S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Oct, 2022

By Alison Bennett and Ronamil Portes

Impending changes to how much credit card issuers can charge in late fees could have a big impact on small institutions.

The Federal Reserve's late fee rules are under review by the Consumer Financial Protection Bureau in a move that could result in a formal notice of proposed rulemaking early next year, according to CFPB Director Rohit Chopra. A key question is what may happen to a safe harbor permitting credit card issuers to charge a specific amount without fearing action by the government, enacted under the CARD Act in 2009.

The CFPB announced the proposed rulemaking in June, seeking data about credit card late fees and late payments, and assessing whether those fees are "reasonable and proportional." The agency said it was seeking data about card issuers' revenue and expenses, the potential deterrent effect of late fees and the role late fees play in credit card companies' profitability.

While it is unclear exactly what the CFPB will change, experts anticipate a big impact on credit card issuers, particularly the smallest financial institutions.

"The vast majority of card issuers rely on the safe harbor provision to determine what their late fees will be," Jonathan Engel, co-leader of the enforcement and investigations practice within the banking services group at law firm Davis Wright Tremaine and a former CFPB enforcement attorney, said in an interview. The CFPB project "really can change the entire credit card industry pretty significantly," Engel said.

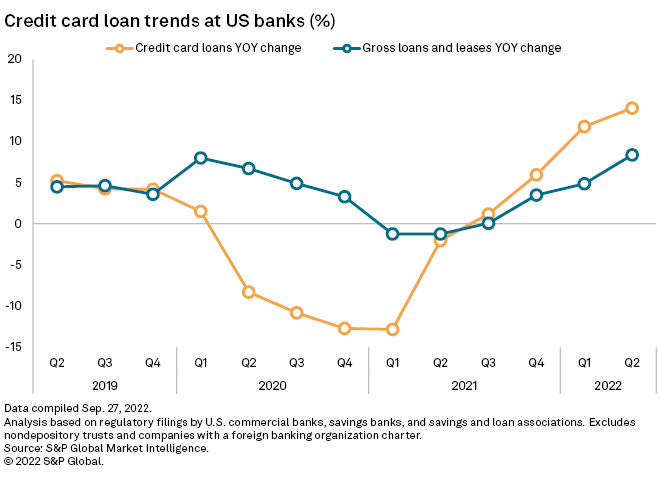

The potential changes come at a time when U.S. banks' credit cards loans are rapidly growing. During the second quarter, credit card loans at U.S. banks grew 14.1% from the same quarter in 2021, to $903.45 billion. Such loans increased 6.1% on a quarterly basis, according to S&P Global Market Intelligence data.

Big impact on small issuers

The CFPB reform represents "the most underappreciated policy risk for the financial services industry" because it is highly likely the CFPB will eliminate or significantly cut the late fee safe harbor, Raymond James analysts Ed Mills and Michael Rose wrote in a September note.

"There is a very high probability that we will see a material reduction in late fees," the analysts wrote. "Such changes could challenge the ability of credit card issuers to charge late fees overall."

Several financial institutions wrote public letters to the CFPB opposing changes to current credit card late fee regulation. One North Carolina-based credit union argued that the agency's potential changes could have a big impact on smaller financial institutions.

"Coastal relies heavily on fee revenues and dividend income to cover operational expenses and reinvests profits in the form of lower fees, better loan rates and higher dividends on deposit accounts for our members," Coastal FCU Chief Member Operations Officer Jim Pack wrote in a letter to the CFPB. "Restrictions on our ability to assess fees could have unintended adverse impacts to a large share of our members if we can no longer support our full range of products and services."

Similarly, the American Bankers Association, Consumer Bankers Association, Credit Union National Association and National Association of Federally-Insured Credit Unions argued that the changes would have the biggest impact on smaller institutions.

"Any reduction in or elimination of the late fee safe harbor would have a significant adverse impact on a substantial number of financial institutions with less than $750 million in assets," the groups wrote in a letter to the CFPB.

Among the approximately 842 banks that issue credit cards, more than half have assets below $750 million, and among the 3,172 credit card-issuing credit unions, nearly 85% have assets below $750 million, according to the groups.

Potential changes

Consumer advocacy groups are advocating for late fees that are proportional to the debt the consumer owes, such as capping the late fee issuers can charge to no more than 1% of an outstanding balance and no more than 25% of a missed payment, which would have a big impact on smaller balance and credit limit cards, according to the Raymond James analysts.

One consumer group is pushing for a grace period in which late fees would not be imposed for 30 days following a missed payment, but not a complete elimination of the safe harbor.

"We want the fees to be more closely tailored to the debt held by customers," Rachel Gittleman, financial services outreach manager for the Consumer Federation of America, said in an interview with Market Intelligence.

US banks' exposure to credit cards

The three banks with the highest credit card loans in the second quarter were Citigroup Inc. with $149.45 billion, JPMorgan Chase & Co. with $146.48 billion and Capital One Financial Corp. with $110.18 billion.

Credit card delinquency at U.S. banks grew to $23.69 billion in the second quarter from $23.04 billion in the first quarter. However, credit card delinquency as a proportion of total credit card loans dropped to 2.62% in the second quarter from 2.71% in the first quarter.

Credit card-related net charge-offs at U.S. banks have risen for the past three quarters but remain low compared to the levels seen in 2019 and 2020. Net charge-offs on credit card loans stood at $4.43 billion, or 2.08% of average credit card loans, in the second quarter, compared to $3.98 billion, or 1.95% of average credit card loans in the first quarter.