S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Nov, 2024

By Shahrukh Madni and Beenish Bashir

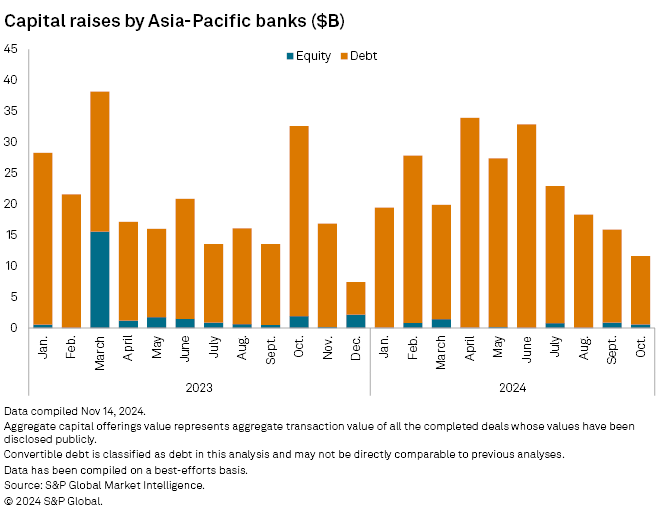

Asia-Pacific banks' aggregate debt issuance volumes plunged 64.1% year over year to a 10-month low in October, mainly as Chinese banks were conspicuously absent from debt capital markets.

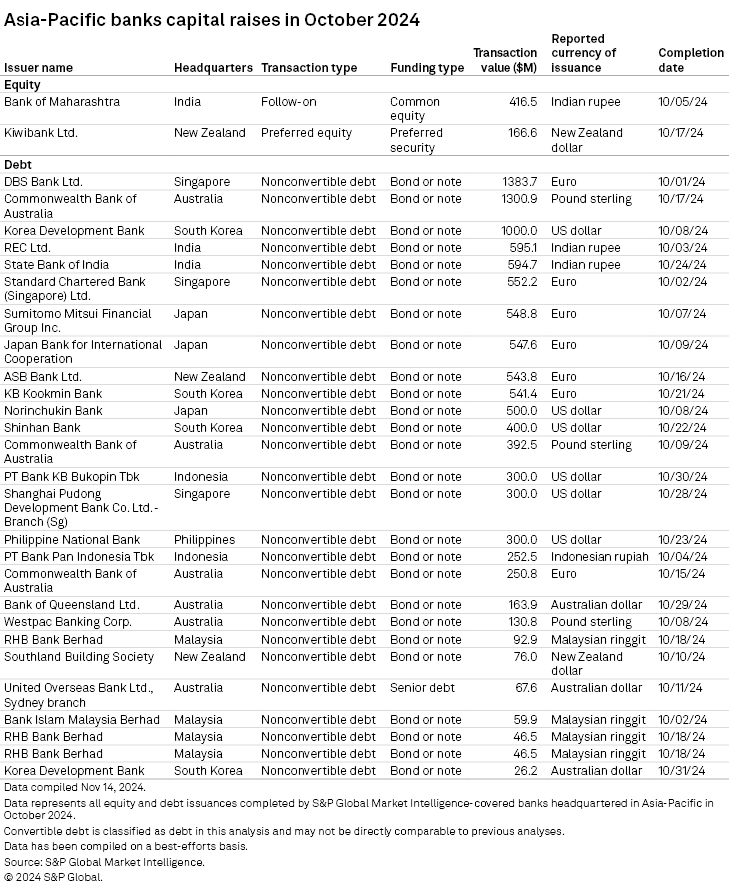

The region's banks raised $11.01 billion via debt instruments in October, compared with $15.03 billion in September and $30.66 billion in October 2023, according to data compiled by S&P Global Market Intelligence on a best-efforts basis.

While Chinese lenders stayed away, banks based in Australia, Singapore and South Korea raised more than half of the total debt during the month, with DBS Bank Ltd., Commonwealth Bank of Australia and Korea Development Bank each completing billion-dollar offerings. Other notable issuers included State Bank of India, Standard Chartered Bank (Singapore) Ltd., Sumitomo Mitsui Financial Group Inc., Japan Bank for International Cooperation, Shinhan Bank and Norinchukin Bank.

Despite the October plunge, aggregate debt issuance volume by banks in Asia-Pacific has recovered this year. Banks raised $225.33 billion in debt in the January-to-October period, compared with $215.25 billion in full-year 2023, the data showed. This is broadly in line with trends seen in capital markets across the world. Following the recovery this year, the outlook for capital market issuance remains positive with loosening monetary policy, especially in the US, according to Market Intelligence's 2025 Capital Markets Outlook report.

Issuance has surged across debt capital markets, with strong investor appetite for US bonds and robust demand for riskier emerging market securities. Other bright spots include strong IPO markets in India and Japan, according to the report.

Foreign-currency appeal

Foreign currency-denominated bonds made up more than 80% of the total debt issued in October, a reversal from a few months ago when the region's banks increasingly issued local-currency debt to raise funds. Banks raised $8.99 billion of bonds denominated in US dollars, euros and pounds sterling in October, Market Intelligence data showed.

"[US dollar-] and euro-denominated bonds have been popular due to a deep pool of liquidity among investors and there is an established yield curve for short-term as well as longer-dated bonds," said Jini Lee, head of Asia and global head of finance, funds and restructuring, at law firm Ashurst.

Lee said the outlook over the next few months is promising, given the completion of the US elections and expectations of further interest rate cuts.

Equity markets

Asia-Pacific banks' activities in the equity markets remained muted in October, with just two offerings.

India's Bank of Maharashtra raised $416.5 million by selling common stock shares to institutional investors. Kiwibank Ltd. raised $166.6 million by issuing perpetual preference shares, which will constitute additional Tier 1 capital for the bank's regulatory capital requirements.