S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2023

By Vanya Damyanova and Adrian Jimenea

|

A Credit Suisse office in London. |

Credit Suisse Group AG is expected to underperform peers in the coming years as it labors through its latest restructuring process and recovers from losses booked in 2022.

The Swiss bank and asset manager plans to cut 17% of full-time jobs and sell billions of investment bank assets by 2025 to stabilize its franchise, reduce risk, and focus on less volatile wealth management and private banking operations.

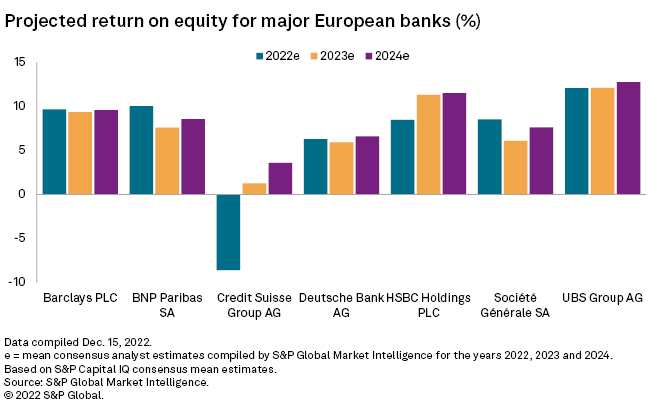

Its return on equity is projected to be far lower than that of other European banks with large global operations in 2022, 2023 and 2024, S&P Global Market Intelligence data shows. Analyst consensus estimates put Credit Suisse's ROE at 3.6% in 2024, compared to between 6.6% and 12.7% at Barclays PLC, BNP Paribas SA, Deutsche Bank AG, HSBC Holdings PLC, Société Générale SA and UBS Group AG.

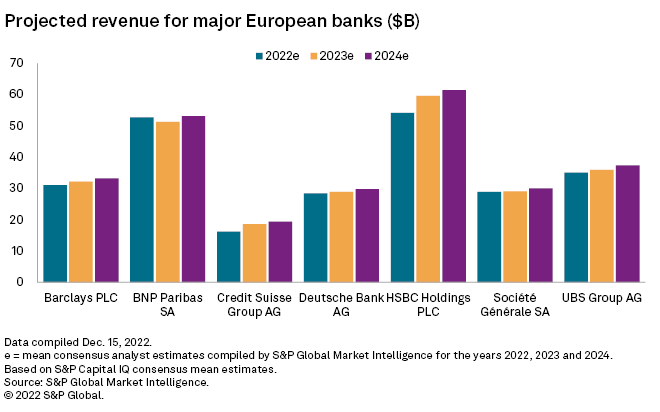

For 2025, Credit Suisse expects a return on tangible equity of about 6%. Group revenues are expected to improve to more than CHF19 billion in 2024, but that is below the 2021 and 2020 levels of over CHF22 billion.

Selling problematic businesses is a good way to return to profit but will mean a smaller global footprint and a loss of revenues for the foreseeable future, credit and equity analysts said. Headcount cuts could impact revenues as the bank risks losing some of its best people amid the revamp.

Credit Suisse declined to comment to Market Intelligence for this article.

Tough 2022

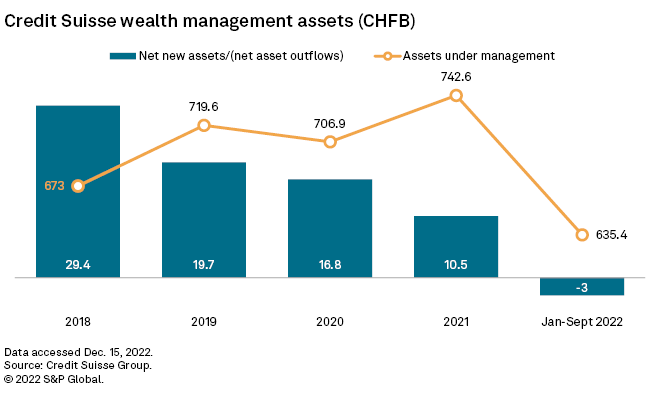

A string of debacles, including exposure to the collapses of U.S. hedge fund Archegos Capital and financial services firm Greensill Capital (UK) Ltd., have knocked confidence in Credit Suisse's franchise. clients pull roughly CHF84 billion of assets from the company in recent months, mainly in its core wealth management unit. Assets under management in the unit slumped in the first nine months of 2022 as net new assets turned negative.

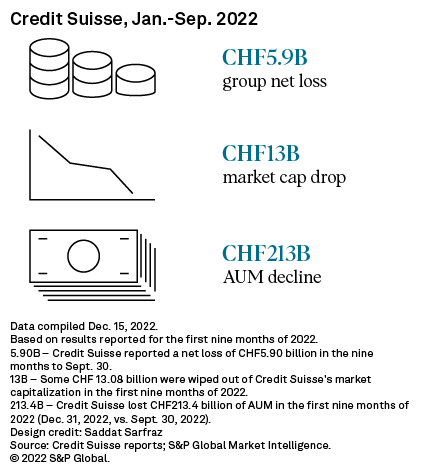

In late November, Credit Suisse issued its fourth profit warning for 2022, flagging an expected pretax loss of roughly CHF1.5 billion for the last three months of 2022. For the nine months to Sept. 30, 2022, the group booked a net loss of CHF5.9 billion as its market capitalization fell by about CHF13 billion amid continued share price volatility. Analyst consensus estimates as of Dec. 20, 2022, put Credit Suisse's full-year 2022 net loss at CHF2.63 billion, its largest loss since 2016.

Rebound possible

Credit Suisse's retreat from various businesses and markets could harm its competitive position, equity analysts said.

Permanent loss of business to rivals cannot be ruled out, given the complete shift away from certain investment banking activities such as prime brokerage, Octavio Marenzi, CEO and founder of management consultancy Opimas, said in an interview.

Credit Suisse decided to close its prime services business in November 2021 after it was left nursing losses of over $5 billion amid the collapse of U.S. family office Archegos Capital. The unit had over 1,880 clients at that time, according to estimates of sector data provider Convergence Inc.

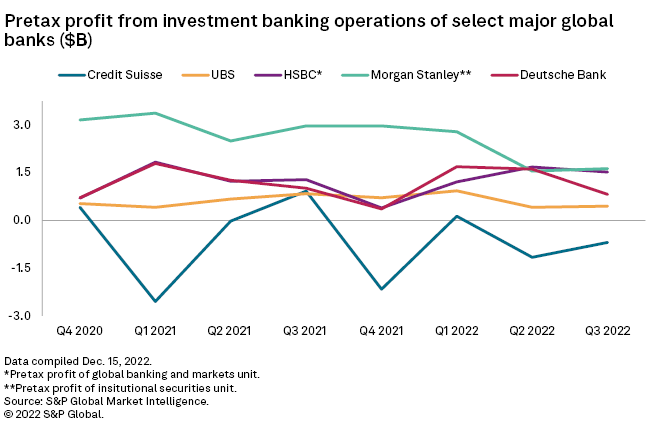

In 2023, Credit Suisse will shed roughly $55 billion of investment bank assets, selling the bulk of its securitized products business to Apollo Global Management Inc. Pretax profits at the group's investment bank lagged those of major European and U.S. peers over the two years to Sept. 30, 2022, Market Intelligence data shows.

Lasting reputational damage linked to Archegos could also spook some high-net-worth clients of the wealth management division who are "extremely risk-averse" and may consider moving their money to more stable and better-performing peers such as UBS, Marenzi said.

UBS Chairman Colm Kelleher said at a conference Nov. 30, 2022, that the bank is not actively benefiting at Credit Suisse's expense but would also not turn away clients "moving money around" that otherwise would go to U.S. rivals.

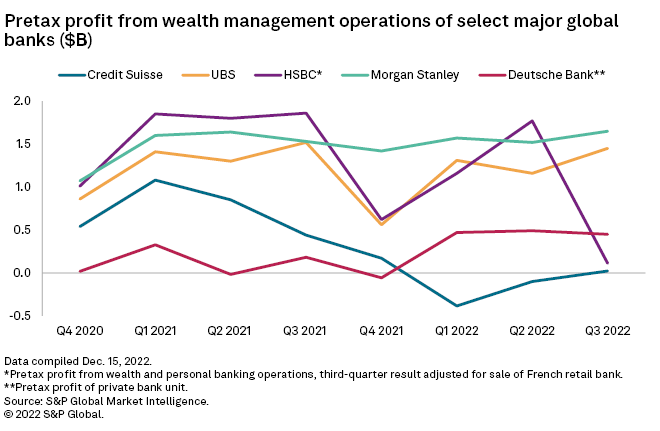

Pretax profits at Credit Suisse's wealth management unit has trailed those at most select competitors since the third quarter of 2020, Market Intelligence data shows.

Yet if Credit Suisse succeeds with its turnaround, there is no reason why it cannot strengthen its reputation and grow its profit and global footprint in the longer term, said Firdaus Ibrahim, senior equity analyst at CFRA Research.

Key risks

The biggest challenge for Credit Suisse will be to retain key bankers as it cuts costs, Johann Scholtz, equity analyst at Morningstar, told Market Intelligence. The group must offer competitive pay to its best relationship managers in wealth management and the rainmakers in the investment bank to avoid losing revenues, Scholtz said.

Credit Suisse aims to reduce costs by about CHF2.5 billion by 2025.

Of its two primary markets, growth prospects in the investment bank-focused U.S. business are less clear than those in Switzerland.

The U.S. arm was focused on operations with limited relevance to wealth management, such as securitized products, which would be sold off under the new strategy. The relaunch of the CS First Boston brand as a way to split advisory from trading is an interesting move that could unlock value, Scholtz said. The New York-based First Boston unit could generate over $3 billion in annual revenue going forward, according to Market Intelligence estimates.

Credit Suisse has a stronger franchise in its home market than internationally, and its Swiss arm is one of the group's better-performing units, Ibrahim said.

As a separate, ring-fenced legal entity, the domestic unit is sheltered from stress in the group's global operations, and recent asset outflows were less pronounced in Switzerland, Scholtz said.

Chairman Axel Lehmann said Dec. 1, 2022, that Credit Suisse can regain lost business in the future as "massive outflows" have flattened globally with a partial reversal in Switzerland.

A recent CHF4 billion rights issue also strengthened group capital, while liquidity improved following the outflows, according to Roderic Finn, director EMEA banks at Fitch Ratings. But high execution risks remain amid heavy financial losses and weakened client confidence, Finn told Market Intelligence.