S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Feb, 2021

By Joseph Williams and Stefen Joshua Rasay

AMC Entertainment Holdings Inc. faced the long barrel of bankruptcy throughout 2020, and if it survives through the pandemic period, it will carry a balance sheet full of bullet holes.

AMC theaters have largely been closed through the pandemic. Source: AMC Entertainment |

In order to keep its iconic three letters glowing above its empty theaters, the company has had to pull a range of financial levers to attract lenders and investors, often having to offer stock and accept daunting debt terms to stay afloat. The pandemic-era commitments could leave AMC scrapping for many years to come, especially if the evolving theatrical model bends against theater operators and cuts into future earnings.

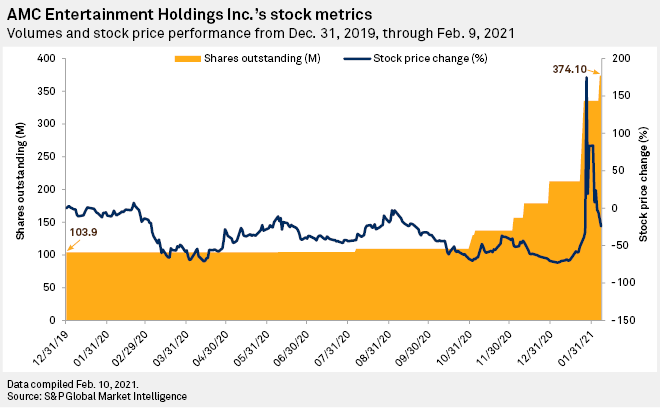

With top-line revenue plummeting to near sea level in 2020 due to the pandemic, AMC had to add cash to its balance sheet quickly through a series of stock and debt offerings. All told, AMC more than tripled its shares outstanding, up to 374,097,577 shares from 103,849,861 shares reported at the end of 2019, according to S&P Global Market Intelligence.

While the dilution provided AMC some survival capital, it represented diminishing returns. The company saw a low-point for its share price in early January this year when it was trading under $2 a share, down over 72% off its Dec. 31, 2019, close of $7.24 per share.

In late January, AMC's shares spiked as the ticker was picked up by a new breed of social media traders whose stated motivations were to undermine the market dominance of perceived Wall Street insiders like hedge funds. The sudden pop in share price gave some investors an opportunity, and Silver Lake Management LLC saw a particular opportunity to turn a prior deal with AMC into quick cash. That private equity fund in July 2020 scooped up $600.0 million in convertible senior notes that AMC issued to survive pandemic closures that extended beyond expectations. During the January "meme stock" surge, Silver Lake converted those notes to AMC shares, a dilutive event in itself, and sold the entire holding for $713 million.

Shortly afterward, AMC fell out of the attention of online buyers, and the stock price again receded.

AMC shares closed at $5.61

The theater operator had only issued stock a couple of times before 2020. It debuted with 21,052,632 shares for $378.9 million during its 2013 IPO, along with an underwriter's allotment and an equity incentive plan announced later that year. It issued shares again in 2017 when it added 20,330,874 shares to raise $640.4 million. The 2017 follow-on offering helped fund its acquisition of Scandinavian cinema chain Nordic Cinema Group and pay down debt it accrued with its consolidation of the U.S. theater industry in the Carmike Cinemas acquisition.

Along with the acquisition of European chain Odeon and UCI Cinemas, AMC's consolidation strategy would come back to haunt the company when a global pandemic made it impossible for it to use cash flow to pay down its swollen balance sheet. The company entered 2020 with $10.35 billion in total debt, according to S&P Global Market Intelligence. In the first three quarters of 2020, it added another roughly $1 billion, and since then it has added at least another $500 million, according to a January disclosure of recent transactions. That included expanding a European term loan by 4x, up to £400 million, and putting a 10.75% interest rate on it with a 2.5-year maturity. The company's fourth-quarter and full-year filings will include a more detailed aggregate picture of the toll 2020 took on its total debt burden.

Double-digit interest rates became standard for AMC as it negotiated with its lenders through 2020. Gearing its balance sheet for short-term survival, much of the senior debt issued in the pandemic period carried coupons at or above 10%, with one $100.0 million senior issuance completed in the first weeks of 2021 carrying a variable rate of either 15% or 17%, depending on payment types. That compares to three 2018 issuances of $600 million each in 2024 senior debt that carry a modest 2.95% coupon.

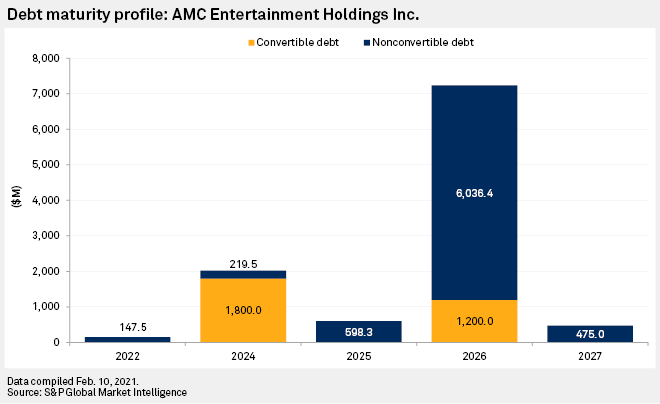

Those 2018 issuances are part of the company's $1.8 billion in convertible commitments coming due in 2024, but 2026 will be the reckoning for AMC's troubled pandemic borrowing. The company will see over $6 billion in non-convertible debt and $1.20 billion in convertible debt come due in that year.