Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Nov, 2022

By Jason Woleben and Tom Jacobs

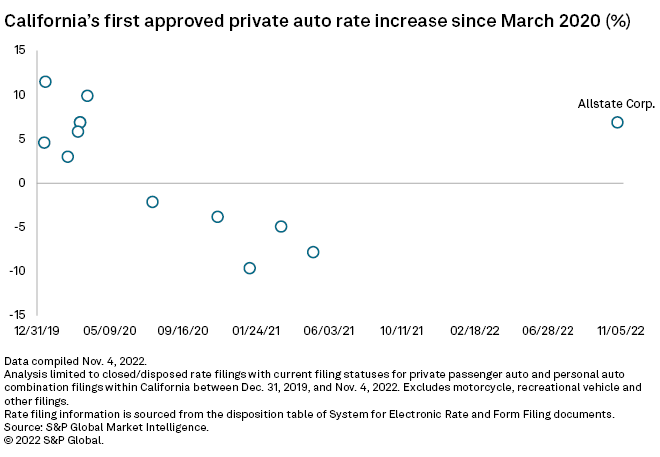

After blocking them for more than two years, California regulators have finally allowed an insurance company to raise its private auto rates in the state.

Allstate unit gets approval

On Oct. 30, Allstate Northbrook Indemnity Co. received its requested 6.9% increase, the maximum allowable under state law without triggering a public hearing.

The approved rate is roughly 9 percentage points below the 15.8% indicated rate level shown in the filing. The indicated rate is the actuarial justified rate needed by the insurer based on expected premiums, losses and expenses.

|

* * Download a template that can analyze rate changes by product type over a selected period of time. |

The premium increase is expected to impact about 992,000 policyholders and will become effective for new and renewal business Dec. 28.

In addition to raising rates, The Allstate Corp. is reducing operating expenses and implementing underwriting restrictions in underperforming states to improve overall profitability. The company suspended new sales within its homeowners and condo business in California and noted that "additional actions are likely" within its private auto business in its latest quarterly financial statement.

Significant backlog remains

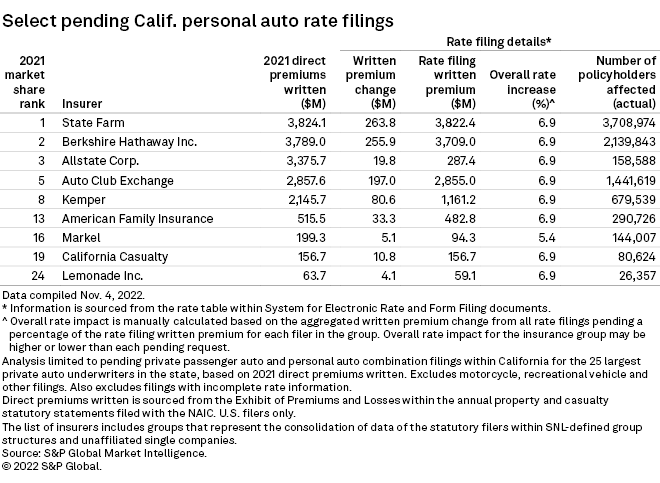

A number of the largest private auto insurers in the Golden State are still waiting for their rate-increase requests to be approved. All told, the pending rate filings equal hundreds of millions of dollars worth of additional premiums.

The California Department of Insurance will "continue to review pending auto insurance rate filings" using the rules set by Proposition 103, which give consumers the best value and the most choices in a highly competitive market, according to a statement emailed to S&P Global Market Intelligence. Proposition 103 requires insurers to receive approval from state regulators before implementing a new rate.

The state's two largest private auto insurers, State Farm Mutual Automobile Insurance Co. and GEICO Corp., have outstanding filings that could boost the insurers' written premiums by $263.8 million and $255.9 million, respectively.

Other large private auto insurers, such as The Progressive Corp., are also seeking to boost their private auto rates by 6.9% as well. The calculated written premium change and other details are not readily available within Progressive's rate filings. The insurer was one of the 10 largest private auto writers in the state in 2021 and said it would refrain from writing additional auto business in California until it receives a sufficient rate.