S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Oct, 2022

By John Wu and Mohammad Taqi

China's self-developed high-tech industries, such as advanced microprocessors and cellular networks, are set to be the next key driver of loan growth for the nation's banks.

Analysts believe Beijing will likely ask banks to step up lending to the high-tech sector during the Central Economic Work Conference in December, after President Xi Jinping reaffirmed the national strategy of focusing on technological self-sufficiency and "high quality development" over the coming five years at the 20th National Party Congress ended Oct. 22. This comes as the U.S. introduces sweeping controls to block exports of some chip manufacturing equipment and to restrict sales of certain semiconductors to China while Beijing seeks to reduce its reliance on imports of critical computing components.

"Banks and financial institutions could be encouraged to put more resources, mainly by way of lending, into the tech sectors to support the so-called high-quality development," said Iris Pang, chief economist of Greater China at ING, adding that exposures to the property sector, which was little mentioned during the party congress, could be managed at the current level.

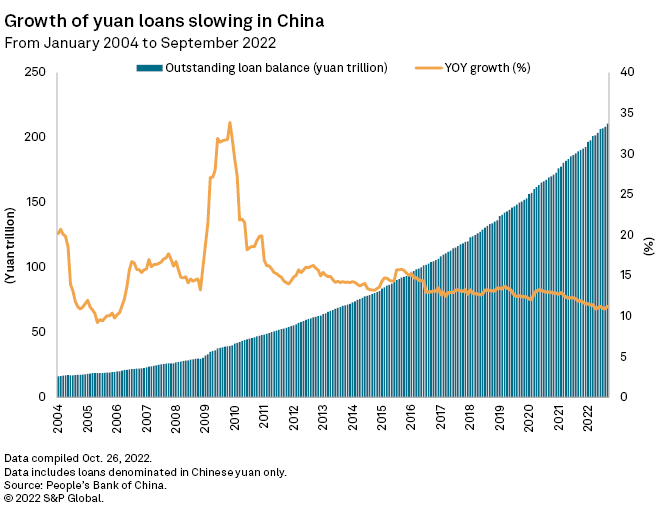

Banks in China are searching for the next bright spot of loan growth, as mortgages and consumer lending are weakening amid a dim economic outlook and business interruptions related to the COVID-19 pandemic, while margins from lending are being squeezed by the nation's easing monetary policy in an attempt to revive economic growth.

Technological self-sufficiency, especially regarding chips and other computing-related industries, has been one of Xi's pillar policies in recent years as the nation tries to reduce its reliance on overseas markets, as outlined in its strategic priorities for 2021 to 2025, or the so-called 14th Five-Year Plan.

China's own chip industry is producing "significant" quantities of microprocessors at less advanced 24-nanometer production nodes, according to a Sept. 1 blog post from the London School of Economics. That is compared to the industry’s most advanced nodes of 5 nanometers. The smaller the production node, the smaller the transistors on a chip, which makes it faster and more power efficient.

Increasing demand

While banks do not provide a breakdown of their loan portfolios, China's latest gross domestic product data for the third quarter could be a proxy for credit demand from the high-tech industries.

Among the subsegments of GDP, the value added of high-tech manufacturing and equipment manufacturing increased by 8.5% and 6.3% year over year, respectively, in the first three quarters of 2022, or 4.6 percentage points and 2.4 percentage points faster than that of the industrial enterprises, according to China's National Bureau of Statistics. This is compared to the 3.9% year-over-year expansion of the total value added of the country's industrial enterprises for the period.

According to an Oct. 24 report from ING, third-quarter GDP for the information and software technology industry grew the fastest among all industries, at 7.9%, while the financial services industry grew 5.5% and the real estate industry contracted 4.2% due to uncompleted projects that almost paused activities from land bidding to housing starts in the industry.

The world’s second-largest economy recorded third-quarter GDP growth of 3.9% year over year, well behind its annual target of 5.5%. First-quarter GDP grew 4.8%, while second-quarter GDP grew 0.4% due to new COVID-19 outbreaks.

With the congress stating that "science and technology is the first productive force" and emphasizing "innovation-driven development," ING's Pang expects accommodative policies, including a large sum of fiscal spending, to be delivered on the objective of high-tech.

Banks will be asked to bear more responsibilities to support growth at the cost of profitability, according to an Oct. 14 report by Natixis Corporate & Investment Banking.

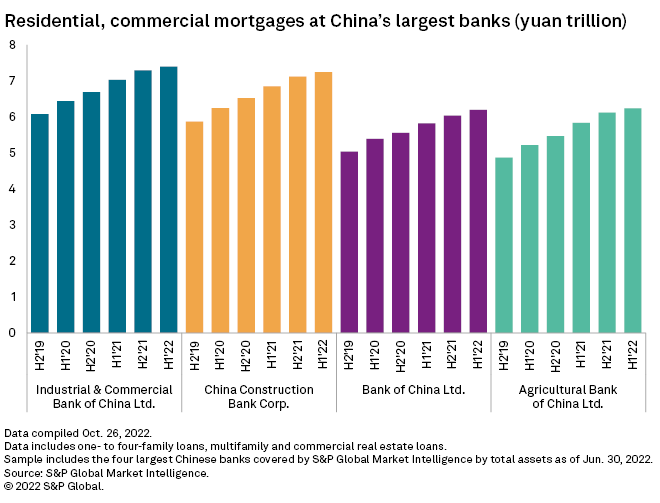

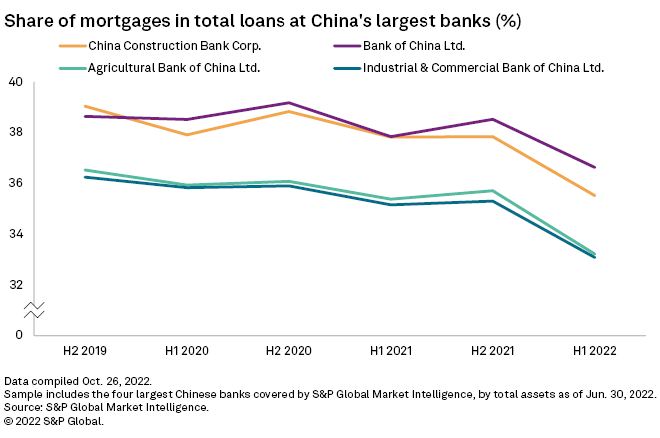

Mortgage mix is falling

The increase in credit demand from high-tech industries could partly mitigate the impact from falling demand on mortgages and consumer loans, analysts said.

Still, real estate remains a major headwind for the banking sector. There will unlikely be a U-turn in property policies, according to Natixis, and home prices are expected to fall further due to weak demand, despite recent changes in macroprudential policies easing some of the pressure on transactions.

While top government posts, including for the central bank governor and banking regulator, will not be officially approved until the annual Central Economic Work Conference in December, UOB expects the People's Bank of China will further ease monetary policy amid China's relatively mild inflation compared with other major economies.

"China said that the foundation for economic recovery is not solid yet and thus we see the need for PBOC to maintain an accommodative monetary policy in the near-term," UOB said in its "Macro Note" report dated Oct 25. The bank added that China's central bank may also cut lenders' reserve requirement ratio. "This will help to reduce banks' funding costs and at the same time optimize their funding structure as it increases the long-term funding source," the report said.

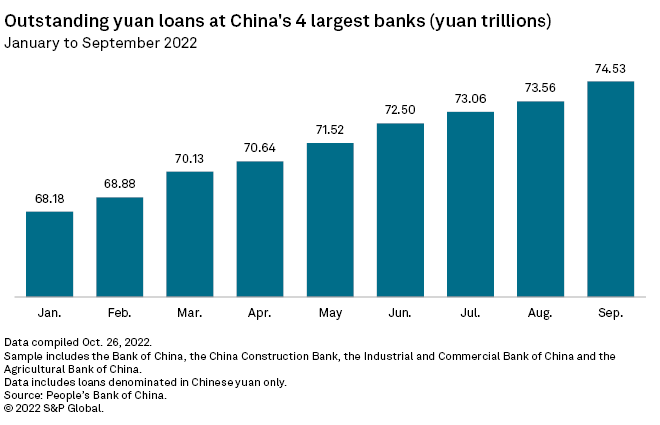

China's four largest banks by assets, Industrial and Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd., reported net profit increases between 5% and 6% year over year in the first half, with nonperforming loans ratios edging lower. Loan growth for the Big Four was reported at between 6% and 8.4% in the first half. They are scheduled to release their third-quarter results by the end of October.

The four major banks declined to comment.

As of Oct. 26, US$1 was equivalent to 7.17 Chinese yuan.