S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Jan, 2022

By Rica Dela Cruz and Xylex Mangulabnan

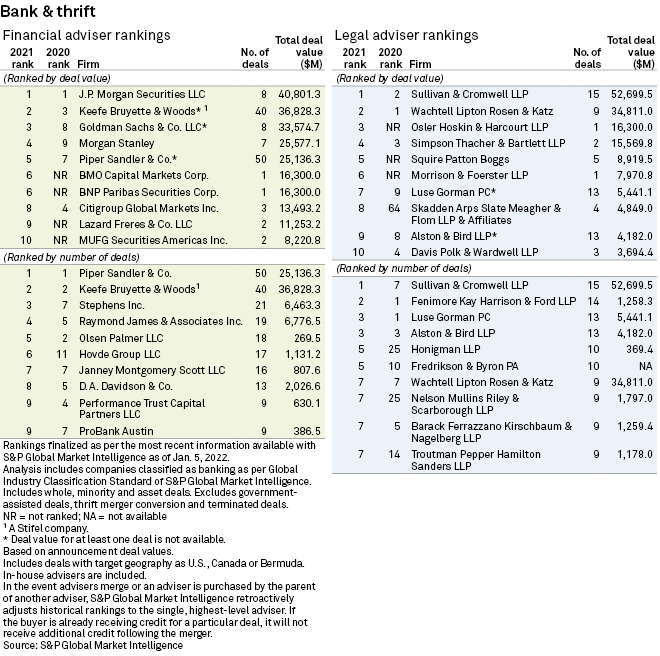

J.P. Morgan Securities LLC topped S&P Global Market Intelligence's bank M&A league table ranked by deal value through the fourth quarter of 2021, ending Keefe Bruyette & Woods Inc.'s three-quarter streak, according to S&P Global Market Intelligence data.

The JPMorgan Chase & Co. unit, which worked on eight deals with a total deal value of $40.80 billion, had an advisory role on Bank of Montreal subsidiary BMO Harris Bank NA's pending acquisition of Bank of the West from BNP Paribas SA for $16.3 billion that pushed it to the top spot of the deal value rankings. Stifel Financial Corp.-owned KBW finished No. 2 in terms of deal value and number of deals for its work on 40 deals worth a combined $36.83 billion.

Both J.P. Morgan Securities and KBW played roles on M&T Bank Corp.'s pending $7.6 billion deal to acquire People's United Financial Inc., Webster Financial Corp.'s proposed merger with Sterling Bancorp for $5.23 billion, and Umpqua Holdings Corp. and Columbia Banking System Inc.'s pending combination for roughly $5.15 billion.

Piper Sandler & Co. topped the financial adviser rankings in terms of deal count thanks to its role in 50 deals with an aggregate value of $25.14 billion. Stephens Inc. ranked third after working on 21 deals valued at $6.46 billion.

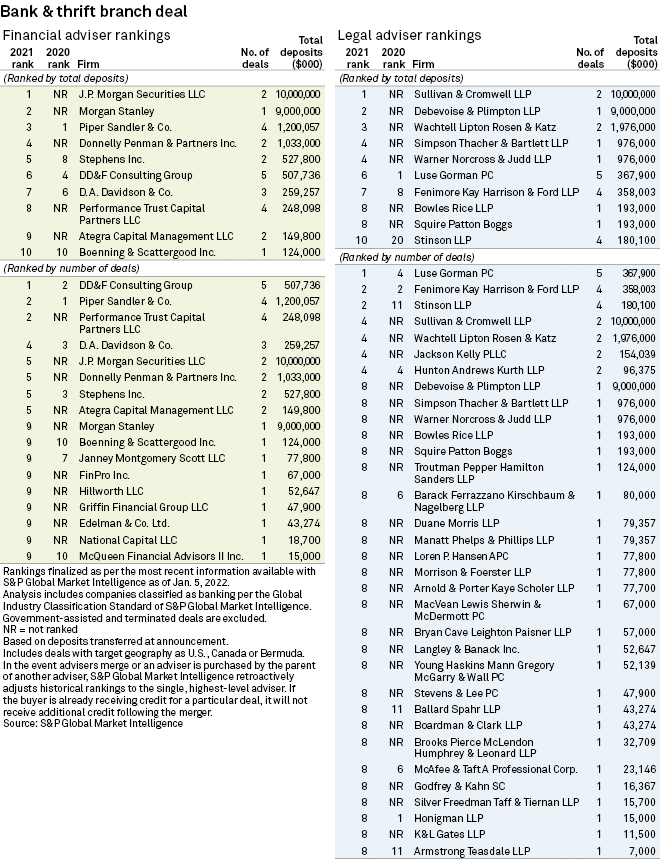

For branch M&A, J.P. Morgan Securities claimed the No. 1 spot due to its advisory role on two deals involving 90 branches and $10 billion in total deposits. Morgan Stanley finished second as it had one deal assignment involving $9 billion in deposits.

Piper Sandler worked on four branch deals and ended 2021 second in number of deals and third in terms of total deposits transferred. In the deal quantity ranking, the company was overtaken by DD&F Consulting Group, which served on five deals.