Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Feb, 2023

Banks are racing to ensure there is no discrimination in their lending operations as the U.S. Department of Justice ramps up its efforts to combat redlining, attorneys told S&P Global Market Intelligence.

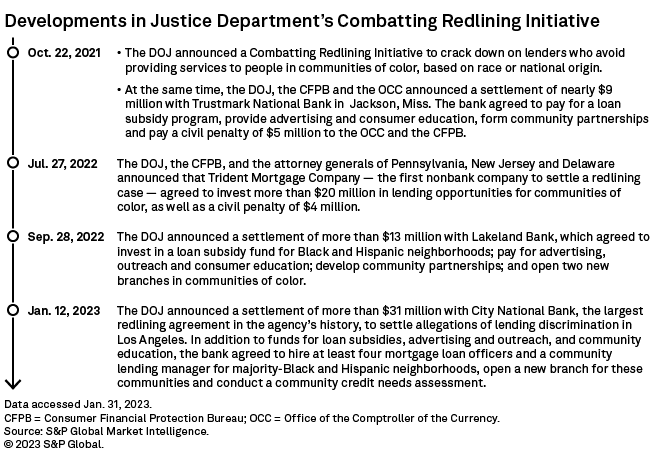

Redlining is a discriminatory practice in which a financial institution denies lending to a consumer "because of the race, color, or national origin of the residents in those communities," according to the DOJ. In October 2021, the agency announced a new crackdown on the practice, with multimillion-dollar settlements increasingly seen in the latter half of 2022 and into 2023. On Jan. 12, the DOJ announced a record $31 million settlement with Los Angeles-based City National Bank.

The DOJ is expected to continue to turn up the heat, and banks should be paying close attention, said Chris Willis, co-leader of the financial services industry group at Troutman Pepper.

"We know that the DOJ has a large number of redlining cases under investigation right now," Willis told Market Intelligence. "It is important for lenders to get a handle on their risk level as rapidly as possible, before they become the subject of a regulatory examination."

Banks 'take it to the top'

As the DOJ's crackdown continues, banks should take vigorous steps to ensure their operations are in line with government expectations, advisers told Market Intelligence.

"Banks and nonbanks alike should be on notice that redlining is a high risk to the industry at large," said K&L Gates Partner and Bank Policy Expert Olivia Kelman. "All institutions should be proactive in developing a plan for comprehensively evaluating their own redlining risk and looking forward as to where there may be weaknesses."

Some banks are already doing just that.

"I'm seeing banks take it to the top more often than I used to," Caroline Eisner, a financial institutions and products attorney with Alston & Bird, said in an interview. "Increasingly, you're seeing more of the presence of the C-suite, and frankly, the CEO being dialed in, at many banks, on what the strategy is."

Many banks are also taking proactive steps to avoid landing in regulatory hot water by marketing in minority communities, engaging with community groups and offering a broad set of products for all consumers, according to Jeff Naimon, a partner who works with banks and nonbanks at Orrick.

What is the DOJ looking for?

The DOJ is looking for a broad variety of clues in its work to determine whether redlining occurred, financial attorneys said.

While the proportion of loans in minority communities and neighborhoods compared to total loans has long been a key component of the DOJ's review, the agency is increasingly focusing on issues such as branch locations, whether the bank has minority loan officers, and what the company's outreach and advertising in communities of color is, experts said. The DOJ is also scrutinizing emails and other communications inside banks to determine whether discrimination has occurred.

All of those issues are playing out in the settlements the DOJ reaches with banks, including the first decision under the new initiative with Jackson, Miss.-based Trustmark National Bank. In addition to a $5 million civil penalty, the bank agreed to pay for a loan subsidy program for minorities, provide advertising and consumer education, and form community partnerships.

Banks agreed to make similar efforts in other cases, including a September 2022 settlement of $13 million with Newfoundland, N.J.-based Lakeland Bank. In addition to a loan subsidy fund and paying for advertising and outreach, Lakeland agreed to open two new branches in minority neighborhoods.

New landscape for nonbanks

Attorneys said nonbanks should also take note as the DOJ's redlining initiative zeroes in on them for the first time. In July 2022, Trident Mortgage Co. LP became the first nonbank company to settle a redlining case. The company agreed to invest more than $20 million in lending opportunities for communities of color, as well as pay a civil penalty of $4 million.

As nonbanks have gained mortgage market share over the years, the DOJ has focused on them more, according to K&L Gates' Kelman. In 2021, nonbanks accounted for seven of the top 10 mortgage lenders, according to Market Intelligence data based on Home Mortgage Disclosure Act information.

The DOJ will be looking at the volume of loans a nonbank is making within a geographic area and applying a statistical analysis, Kelman said.

"It's reasonable to expect that those geographies would be a focal point for any investigation," Kelman told S&P Global Market Intelligence.

Focusing on geographic needs is a new landscape for nonbanks, which largely have nationwide reach through digital operations, according to Orrick's Naimon.

"Nonbanks have used different business models to do business, without needing to focus on whether they were serving a metropolitan area or whether their lending penetration in minority neighborhoods was the same as their overall penetration rates," he said.

Agency coordination

Banks and nonbanks should consider that they are "dealing with this government attention from all sides," said Joann Needleman, who leads the financial services, regulatory and compliance practice at Clark Hill. She pointed out that the Consumer Financial Protection Bureau worked with the DOJ on the Trident case, and the two agencies announced the settlement together.

The state attorneys general in Pennsylvania, New Jersey and Delaware also worked on the Trident case.

"I would expect that coordination among DOJ, the CFPB, the prudential regulators and the state attorneys general is going to continue," Kelman said. "That just broadens the reach and the firepower that could accompany these types of claims."