S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Dec, 2021

By Muhammad Hammad Asif and Darakhshan Nazir

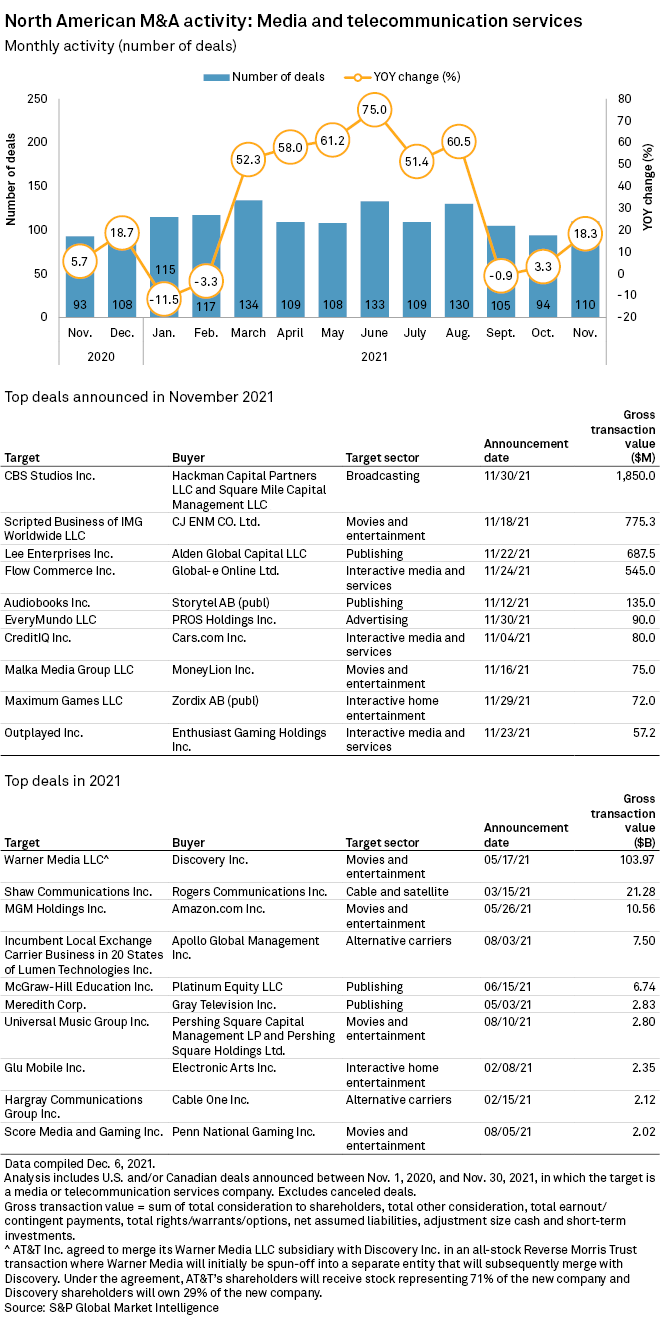

M&A deal volume among U.S. and Canadian media and telecommunications companies grew 18.3% year over year in November. The sector had only one billion-dollar deal during the month.

There were 110 deal announcements with disclosed transaction values in November, compared to 94 deals announced in October, the smallest number of deals for the year to date. The sector had 93 deal announcements in November 2020.

The broadcasting industry saw the largest deal for the month with a group of investors including Hackman Capital Partners LLC and Square Mile Capital Management LLC agreeing to acquire CBS Studios Inc. from ViacomCBS Inc. for about $1.85 billion. The parties signed the deal on Nov. 30 but did not disclose any advisers.

The deal represents the culmination of two trends. The first is ViacomCBS' use of funds from real estate dispositions to fund its streaming ambitions. Second is Hackman's run of studio real estate deals, as the firm looks to capitalize on the need for studio space amid an increasingly competitive streaming video business.

CJ ENM CO. Ltd.'s deal to purchase the scripted business of IMG Worldwide LLC for $775.3 million ranked second for November. JPMorgan Chase & Co. was the financial adviser to Seoul, South Korea-based CJ ENM, while Raine Group LLC was the financial adviser to IMG Worldwide on the transaction. Both parties did not disclose any advisory fees.

Asset management firm Alden Global Capital LLC's agreement to buy the remaining 94% stake in publishing company Lee Enterprises Inc. was No. 3 on the list. Moelis & Co. LLC is the financial adviser to Alden on the deal. The company did not disclose any advisory fees.

Alden has offered to purchase Lee Enterprises for $24 a share in cash in a transaction that would value the newspaper publisher at about $687.5 million, including $524.9 million in net assumed liabilities, according to S&P Global Market Intelligence.

Lee's board subsequently rejected the bid, with Lee Chairman Mary Junck saying in a Dec. 9 news release that the unsolicited offer "grossly undervalues" the business.

In the wake of that rejection, an Alden associate filed a lawsuit, claiming the company acted with improper abruptness in rejecting the deal.

According to Poynter, a nonprofit journalism school and research organization, Lee is one of just four remaining publicly traded newspaper companies. It has 77 dailies.