Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Jun, 2022

By Anser Haider

Apple Inc. is set to grow its market share in the global video game industry as the company tightens its grip on the lucrative mobile gaming space.

Even though the iPhone maker does not produce any of its own gaming hardware or software, the cut it charges for every transaction within the App Store has turned the company into one of the biggest earners in the industry. Nevertheless, analysts think it is inevitable that Apple will deepen its involvement in gaming to stay abreast of evolving technology and regulatory matters.

"With games accounting for about 70% of the entire App Store's revenue, it's very safe to say that Apple is very much invested in the gaming industry," said Angelo Zino, a senior industry analyst at CFRA Research. "Nevertheless, there are still significant opportunities that remain for further growth potential in gaming, and it is only a matter of time before the company pursues them."

Raking in commissions

Apple charges a 30% standard commission on apps and in-app purchases within the App Store. The commission falls to 15% after a year, while developers that make less than $1 million in annual App Store sales can sign up to qualify for a 15% rate as well.

|

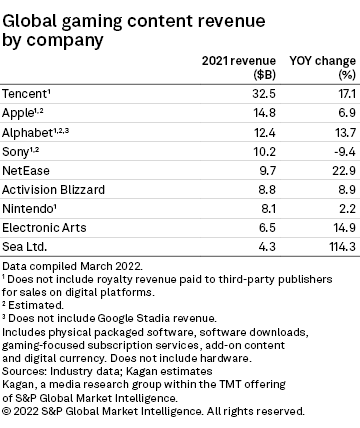

An overwhelming majority of games on the App Store are free-to-play titles that include in-app purchases. Apple has made a killing off this space, pulling in $14.80 billion in 2021 to make it the No. 2 company in global gaming content revenue, according to estimates by Kagan, a media research group within S&P Global Market Intelligence.

Apple's chief rival in the mobile apps space, Alphabet Inc.'s Google LLC, ranked No. 3 on the list with $12.40 billion, also from taking cuts on the Google Play store. China's Tencent Holdings Ltd., the top gaming earner by a large margin, pulled in the bulk of its $32.50 billion in revenue in mobile gaming as well.

While mobile gaming's explosive growth is set to decline in the coming years, it will continue to remain the most profitable space in the video game industry, according to mobile apps analytics firm Sensor Tower.

"We estimate that by 2026, mobile games will represent a 43% share of consumer spending on the App Store, down 23 points from 2020," said Craig Chapple, a mobile insights strategist at Sensor Tower. "However, this will still be up to a record $70 billion according to our forecast, from which Apple will take its share."

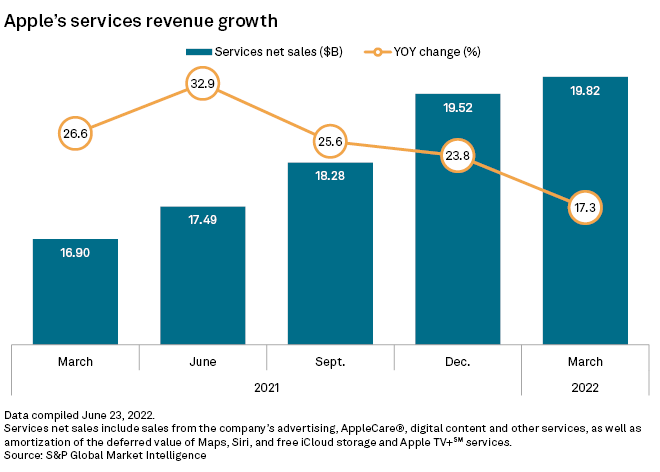

App Store sales have also propelled Apple's services revenues, which grew 17.3% year over year in the March quarter to $19.82 billion. The segment also includes sales from Apple's advertising, Apple TV+ and AppleCare services, among others.

Gaming subscription

While Apple's gaming revenues predominantly stem from the cuts it takes on the App Store, the company's mobile gaming subscription service, Apple Arcade, is poised to steadily grow its user base in the coming year.

The offering, which allows subscribers to download and play a collection of games on Apple devices for $4.99 a month, is estimated to grow its subscriber base to 70 million and pull in $1.20 billion in revenue by 2025.

Apple Arcade launched in September 2019 and offers more than 200 games that do not include any apps or in-app purchases. Google operates a similar subscription service, Google Play Pass, which has the same monthly subscription fee but also includes other apps aside from games.

"Apple Arcade has made inroads with carrier deals and bundling options, but any long-term success will depend on a pipeline of quality content," said Neil Barbour, an analyst with Kagan, a media research group within S&P Global Market Intelligence.

It is very likely Apple will expand into the space with more substantial products in the coming years, Zino said.

"There is potential for Apple to do a lot more on the services side of things in conjunction with launching new gaming hardware," Zino said. "However, they also take their time when it comes to launching new product lines, like they did with wearables."

Regulatory scrutiny

A growing risk to Apple's growth in gaming is intensifying regulatory scrutiny that the company faces over its market power in the mobile apps space.

After Epic Games Inc.'s Fortnite was banned from the App Store for implementing a new payment method that bypassed Apple's own payment system, the gaming company sued Apple for allegedly abusing its market power. Although Apple largely won the lawsuit, the court sided with Epic on the matter of Apple prohibiting app developers from highlighting other payment methods besides Apple's own system.

The issue resurfaced in the Netherlands after the country's competition regulator pressured Apple to allow customers of dating apps to use other payment methods. After receiving multiple fines, the company finally started complying in June and enabled third-party payment options in the apps.

"Lifting the restrictions off dating apps in the Netherlands is just the start, and it is only a matter of time before this spills over to additional territories and additional apps, including games," said Zino.

However, giving consumers the option to pay using alternative methods is not likely to have a significant impact on Apple's bottom line in the long run, the analyst said.

"While overall growth could slow down a little, consumer behavior always leans toward convenience and Apple's built-in payment systems will always be the more easy-to-use option," Zino noted.

Apple has also faced criticism for not allowing third-party app storefronts on its platforms, including the Epic Games Store. The company also restricts apps for other game streaming and subscription platforms such as Microsoft Corp.'s Game Pass and Google's Stadia.

Documents presented in the Epic v. Apple court proceedings showed that Microsoft was unsuccessful at negotiating with Apple to bring Game Pass onto Apple's devices. The service is currently accessible on Apple's devices through streaming on browsers.

Microsoft declined to comment when asked whether it has been in any recent talks with Apple to allow the Game Pass app to function on Apple's platforms.

"Apple has no real incentive to trade consistent revenue generation on in-app purchases for a cut of subscription revenues," said Kagan's Barbour. "And the cloud service operators are likely not in a hurry to pay a commission to Apple while starting up a potentially disruptive new market."

However, the shifting regulatory landscape is likely to force significant changes on Apple's business practices in the coming years, potentially providing an opening for competitors to offer their services with fewer or no restrictions, Zino added.