Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Nov, 2022

By Sanne Wass

As the world's top banks set targets to decarbonize their most polluting portfolios, some institutions are opting for metrics that allow them to expand fossil fuel financing, according to environmental and shareholder groups.

Banks including U.S.-based Bank of America Corp. and JPMorgan Chase & Co. and U.K.-headquartered Standard Chartered PLC have set intensity-based interim targets for their oil and gas portfolios while having no absolute emissions reduction goals to complement them, according to new research by ShareAction, which coordinates investor campaigns.

Intensity targets measure emissions of a portfolio relative to the total financing levels or units of energy produced, which could enable banks to achieve their targets while absolute emissions continue to grow, ShareAction said Nov. 8.

The criticism comes as the COP27 climate change conference takes place in Egypt. The event's finance day on Nov. 9 will, among other things, focus on the progress made by financial institutions to cut their financed emissions and support a green transition.

'Misaligned' goals

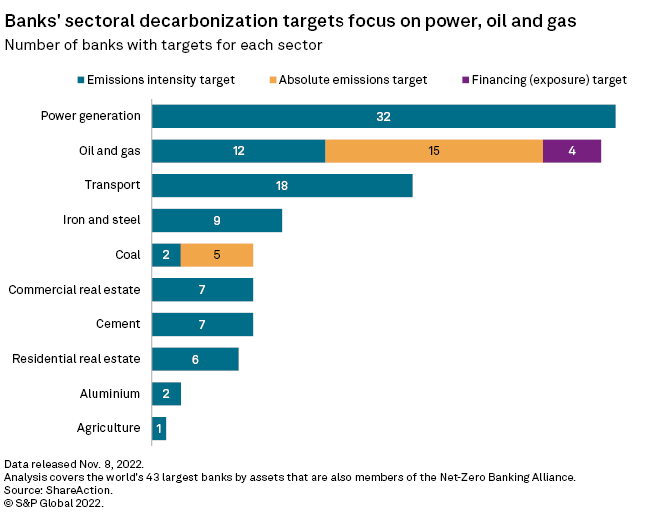

ShareAction analyzed 43 of the largest Net-Zero Banking Alliance members globally and found that 31 of them have set interim targets for their oil and gas portfolios. However, over a third of those banks have not set an absolute metric, it said.

Sierra Club, an environmental nongovernmental organization that assessed U.S. banks' net-zero commitments, raised similar concerns over lenders' ability to grow their oil and gas financing while still reaching their targets.

"Because they allow for an increase in new finance for oil and gas, intensity targets for this sector are fundamentally misaligned with a 1.5°C aligned pathway," Sierra Club said in a Nov. 2 research report. Four of the six largest banks in the U.S. have failed to set absolute reduction targets for oil and gas, it found.

Through the Net-Zero Banking Alliance, banks pledge to bring greenhouse gas emissions linked to their lending and investment portfolios to net-zero by 2050, consistent with the Paris Agreement on climate change goal of limiting temperature rises to 1.5 degrees C from preindustrial levels. They also commit to publishing interim targets for 2030 or sooner. Some 122 financial institutions globally have signed up for the coalition since its launch in April last year.

The Net-Zero Banking Alliance guidelines allow banks to set their interim targets based on emissions intensity, although institutions are still required to report annually on their progress using both absolute and intensity metrics "to give a complete picture."

JPMorgan said in its 2020 environmental, social and governance report, released simultaneously with its first interim decarbonization targets, that it uses carbon intensity because it is the "most decision-useful metric for our commitment." Intensity metrics are most effective to evaluate a sector or company's performance against decarbonization trajectories that must be achieved to align with the Paris Agreement, and also allow for easier comparison within each sector and between companies of different sizes, the bank said. Absolute metrics, meanwhile, are more affected by year-to-year emissions volatility that may come from changes in companies' production, it said.

JPMorgan, Bank of America and the Net-Zero Banking Alliance declined to comment on ShareAction's claims, while Standard Chartered did not respond to a request for comment from S&P Global Market Intelligence.

While intensity metrics are helpful to benchmark companies or portfolios, "they put the 1.5°C of warming limit at risk of serious overshoot if used in isolation," ShareAction said.

Intensity-only targets encourage more efficient production rather than an absolute reduction in output, which is inadequate for a sector facing terminal decline, the group said.

The International Energy Agency, a global energy watchdog, has guided that there is no room for investment in new oil and gas fields in order to limit global warming to 1.5 degrees C by 2050. In its net-zero road map, the agency projected global demand for oil and gas would fall by 75% and 55%, respectively, between 2020 and 2050.

This could translate into higher credit risk and loss of revenue for banks that fail to reduce their exposure to the industry.

"Simply put, this need for steep and rapid decline in oil and gas production requires a similar decrease in new financing to the sector," Sierra Club said.

Other issues

ShareAction and Sierra Club also uncovered other problems with banks' net-zero targets — for example, that most of them only cover lending activities. This creates "a massive loophole through which billions of dollars can still be poured into heavily emitting sectors and projects," Sierra Club said.

Some 80% of banks with oil and gas targets exclude underwriting activities from their targets, ShareAction found.

ShareAction also found that only 16% of the banks covered by its research have set an overarching interim target to cut emissions across their financing activities. Among them, British lenders Lloyds Banking Group PLC and NatWest Group PLC have committed to halving their financed emissions by 2030, while Finland-headquartered Nordea Bank Abp has pledged to reduce emissions by between 40% and 50%.