Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Dec, 2021

By Joseph Williams and Darakhshan Nazir

If there was ever a thought that information technology M&A activity might back off its frenetic pace before the end of the year, November did its share to put that notion to rest.

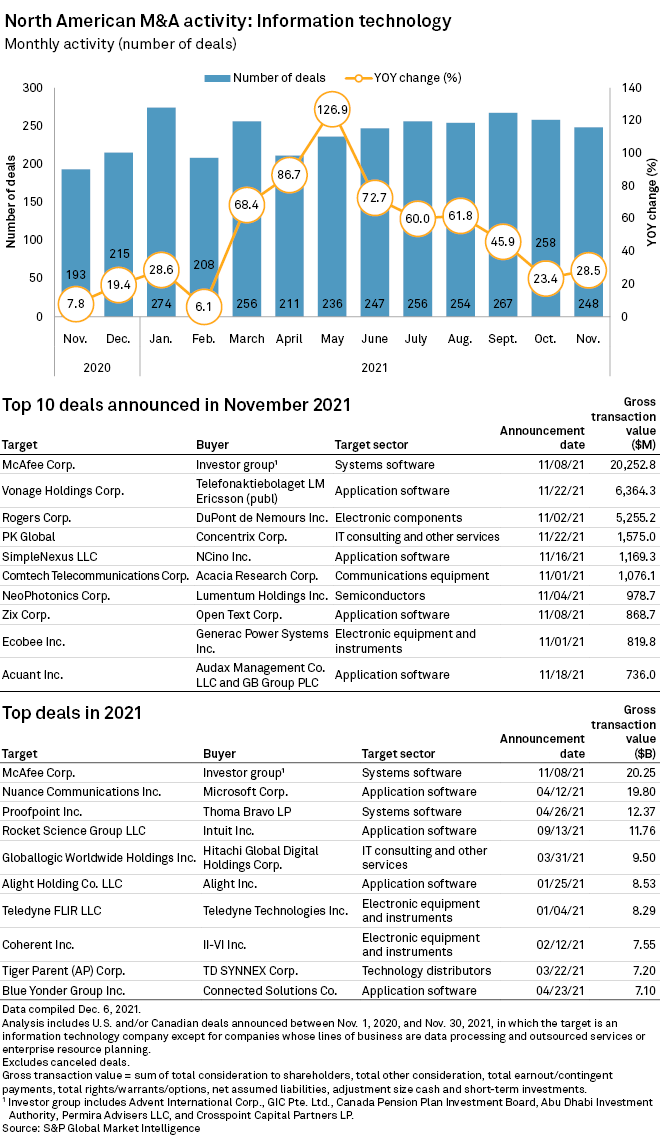

The month marked a few superlatives for the year, including marking the largest sector deal announcement and the highest aggregate technology deal values, according to data from S&P Global Market Intelligence and 451 Research. Total information technology deal volumes hit 248 domestically, up 28.5% year over year and in line with volumes that have been floating around the 250 mark since June.

The run of activity has pushed total 2021 tech transaction values to nearly twice the previous annual record, by 451's count.

Private equity firms did their part to make November one for the books, with a consortium of funds led by Advent International Corp. offering up $20.25 billion for legacy cybersecurity company McAfee Corp., which includes about $8.04 billion in assumed liabilities like debt and minority interest. The deal cut above Microsoft Corp.'s $19.80 billion acquisition of Nuance Communications Inc. to become the largest information technology transaction of the year, and 451 tagged it as the largest information security transaction ever.

The take-private deal comes at a significant price, but private equity firms have been shrugging off astronomical numbers all year. Financial buyers are sitting on a dragon's hoard of dry powder, as much as $3 trillion, and persistently low interest rates are making the high price tags justifiable, according to S&P Global Market Intelligence. To illustrate, private equity firms have been announcing a technology transaction above $1 billion almost every week of 2021, a record pace. 451 Research projects 50 $1 billion-plus private equity deals in 2021, compared to 28, 24 and 35 in the three years prior, respectively.

The McAfee transaction almost doubled the amount of private equity money spent on systems software acquisitions during the year, and it accounts for only part of the business McAfee entered 2021 with. The company in July closed the $4.0 billion sale of its enterprise segment to another private equity firm, Symphony Technology Group (Unspecified Vehicle).

For the latest sale of the consumer business, Barclays PLC, Bank of America Corp., Citigroup Inc. and JPMorgan Chase & Co. advised the buyers. McAfee will take on The Goldman Sachs Group Inc. and Morgan Stanley for its consultation, with Goldman providing a fairness opinion.

Adviser fees were not disclosed in either of those transactions. By comparison, both Goldman and Morgan Stanley worked on the third-largest information technology deal of the year, and the second-largest cybersecurity acquisition by a private equity firm, Thoma Bravo LP's $12.37 billion addition of Proofpoint Inc. For that transaction, Morgan Stanley disclosed fees of $62.0 million and charged $16.0 million for a fairness opinion.

Thoma Bravo has been highly active in the technology space in recent years, with 76.2% of its investment concentrated in the technology, media and telecommunications industry. Advent is a similar size, with both firms holding just over $75 billion in assets under management at the end of 2020, but Advent is much more diversified from a sector perspective. About 26.1% of its assets are in the technology, media and telecommunications industry, with nearly as large holdings in consumer, industrial, financial and healthcare industries.

Even without the McAfee transaction, November's deal values held up against most other months of 2021, with five other transactions landing above the $1 billion mark. The second and third largest acquisitions broke $5 billion.

JPMorgan and Goldman will also advise on the third-largest deal, DuPont de Nemours Inc.'s $6.38 billion combination with Rogers Corp. The acquisition will see materials technology company DuPont expand its electronic components business with Rogers. Evercore Inc. also advised on the deal.

The second largest deal will see telecommunications infrastructure company Telefonaktiebolaget LM Ericsson (publ) pay $6.36 billion for cloud technology provider Vonage Holdings Corp., and that transaction will throw more business to boutique adviser Qatalyst Partners LP. Qatalyst has been increasingly visible at technology deal tables, consulting on four $10 billion-plus deals in 2020 and 2021.