Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Oct, 2021

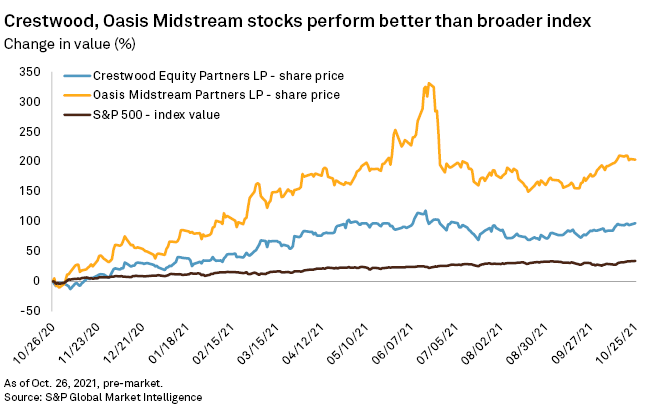

Crestwood Equity Partners LP has agreed to acquire Oasis Midstream Partners LP in a $1.8 billion equity and cash deal that is expected to create one of the top three midstream operators in the Williston Basin with a pro forma enterprise value of roughly $7 billion.

Crestwood said the deal is well aligned with its "strategy of consolidating high-quality midstream assets in our core operating areas" as it augments the company's positions in the Williston and Delaware basins, according to an Oct. 26 news release.

Specifically, the deal adds crude oil, produced water gathering and natural gas gathering and processing assets, increases the drilling location inventory, and expands Crestwood's footprint into the western and northern portions of the Williston Basin. Meanwhile, the acquired assets in the Delaware Basin provide crude oil and produced water gathering services in Loving, Ward and Winkler counties in Texas, complementing Crestwood's existing Nautilus natural gas gathering system and Desert Hills produced water gathering system.

Crestwood also said it plans to connect its Arrow gathering system with Oasis Midstream's Wild Basin system for an expected total processing capacity of 430 MMcf/d, with current natural gas throughput of about 330 MMcf/d. The partnership said the excess processing capacity will remove potential constraints for existing Arrow customers and create opportunities to commercialize Oasis Midstream's assets as gas volumes continue to climb across the basin.

"Importantly, we are completing this transaction during a period when macro oil and gas fundamentals are exceptionally supportive of upstream development and there is increasing demand for midstream infrastructure and services," said Crestwood President, CEO and Chairman Robert Phillips.

The midstream sector has been slower to consolidate than exploration and production companies, but Crestwood and Oasis Midstream's merger marks the second billion-dollar deal announced in the oil and gas midstream space in October.

On the financial side, Crestwood said it expects the merger to result in a strong distribution coverage ratio in 2022, which in turn is expected to speed up the company's return of capital to common unitholders. The partnership added that it plans to raise its common annual distribution by 5% year over year to $2.62 per unit.

The asset integration associated with the merger is expected to help realize roughly $45 million in commercial and cost reduction synergies, Crestwood said, and the combined company is forecast to generate an estimated pro forma 2021 adjusted EBITDA of more than $820 million.

Under the deal, Crestwood will assume Oasis Midstream's outstanding $660 million debt, and Oasis Midstream sponsor Oasis Petroleum Inc. will get $160 million in cash plus a total of 21.0 million common units in exchange for its 33.8 million Oasis Midstream common units. Oasis Midstream public unitholders will get 12.9 million Crestwood common units in exchange for the 14.8 million Oasis Midstream common units outstanding.

Upon deal completion, which is slated to occur in the first quarter of 2022, Oasis Midstream's former unitholders will hold about 35% of Crestwood's outstanding common units, 22% of which will be owned by Oasis Petroleum. The deal has been approved by the board of the general partners of both Crestwood and Oasis Midstream. Oasis Petroleum has also agreed to vote in favor of the merger.

JP Morgan Securities is acting as the lead financial adviser, Intrepid Partners LLC is serving as financial adviser, while Baker Botts LLP is serving as legal adviser to Crestwood. Morgan Stanley & Co. LLC and Tudor Pickering Holt & Co. are acting as financial advisers, while Vinson & Elkins LLP are serving as legal adviser to Oasis Petroleum and its affiliates. Jefferies is acting as financial adviser, while Richards Layton & Finger PA is serving as legal adviser to Oasis Midstream's conflicts committee.

Theme

Segment