Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Feb, 2021

As Exelon Corp. spins off its unregulated generation assets, company management hinted that the future of some plants could be in jeopardy amid mounting concerns about the future of the Electric Reliability Council Of Texas Inc. market.

Exelon management said they are hopeful that ERCOT and Texas regulators will take the "proper actions on the design" of the electricity market in the aftermath of the recent grid crisis in the region.

"As a result, we are evaluating all our options with respect to our ERCOT business," Exelon President and CEO Christopher Crane said Feb. 24 on the company's fourth-quarter 2020 earnings call.

"The first step is working with the other stakeholders on what happened and what is the future design of the Texas market," Crane said, adding it will be important to know if ERCOT leans toward a reliability standard for capacity performance.

"There's been a lot written on this over the years, that we were heading in this direction," the CEO said. "It's a very unfortunate event. But we have to know, first, the market design."

Exelon also will need to look at what issues its plants faced during the Arctic blast that swept through Texas the week of Feb. 15.

"We had taken some action after the Super Bowl event a couple years ago, but you don't get compensated to do what we've done in other jurisdictions hardening the plants that have not only penalties but capacity payments that allow you to make those investments," Crane said. "So, we have to look at it. We want to be a reliable provider. We want to participate in a market that's designed to not only protect the consumers ... but allow[s] us to make the investments and operate our plants safely and reliably."

Business separation

Shortly before the call, Exelon announced that it will separate its regulated utility business and its competitive power generation business into two publicly traded companies. The plan has been approved by the company's board of directors.

In November 2020, Exelon confirmed the launch of a strategic review of its corporate structure, which included the possibility of splitting its unregulated Exelon Generation Co. LLC arm from its utility operations.

Exelon Utilities will now be part of the temporarily called RemainCo, which will consist of six regulated electric and natural gas utilities serving more than 10 million customers across five states and Washington, D.C. The 100% regulated transmission and distribution utility business will target 6% to 8% earnings growth through 2024 underpinned by about $27 billion of capital spent on grid modernization and resiliency.

The utility business is expected to need about $1 billion of new equity funding through 2024.

Exelon Generation will be part of SpinCo and will operate a fleet of more than 31,000 MW of generation capacity from nuclear, wind, solar, natural gas and hydro assets.

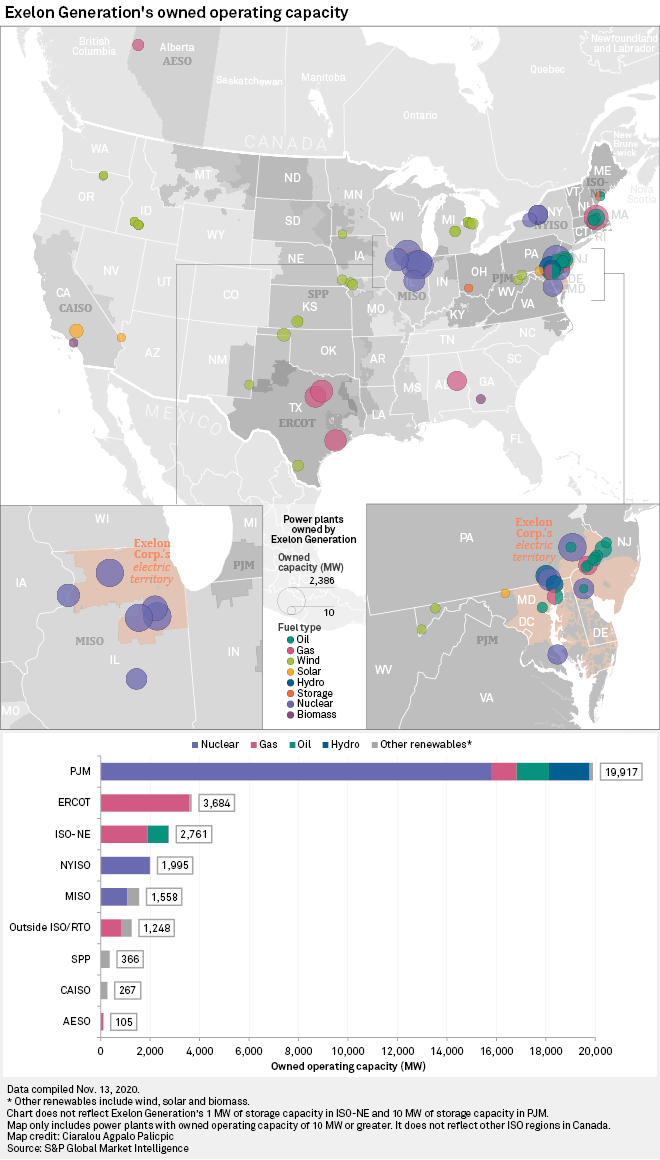

Nearly 20,000 MW of the generation fleet is in the PJM Interconnection footprint, according to S&P Global Market Intelligence data. More than 3,600 MW is in ERCOT, with the next-largest concentration of power plants in ISO New England.

The spin includes energy trader and competitive retail energy supply business Constellation NewEnergy Inc.

Under the plan, Exelon shareholders will retain their current shares and receive a pro rata dividend of shares of the new company's stock in a tax-free transaction. The actual number of shares to be distributed will be determined prior to closing, which is expected in the first quarter of 2022 following approval by the Federal Energy Regulatory Commission, the Nuclear Regulatory Commission and the New York Public Service Commission.

An analyst pointed out that New York approval has proved challenging in similar past circumstances.

"We are confident that we will get through New York," Exelon Senior Executive Vice President and Chief Strategy Officer William Von Hoene said on the call. "It's going to be a process, obviously, and there will be some negotiations, but the initial signs are good."

Crane and the existing management team will continue to lead Exelon until the public listing of the spinoff company, which will target investment-grade credit ratings.

"First and foremost, we're going to continue to pay down debt there to maintain the strength of the balance sheet because we think that an investment-grade rating is important," Senior Executive Vice President and CFO Joseph Nigro told analysts and investors. "And then beyond that, we'll determine how we return capital to the shareholders. And we expect to have those decisions made through time here. We're just not ready to commit to that at this point, given some of the uncertainty."

'Unacceptable' loss in ERCOT

Exelon Generation operates the 1,211.8-MW Colorado Bend Energy Center II, the 1,193-MW Wolf Hollow II and the 1,265-MW Handley natural gas plants in ERCOT, which were knocked offline temporarily during the Texas freeze.

"They only periodically were available when the prices hit and were maintained at the administrative cap of $9,000 [per MWh]," Crane said. "Our preliminary estimate ... of the impact of this event across our portfolio is $750 [million] to $950 million pretax or $560 million to $710 million posttax. At this point, the range is wide. It includes our best estimate from load obligations, ancillary charges and bad debt."

Exelon management plans to provide a clearer update no later than the company's first-quarter 2021 earnings call.

"This loss is unacceptable to us," Crane said, adding that the company is mitigating the losses through "mostly one-time cost reductions and deferral of nonessential maintenance."

"We have to date found updates and offsets that are expected to reduce our net impact to 20 cents per share at the midpoint of our loss estimates," Crane said. This is reflected in the company's full-year 2021 adjusted operating earnings guidance of $2.60 per share to $3.00 per share.

"These mitigating efforts are expected to reduce the cash impact to $200 million," Crane said.