S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 May, 2021

By Darren Sweeney

| Duke Energy Chair, President and CEO Lynn Good speaks in October 2020 at the company's virtual ESG Investor Day. Activist investor Elliott Management wants Duke Energy to split into three separately traded entities. Source: Duke Energy Corp. livestream |

As Elliott Management Corp. sets its sights on a restructuring at Duke Energy Corp., Wall Street analysts and markets are not yet sold on the merits of the hedge fund's plan for the utility giant.

Elliott Investment Management LP, an affiliate of New York investment firm Elliott Management, on May 17 disclosed a plan for Duke Energy to create $12 billion to $15 billion in near-term value for shareholders through the tax-free separation of the company into three publicly-traded entities. Elliott, which said it is a "top 10 investor" in the Charlotte, N.C.-headquartered utility giant, argues that "Duke's long-term underperformance has not been reflective of its high-quality assets."

Duke Energy disagrees and based on initial reactions, Wall Street appears to need more convincing.

"[W]e don't believe the proposal makes much sense," CreditSights analyst Andrew DeVries wrote in a May 18 research report. "[I]t seems like the consensus view also doesn't see any low-hanging fruit for Elliott to 'unlock.'"

Duke Energy has a market value of about $78 billion, as of May 19, but Elliott believes the company could create more value by splitting into "three regionally focused entities" each with separate headquarters in the Midwest, Florida and the Carolinas.

"We estimate that the Carolinas, Florida, and the Midwest would command equity market valuations of $54 [

Why now?

Elliott flagged the cancellation of the Atlantic Coast pipeline and related $2.1 billion write-off, coal ash remediation costs that included a $1 billion write-off, the "overpriced" $6.7 billion acquisition of Piedmont Natural Gas Co. Inc., and "dilutive equity capital raises totaling $6 billion" over the past four years as among the "strategic missteps" by Duke Energy that have led to credit pressures from a weakened balance sheet and impaired shareholder value.

"It is tough to argue against Elliott on any of these points but they all simply point to replacing some members of management and/or the board, not a full-blown breakup of the company as Elliott has proposed," DeVries wrote.

Others on Wall Street appear to share this view.

"In the simplest sense, the discounted valuation over the past several years was not related to subpar operations or growth at the satellite utilities, in our view, but rather problems that Duke created and has subsequently remedied (broadly speaking)," Scotia Capital (USA) Inc. analyst Andrew Weisel wrote in a May 20 research report.

The analyst said Duke Energy deserves credit for "cleaning up its own mess" by reaching a settlement on coal ash costs and de-risking the portfolio over the past 18 months. But despite the company's past mistakes, including the early retirement of the Crystal River nuclear plant in Florida and the 2014 coal ash spill in North Carolina, Weisel does not see Elliott's involvement "as being likely to drive change."

Elliott argues the company is overlooking and undervaluing its subsidiaries outside of the Carolinas. The firm also notes that Duke Energy Florida LLC, for instance, has residential customer rates that are "approximately 30% higher" than its peers but "the lowest rate base growth."

"I think it's reasonable to say that management is primarily focused on the largest subsidiaries, but I also know that the subsidiary leadership teams are quite strong," Weisel said in response to questions from S&P Global Market Intelligence. "I don't believe that the level of investment would be different however; the limiting factors on capex are customer affordability and regulatory approvals, not balance sheet constraints."

Don't break it up

Duke Energy argues that it provides more benefits to its customers, employees and the financial community as a consolidated company.

"Given the performance of the company, there is no strategic logic to breaking the company apart, and there is serious risk of dis-synergies that would weigh down the various spun-off entities and raise questions about the viability of the dividend to shareholders," Duke Energy wrote in a May 17 response to Elliott's offer, adding that a break-up would be costly and "require extensive regulatory review at the state and federal level."

In addition, the company argues Elliott's plan would erode credit quality given that each smaller entity would be allocated a proportional share of parent-level debt, estimated at between $20 billion and $22 billion.

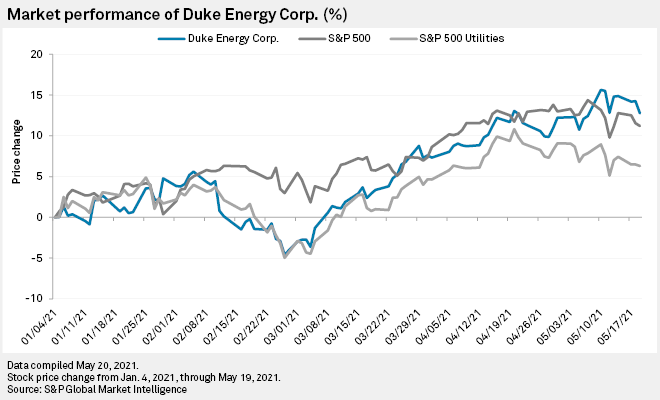

Duke Energy also noted that its share price has outperformed many peers.

"Over the last 12 months, Duke Energy's stock price has increased 25.2% versus 18.7% for the S&P Utility Index," the company wrote.

Analysts have applauded Duke Energy's January announcement that it would forgo plans to raise $1 billion in common equity by selling a 19.9% interest in subsidiary Duke Energy Indiana LLC to GIC Pte. Ltd. affiliate EPSOM Investment Pte. Ltd. in a $2.05 billion all-cash deal.

In conjunction with the transaction announcement, Duke Energy increased its long-term adjusted EPS growth rate to 5% to 7% through 2025, with deal proceeds to fund an increased $59 billion five-year capital plan.

Wall Street analysts have speculated that Elliott may be "drumming up interest, board votes and shareholder votes" to persuade Duke Energy to accept NextEra Energy Inc.'s previously reported bid for the entire company.

Duke Energy's "historic equity outperformance, an above average forward [price-to-earnings] ratio and a fully regulated business model somewhat begs the question of what is Elliott's true end-game here and we speculate maybe they simply want Duke to re-engage with NextEra on a potential deal," DeVries, of CreditSights, wrote.

The investor's letter mentions a "potential monetization" of Piedmont Natural Gas as a way to unlock additional value based on the valuation CenterPoint Energy Inc. received for its Arkansas and Oklahoma gas utilities.

"We believe this could add an incremental $1[billion] to $2 billion of value beyond what we have already identified, with minimal cash tax leakage," Elliott wrote.

Weisel said a potential sale of Piedmont Natural Gas would largely depend on market interest.

"I think that if Duke were offered multiples like those [CenterPoint] received, they [would] have to consider it long and hard," he said. "I imagine they would sell at those multiples, but I don't expect anyone to offer those. M&A is always tough to predict, especially when private players are so involved."

Some analysts have spoken directly with Duke Energy's management team since Elliott publicly disclosed its strategic review request.

"At this juncture, we do not see Duke as 'sellable' given its size, and multi-state jurisdictions, which can be somewhat challenging for M&A ... and multiple initiatives happening currently including on the regulatory and legislative side that could be put to a halt during a 1-2 year M&A process," Guggenheim Securities LLC analyst Shahriar Pourreza wrote in a May 18 research report, adding Duke Energy's debt, dis-synergies and "material rightsizing of the dividend would be a material hindrance that in our view would be very difficult to overcome."

Mizuho Securities USA LLC analyst Anthony Crowdell believes Elliott can either pursue a settlement with Duke Energy in order to get board seats "or a proxy contest where Elliott makes a push with large holders that their path to valuation creation is superior to the current one."

"Neither option is easy, with our belief that the proxy contest is more challenging than Elliott reaching an agreement with the company," Crowdell wrote in a May 18 report.

Duke Energy pointed out in its response that Elliott has had "decidedly mixed results" with its involvement at Sempra Energy, FirstEnergy Corp. and Evergy Inc.

"These utilities' share prices have materially underperformed the sector to date since Elliott became involved, establishing an unenviable track record of shareholder value destruction," Duke Energy contends.

CreditSights, however, said it has "tremendous respect" for Elliott's accomplishments in the utility sector.

"Elliott's previous triples and home runs in the utility sector at FirstEnergy, Sempra, [NRG Energy Inc.] and CenterPoint all involved significant non-utility subsidiaries with clear line of sight to a solution while Duke and Elliott's so far unsuccessful battle with [Evergy] are entirely different situations with fully regulated businesses," it said.