S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Mar, 2021

By Camilla Naschert

|

| The West Burton power station in Nottinghamshire, commissioned in 1966, will be taken offline two years ahead of the U.K. government's deadline for coal plant closures. Source: EDF Energy |

In 1882, American inventor Thomas Edison's Edison Electric Light Co., the company that would later become General Electric Co., built the world's first public-serving coal-fired power station in central London. And 140 years later, Britain will be home to just a single plant once again.

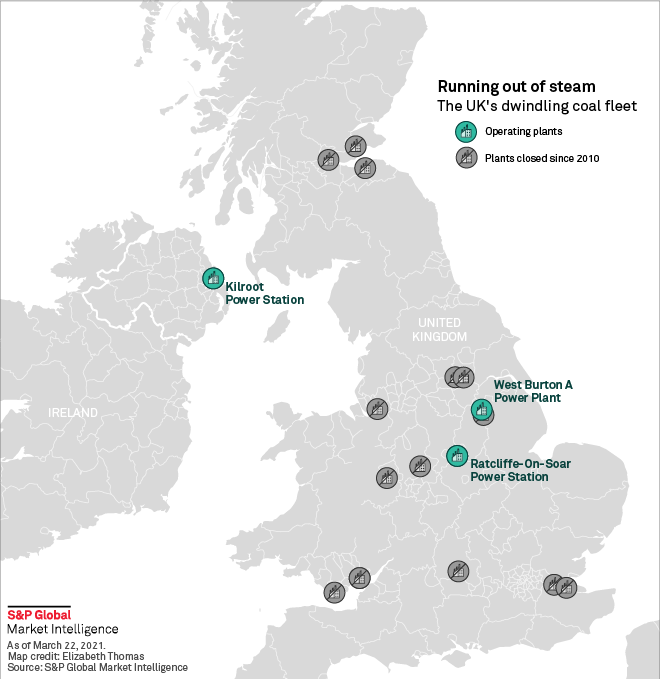

That is because Electricité de France SA will shut down West Burton A, one of only two coal-fired power stations still running in Britain, in September 2022, two years ahead of the government's deadline for coal plant closures.

Over the next 18 months, two of the plant's four 500-MW units will only be available to meet capacity market commitments, U.K. division EDF Energy Ltd. said March 22. The 2-GW power plant in Nottinghamshire was connected in 1966.

The closure of West Burton means half of Europe's coal plants have closed or have a fixed closure date, according to environmental group Beyond Coal.

In Britain, coal has already all but disappeared from the power mix, with the country recording nearly 68 consecutive coal-free days between April and June 2020, the longest run since the industrial revolution. The government announced in 2015 its intention to shut all coal plants by 2025, bringing that deadline forward by a year in 2020.

Britain's last coal plant still standing after West Burton's closure will be Uniper SE's Ratcliffe-on-Soar Power Station. In Northern Ireland, which operates on a separate electricity system, Kilroot Power Station, owned by Czech investor Energetický a prumyslový holding a.s., is also still running, with operator EP UK Investments Ltd. planning a conversion to gas at the site.

Uniper is already considering an early closure of its Ratcliffe plant. The company is mulling converting it to gas in order to benefit from the country's attractive capacity market, CEO Andreas Schierenbeck said this month.

As the U.K. eyes an even earlier exit from coal power by 2024 amid deteriorating economics of the fuel, several units have been taken offline in the past two years. Drax Group PLC closed its Drax Power Station in Selby this month, years ahead of schedule, although units will be available on standby to fulfill capacity market obligations.

One of Drax's coal units was recently called by National Grid PLC to supply power under the balancing mechanism as power supply tightened. As such, EDF's decision to keep West Burton on standby for an extra year "could reflect the perceived increase in value for flexible plant in light of the extreme price spikes seen this winter, offering the potential for relatively inefficient plants to recoup their annual operating costs over a handful of very expensive hours," said Glenn Rickson, manager for European power at S&P Global Platts Analytics.

The closure of West Burton underscores EDF's focus on nuclear and renewables, according to Matt Sykes, managing director of the utility's generation business. The company also switched off its 2-GW Cottam Power Station in Nottinghamshire in 2019. In March 2020, SSE PLC closed its Fiddlers Ferry Power Station and RWE AG took offline its Aberthaw Power Plant.

In the European context, Britain's departure from coal is one of the speediest. Germany, which is phasing out both coal and nuclear power, even saw the connection of a new hard coal power plant in 2020 but will phase out the fuel by 2038, with alternatives such as gas and renewables not growing fast enough to meet the country's power needs.

"We are in the endgame for the coal industry in Europe. After years of unrelenting decline, half of Europe's coal fleet is history," said Kathrin Gutmann, Beyond Coal's campaign director for Europe. Governments, energy companies and financial institutions must now plan for a full exit by 2030 or earlier, ending funding of fossil fuels and pivoting to renewables, Gutmann added. "The coming five years will then see off most remaining plants."

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.