S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Jan, 2021

| A coal truck drives across a surface coal mine in the Powder River Basin in the U.S. in 2017. Source: S&P Global Market Intelligence |

A controversial U.S. tax credit for refined coal production will expire in 2021 without an extension, raising questions about the future of refined coal facilities and their associated power plants.

Studies by Resources for the Future found that the credit, primarily collected by a few financial services companies invested in refined coal facilities, generates questionable environmental benefits and may contribute to higher greenhouse gas emissions. A group of three U.S. senators called for an audit of the refined coal tax credit in late 2019 and it is underway but not yet completed, a spokesperson with the Government Accountability Office confirmed.

The tax credit, stemming from the American Jobs Creation Act of 2004, is currently worth more than $7.30 per ton of refined coal. According to the most recent line-item estimate data from the IRS, in 2017, a total of just six tax filers claimed $737.2 million in tax credits for the production of refined coal.

With Democrats leading both sides of the U.S. Congress and the Biden administration taking control of the White House, a tax credit for coal use may be less likely to see a revival.

Sen. Sheldon Whitehouse, D-R.I., was one of the Democratic senators calling for an audit of the program in 2019. Whitehouse said he is glad to see the "investigation into hundreds of millions in tax write-offs based on shoddy emissions data" is underway.

"The IRS must correct its guidance that allows companies to cash in on this tax credit while producing 'refined' coal that fails to deliver the promised emissions reductions," Whitehouse said in a statement to S&P Global Market Intelligence.

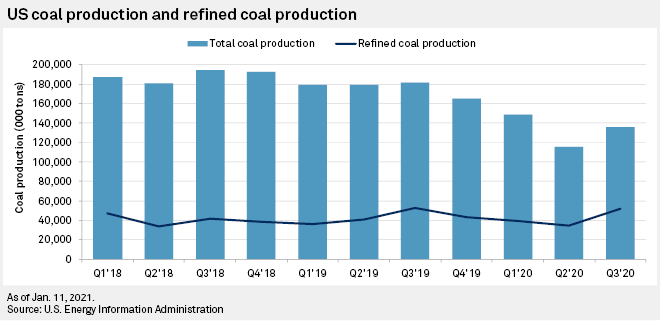

According to U.S. Energy Information Administration data, companies mined about 400.1 million tons of coal in the U.S. during the first nine months of 2020. Coal refining plants produced about 125.8 million tons in the same period, or an amount equal to about 31.5% of national coal production.

Questionable environmental benefits

Resources for the Future researchers Brian Prest and Alan Krupnick published a study concluding that "the emissions reductions from refined coal achieved in the field fall short of the targets for tax credit eligibility." They said this suggests companies claiming the credit may be in technical compliance by meeting laboratory test criteria while violating the spirit of the law.

"Once you get out into the field, a lot of things go on," Prest said in an interview. "It turns out, from our analysis, that these emissions are not meeting the requirements to earn the tax credit."

The researchers, who said they were recently interviewed by the GAO, estimated the credit's cost was more than seven times larger than its benefits. The study has been peer-reviewed and accepted by the journal Energy Economics, though it had not assigned a specific volume or issue of publication as of Jan. 12.

It is difficult to tell if the expiration of the tax credit could contribute to a new round of coal plant retirements, Prest said. However, the researchers' model suggests the credit may delay retirement for some coal plants, extending emissions of greenhouse gases.

A subsidiary of power generator Ameren Corp. paid lobbyists to advocate to extend the credit as recently as the first quarter of 2020, but the issue has not appeared in the company's subsequent disclosure forms. The Ameren Missouri unit plans to end the use of refined coal in 2021 and it will instead "continue its emission reduction strategy through use of alternative emission control technologies," a spokesperson said.

In late 2020, Ameren set a goal to hit net-zero carbon emissions by 2050. Its plan includes advancing the retirement of its coal fleet, with the first scheduled for 2022.

A lucrative business model

The refined coal tax credit allows companies to build facilities, buy coal from a power generator and sell it back after treating the fuel. Several companies have described plans in which they sell the coal back to power generators at a lower price than paid while reaping the tax credit benefits. Refined coal facilities can be built at scale for about $4 million to $6 million, according to the Resources for the Future study.

One of the companies using the tax credit is Arthur J. Gallagher & Co., an Illinois-based global insurance brokerage and risk management services firm. At a 2018 investor meeting, Gallagher & Co. CFO and Corporate Vice President Douglas Howell touted "staggering" returns of up to 500% from the business because it "costs so little to develop it."

Gallagher & Co.'s ability to generate tax credits on 14 of its 35 plants expired at the end of 2019, it wrote in a late October 2020 security filing. The company said it believes the production and sales from its 21 other facilities are eligible for the tax credit. The insurer disclosed that it expects to earn between $65.0 million and $70.0 million from its refined coal business in 2020.

"Absent an extension of the law, '21 will end, what I'd consider, the credit production era," Howell said during a mid-December 2020 conference call. "At that time, we'll have about $1.1 billion of credits receivable from the government, a deferred tax asset."

Howell also said the company had "invested a lot of money" to make coal production cleaner and that "it will be nice to enter into that cash harvesting era."

Uncertainty going forward

Gallagher & Co. did not respond to a request for further comment, and it is not clear what will become of its refined coal facilities when the tax credit expires if Congress does not pass an extension. The Scottish American Investment Co. PLC called out the insurer over its use of the credits in a 2020 sustainability report and said it spoke with senior management at Gallagher & Co. and advised against using the credits to lower its tax bill.

The most recently available lobbying disclosure forms show lobbyists working for Gallagher & Co. continued to lobby for the extension of the credit through the third quarter of 2020.

Subsidiaries of Gallagher & Co. are engaged in a legal battle with the Internal Revenue Service over its past use of the credits. The IRS concluded in 2017 that two of the three investment partners in a refined coal facility that provided coal to Santee Cooper's Cross coal-fired power plant in South Carolina were not entitled to claim the tax credit, comprising affiliates of Fidelity Investments and Schneider Electric SE.

The government's arguments in the case were that the companies formed the partnership primarily to allow a Gallager & Co. affiliate to sell the tax credits to other entities impermissibly. A lower court sided against the IRS, but an appeal from the government in the U.S. Court of Appeals for the D.C. Circuit is underway. The appellees filed a brief Jan. 6 to defend the use of the credits.

Other companies that have benefited from the refined coal tax credits include Goldman Sachs Group Inc., JPMorgan Chase & Co. and Capital One Financial Corp., according to a December 2019 news release from Whitehouse.