Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jan, 2022

As the holiday season closed one of the theater industry's worst years on record, it found a welcome present under the tree from "Spider-Man: No Way Home." |

The winter's return of a $1 billion-plus title to theaters proved that the box office is still as relevant as ever for big-budget franchises, even as distribution strategies for smaller films remain in flux.

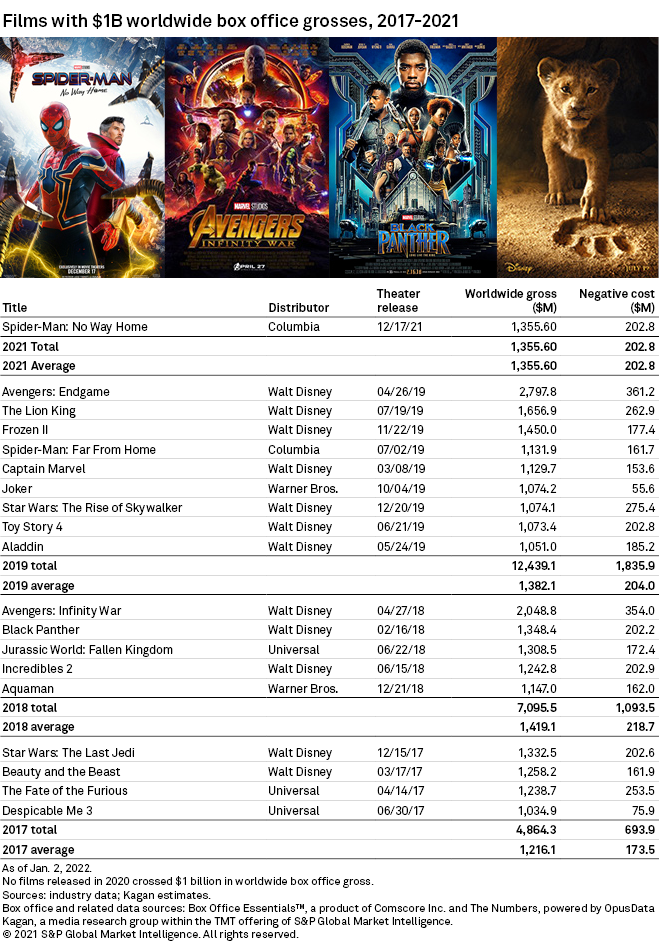

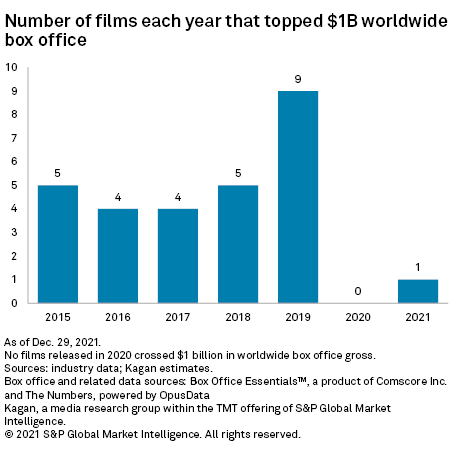

Sony Group Corp.'s "Spider-Man: No Way Home" was the first film in two years to cross the 10-figure benchmark. While it is an encouraging sign of recovery, that single success comes after several pre-pandemic years when studios and theaters split ticket sales on multiple $1 billion films per year. In 2019, for instance, a total of 9 films topped the $1 billion mark.

Analysts said the performance of "No Way Home" proves that tentpole four-quadrant films — those targeting male and female audiences, as well as those both over and under 25 — can still find massive success at the box office, making theatrical releases important for studios. But for smaller, niche films, studios are likely to continue de-emphasizing the theatrical window.

"Studios will have to get smarter about what they send to streaming and what they have in shortened windows," Wedbush Securities analyst Alicia Reese said in an interview.

Studios will deem entire genres — such as musicals or mature content — unlikely to draw enough attendance to justify theatrical releases, Reese expects. These genres will thus be given shorter windows or streaming releases.

Audience arbitrage

An abbreviated theatrical release could become especially important for "low- to mid-profile movies aimed at niche audiences," said Shawn Robbins, chief analyst at Box Office Pro. Robbins noted these films saw especially low box office performances when debuted simultaneously in theaters and on demand.

As an example, Robbins pointed to Will Smith's "King Richard," about the father of Venus and Serena Williams. The film had the potential to be a "sleeper holiday hit," said Robbins, but opened to just $5.2 million and has struggled to cross $15 million in worldwide gross, despite very strong critical reception. The Warner Bros. film had a day-and-date release in theaters and on streaming platform HBO Max. Even superhero franchise films such as "Black Widow" that were debuted on streaming day-and-date with theaters saw massive drop-offs in their performance after the opening weekend, whereas comparable titles like "No Way Home" that were released exclusively in theaters held strong.

"Theatrical exclusivity is important. It mitigates the potential of being cannibalized, not only at home on streaming but also with piracy," Robbins said.

Indeed, Robbins and Reese highlighted piracy as a material impact on the performance of films that received a streaming debut.

It may make more sense for studios to lure moviegoers to theaters with a brief exclusive theatrical release, and then cater to older audiences, namely those over 35, with a subsequent premium on-demand release.

"Older adults are one of the more cautious groups," Robbins said. Before the pandemic there were concerns that the moviegoing audience was aging more rapidly than the general population, but "it's young people that are now driving the movie business."

A new way home

This is certainly true in terms of the success of "No Way Home," which had a PG-13 rating. Even Disney's animated title "Encanto" managed a strong pandemic-era animated debut at $40.6 million during the Thanksgiving frame, notably after vaccines were widely approved for children.

But the performance of "Encanto" was still weaker than big-budget family films released before the pandemic. Also, given that children often watch their animated favorites at home many times, Reese believes big family-oriented franchises could be used to support studios' streaming platforms more than their box office revenues.

The shift in importance between streaming revenues versus box office revenues has become readily apparent during the pandemic. Total revenue for studios distributing films gained 0.8% in 2021 compared to 2020, according to estimates from Kagan, a media research group within S&P Global Market Intelligence, largely due to streaming. Studio revenues generated by theatrical rentals accounted for just 11.2% of total revenues in 2021, down from about 30% in prior years.

While theatrical revenues should grow as the pandemic resolves, Reese said, they may never return to pre-pandemic levels. And the near term looks especially soft.

"Q1 ... is really weak," Reese said of slated theatrical releases. "There's not a whole lot going on. We expect it to be a lull."

Enduring demand

Studios, though, are expected to release more and more titles as the year goes on, with billion-dollar franchises like Jurassic World, Black Panther and Avatar returning to cinemas.

That gives Kagan film and theater analyst Wade Holden reason for optimism when it comes to the future of box office revenues and the opportunity for more titles to crest the 10-figure mark.

"As great as it is to have a 4K, 80-inch TV with premium surround sound in your family room, it doesn't replicate that experience of a gigantic screen in a dark room, and sharing the experience with friends and strangers," Holden said. "The theatrical experience is not going away."

Holden pointed to AT&T Inc.'s decision to release its Warner Bros. titles exclusively in theaters in 2022 after it put all its titles on its HBO Max streaming platform the same day they were available in theaters through 2021. Disney also released more and more titles exclusively in theaters as 2021 progressed.

But though a return to exclusive theatrical windows seems inevitable, that window is likely forever changed. The pandemic gave studios time and leverage to negotiate new terms, and they garnered much more flexibility around what films they can release on streaming and when they can move them from theaters to streaming.

"I'm not sure we'll see fewer releases. I just think the timetable maybe advanced," Holden said.