S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Jan, 2023

By Sanne Wass and Marissa Ramos

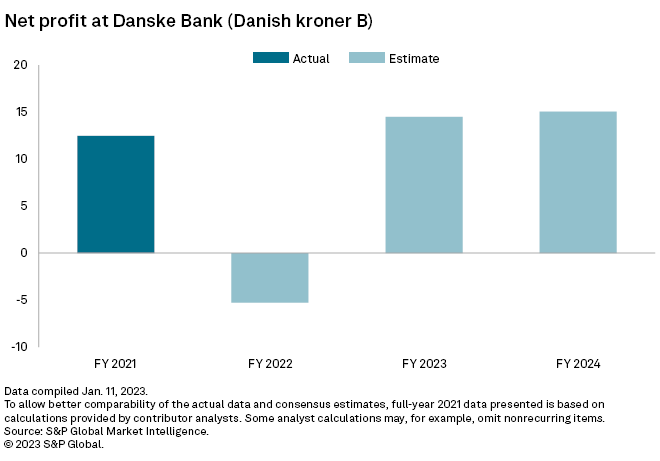

Profits at Danske Bank A/S are set to rebound this year on the back of a projected loss for 2022 due to the settlement of a money-laundering fine.

Denmark's largest lender posted a net loss of 9.24 billion kroner for the first nine months of 2022 and expects to make a full-year loss of up to 5.3 billion kroner. This guidance comes after the bank agreed in December to pay 15.3 billion kroner to U.S. and Danish authorities to settle investigations into a money-laundering case at its former Estonia branch.

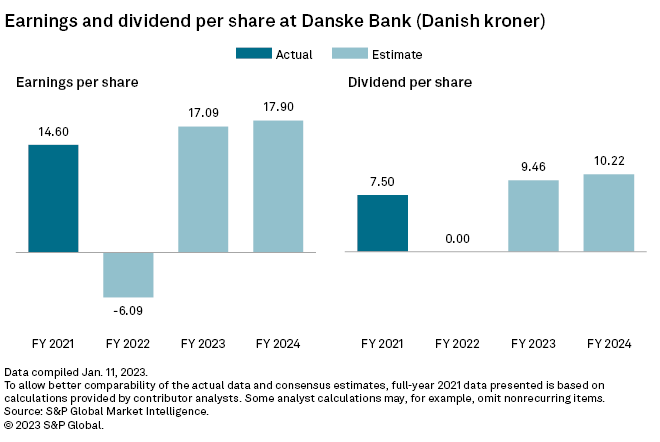

Danske's earnings are now expected to rebound strongly in 2023, driven by higher net interest income, according to S&P Capital IQ consensus estimates. Analysts expect net profit to total 14.50 billion kroner in 2023 and 15.06 billion kroner in 2024. This compares to net profit of 12.47 billion kroner in 2021.

Continued NII boost

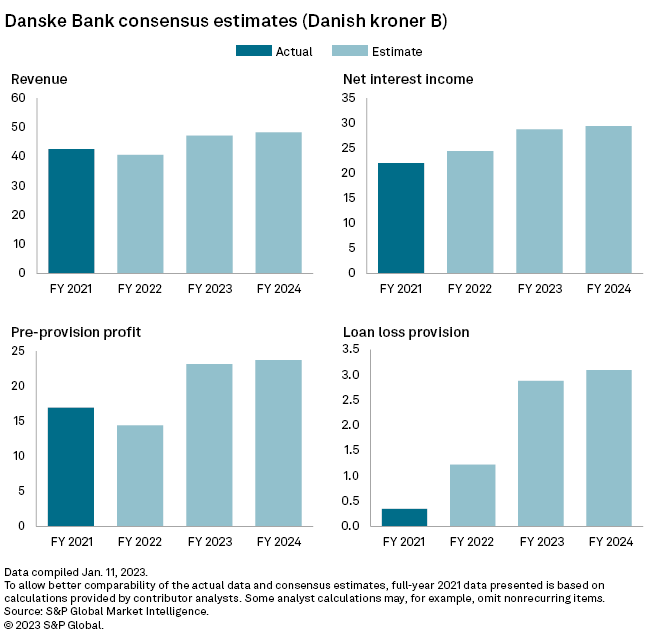

Higher central bank interest rates will be a key revenue driver. Danske's repricing initiatives have now taken full effect which, combined with positive volume trends, is bolstering net interest income, or NII, the bank said Dec. 13, 2022.

Analysts expect Danske's NII to increase to 24.42 billion kroner in 2022, jump to 28.77 billion kroner in 2023 and further to 29.43 billion kroner in 2024.

Danske has seen commercial momentum in 2021 and 2022, with solid customer activity and growth in core banking activities, Stefan Singh Kailay, head of press relations, told S&P Global Market Intelligence by email. At the same time, underlying costs have come down as a result of the bank's transformation work, said Kailay.

The Danish lender has maintained its ambition to reach a return on equity of 8.5% to 9% in 2023, and now aims for "the upper end of the range." Specific guidance for the year will be provided with its 2022 annual results, set to be published Feb. 2.

Good news for investors

Danske reserved 14 billion kroner in provisions for the "Estonia matter" in the third quarter of 2022, having already booked 1.5 billion kroner in 2018, fully covering the impact of the settlement.

The bank said Dec. 13, 2022, that it "apologizes unreservedly for the unacceptable historical failings and misconduct, which have no place at Danske Bank today."

A 2018 probe found that more than €200 billion of nonresident money flowed through the Danske bank's Estonian branch from 2007 to 2015, of which a "significant" part was found to be suspicious.

Investors and analysts have welcomed the news of a money-laundering settlement as it removes uncertainty around a penalty. Since it provisioned for a fine on Oct. 27, 2022, Danske shares are up around 37% as of Jan. 19.

S&P Global Ratings on Dec. 16 revised its outlook for Danske to stable from negative, saying that "balance sheet strength will adequately shoulder the financial impact from the resolution."

Danske recorded a common equity Tier 1 ratio of 16.9% at the end of the third quarter.

"We anticipate ... improving earnings on the back of rising interest rates and Danske Bank's well-established pan-Nordic franchise will counter the higher risk cost in the challenging operating environment," S&P Global Ratings said.

A weaker macroeconomic outlook has led analysts to forecast higher loan loss provisioning among Nordic and European banks.

Danske is expected to pay a dividend of 9.46 kroner per share in 2023 and 10.22 kroner in 2024, according to consensus, after the bank canceled distributions for 2022 and 2021.

As of Jan. 18, US$1 was equivalent to 6.88 Danish kroner.