Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Dec, 2023

By Karin Rives

| Cryptocurrency mining rigs use large amounts of energy to cool and operate. Source: South_agency/E+ via Getty Images. |

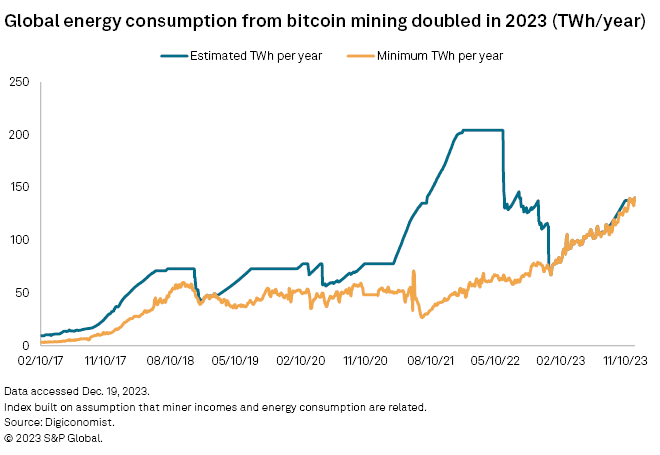

Global energy consumption from bitcoin mining has grown 101% since Jan. 1 to reach 141.2 TWh as of Dec. 20, according to data from Digiconomist, a platform managed by Dutch economist and blockchain expert Alex de Vries.

The US is one of the largest bitcoin miners in the world, a separate analysis by the University of Cambridge estimated.

The rise in power demand reflects a rebound in bitcoin prices from a low of $16,611 on Jan. 1 to top $44,000 on Dec. 20. Observers attribute the rise in prices to the Federal Reserve signaling an end to rate increases and investors anticipating a bitcoin exchange-traded fund getting approval from US regulators in 2024, among other things.

"There's a very direct relationship between prices and electricity consumption," de Vries said in an interview. "The more the value of the resource goes up, the more the miners are paid and the more they mine."

As bitcoin prices continue to move higher by the day, de Vries predicted, the industry's footprint will likely grow even more before the end of the year. But he stressed that the trajectory can change suddenly, if bitcoin's turbulent history is any indication.

The global crypto mining industry currently consumes as much electricity annually as Ukraine, Digiconomist estimated, and emits 78.7 million metric tons of CO2 per year, as much as the nation of Oman.

Environmental impacts are not limited to the energy the industry consumed from power plants burning fossil fuels. A paper de Vries published in late November in the journal Cell Reports Sustainability analyzed water usage from cooling power plants that produce electricity for bitcoin mining and water used to cool mining datacenters.

As mining continues to grow, the total US water use in 2023 could reach the equivalent of 27 billion gallons, the study estimated. That is about what Washington, DC, households use in a year, it said.

Lawmakers react

Bitcoin mining companies use powerful computers housed in sprawling datacenters to verify, process and record cryptocurrency transactions. A single bitcoin transaction using the "proof-of-work" process today requires 705 kWh of electricity, according to Digiconomist. By comparison, Ethereum uses 0.02 kWh after switching to a new approach in September 2022 known as "proof of stake," cutting energy use 99%.

New York in 2022 imposed a two-year moratorium on bitcoin mining over concerns that the industry was using up too much of the state's renewable energy resources. Members of Congress have also voiced concerns over the industry's impact.

A bill reintroduced by Senate Democrats in March called on the US Environmental Protection Agency to issue a rulemaking requiring cryptocurrency mining operations that use more than 5 MW of power annually and emit greenhouse gas emissions exceeding 25,000 metric tons to monitor and report such emissions. The bill never made it out of committee.

The same month, Rep. Pete Sessions (R-Texas) sponsored an opposite resolution declaring that "energy development should be a key pillar to the growth of the United States economy, infrastructure, and national security, and Proof-of-Work mining can help develop advancements in all of these sectors."

Industry lobbyists weigh in

By August, the bitcoin mining industry had established an advocacy group in Washington, the Digital Energy Council, with a message that digital asset mining can help stabilize the electric grid. In October, another trade group, the Digital Power Network, lobbied Congress in support of Sessions' resolution.

"We met with nearly 40 members of Congress from both sides of the aisle, sharing tangible, real-world examples that underscore how the bitcoin mining industry is playing a pivotal role in advancing America's energy security in four significant ways: grid stability, national security, decarbonization and sustainability," Perianne Boring, CEO of the Chamber of Digital Commerce and organizer of the network's lobbying event, said in a release at the time.

The industry is also pointing to miners that invest in their own renewable energy sources to power datacenters, or that employ underutilized power sources that might otherwise go to waste. In Texas, the epicenter of US bitcoin mining, companies also take advantage of the state's demand response programs to help conserve energy during peak demand.

Riot Platforms Inc., the largest bitcoin miner operating in Texas, collected $49.6 million in power curtailment credits from Texas during the third quarter, more than it made from mining, the company reported.

To date, however, no independent analysis has shown that the industry is getting greener or shrinking its carbon footprint, de Vries said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.