Barel, deputy CEO of the French Banking Federation, at a COP27 side-event Nov. 9.

"We see a temporary need for financing in the fossil fuel sector," said Jörg Eigendorf, chief sustainability officer at Deutsche Bank AG, speaking at the same event. "But we just published our targets, and we didn't change these targets because of this environment."

This includes Deutsche's goal to cut absolute financed emissions in upstream oil and gas by 23% by 2030, Eigendorf said.

More than 60 European banks have pledged to reach net-zero emissions in their lending and investment activities by 2050 through membership of the Net-Zero Banking Alliance. Globally, the coalition now has 122 members, more than half of which have set 2030 decarbonization targets for select high-emitting portfolios, according to the alliance's latest progress report, published Nov. 9.

"Clearly, there are many uncertainties, but now is maybe even a better time to make sure that we transition in society," said ING Groep NV's CEO Steven van Rijswijk, speaking to S&P Global Market Intelligence during an on-stage interview at the Sibos conference Oct. 11. "Because we are now seeing the dependency that we have on fossil fuels, which we should really change. So we are sticking to our guns."

The Dutch lender earlier this year committed to not finance new oil and gas fields, and to mobilize €125 billion of sustainable finance per annum by 2025. Those pledges have not changed, van Rijswijk said.

Some financial institutions have even introduced more ambitious climate policies in recent weeks. U.K.-based Lloyds Banking Group PLC committed to not directly finance new oil and gas fields, while Spain's Banco Bilbao Vizcaya Argentaria SA raised its sustainable financing target.

Renewables push

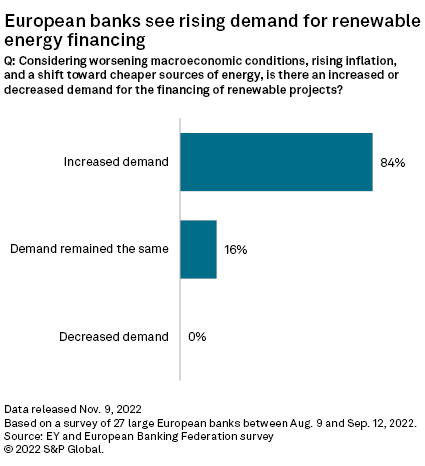

Many banks believe the current crisis could in fact accelerate the global transition over the medium term, according to the EBF and EY research. Some 84% of respondents said macroeconomic challenges are pushing up demand for financing of renewable energy, such as biogas and solar, as a means to decarbonize and improve energy security.

"The fact that we are fighting for energy supply this winter is actually accelerating the climate agenda," said Marisa Drew, chief sustainability officer at Standard Chartered PLC, speaking at Sibos Oct. 12. Governments are looking to speed up investment into renewable energy and have also become more open to energy sources such as nuclear power, she said.

"These are conversations that would not have happened if we weren't sitting here facing this crisis," Drew said.

Government policy to drive the energy transition will be crucial for banks to reach their longer-term climate targets. While finance plays a critical role in supporting the transition, it "cannot be a substitute for government action," the Glasgow Financial Alliance for Net Zero, or GFANZ, said Nov. 1.

GFANZ, an umbrella group for seven climate coalitions including the Net-Zero Banking Alliance, called on G-20 governments to "urgently update" their energy transition strategies to take into account any short-term policy measures in response to the energy crisis. Governments should also clarify how they will "get back on track" to deliver on energy security and net-zero transition policy objectives.

It comes as energy disruption caused by Russia's war in Ukraine has prompted several EU nations, including France and Germany, to reopen or extend the lifespan of coal plants in an attempt to mitigate the decline of Russian gas supplies. The U.K., meanwhile, has opened up a new licensing round to allow oil and gas companies to explore fossil fuels in the North Sea.

"We are a key U.K. bank, so we like to work with government and government policy. Obviously, that's in flux at the moment," Solange Chamberlain, COO for commercial and institutional at NatWest Group PLC, said in an interview. "But we haven't changed any of our policies."

NatWest has committed to halving its financed emissions by 2030 and has also started to exit major oil and gas producers that do not have a credible transition plan, Chamberlain said.

"Clearly, we have to continue to assess [our policies] and we want to do a just transition," she said. "Government policy will evolve. And we've got to work in partnership with government because there's a lot of things we can try and help with, but ultimately, we can't hit our targets on our own."

Banks are hoping for "clearer country-level plans for climate-related policies, tariffs, incentives and investment," according to the EBF and EY study.

"Making national plans and sectoral decarbonization pathways more durable — perhaps with the help of industry initiatives — would also be very valuable," it said.