Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jul, 2021

A forced divestiture of Amazon.com Inc.'s fulfillment business could open the door to more competition for merchants seeking shipping alternatives. But it could also mean higher costs for third-party sellers, at least in the short-term, experts say.

The Ending Platform Monopolies Act, part of a series of House proposals designed to restrain Big Tech firms, would require the e-commerce company to sell off its Fulfillment by Amazon, or FBA, program, an expansive business that a majority of Amazon's third-party sellers rely on for fast delivery. The bill, introduced in June by Rep. Pramila Jayapal, D-Wash., is designed to eliminate the "conflicts of interest that arise from a dominant platform’s ownership and reach across multiple business lines." FBA is currently the only viable option for sellers to ship their goods to Amazon's Prime members within one or two days.

Some third-party sellers say they would welcome an alternative to the FBA program but others fear potentially higher costs for sellers who would have to rely on external delivery firms disconnected from Amazon's fast and reliable shipping network.

Profit engine

Amazon did not respond to multiple inquiries for this story. But Amazon's potential sale of its FBA program would mean losing a profit driver and permanently alter a third-party marketplace that has become one of the company's fastest-growing segments, said Tom Forte, an analyst with D.A. Davidson.

"If they lost that ability or something happened that lessened that ability [to deliver goods on behalf of sellers], it would have a material negative impact on their current business strategy," Forte said.

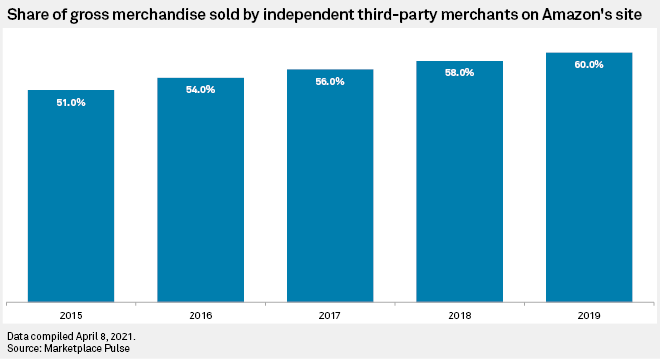

Independent third-party merchants account for a majority of physical gross merchandise sales on Amazon's site, at 60% as of 2019, according to data from Marketplace Pulse, a firm that collects data on e-commerce companies including Amazon. The firm also estimates that Amazon has about 1.5 million active sellers.

Third-party sellers are a profit-engine for Amazon, which charges sellers fees for fulfillment and delivery and takes a cut on each item sold on Amazon.com. The e-commerce company reported that third-party seller services in the first quarter reached $23.71 billion, up nearly 64% from $14.48 billion in the year-ago period.

More competition

It is unclear if the bill will progress through Congress, but it does have some bipartisan support. Of the bill's 12 co-sponsors, five are Republicans and seven are Democrats.

If the bill passes, it could mean more opportunity for delivery companies, including San Francisco fulfillment firm Deliverr Inc. and logistics platform Shipbob Inc., to store, pick, pack and provide last-mile delivery services sellers need, said Jason Boyce, founder of Avenue7Media, which manages third-party private label seller brands on Amazon.

"Every single seller I talk to would welcome the opportunity to take away the power that Amazon gains by indirectly forcing them to be in FBA," Boyce said. If approved, the bill would mean that other delivery companies would be able to say "'Hey Amazon seller, I know you are using FBA, but we can do the same thing for you,'" Boyce said.

Many companies would be hungry for sellers' business, including FedEx Corp. and XPO Logistics Inc., said Nate Rosier, senior vice president and consulting group leader at EnVista, a supply chain software and consulting firm.

"They can do literally everything an Amazon warehouse can do," Rosier said.

Jerry Kavesh — a seller whose company Western Outlets sells items including cowboy boots, hats and jackets — said some of the company's shipping policies have had a negative impact on sellers. For example, Western Outlets saw a steep decline in sales last year when Amazon imposed a moratorium on non-essential goods during the height of the pandemic, Kavesh said.

"It appears to me that they make decisions that are Amazon-centric," the seller said.

Higher costs

But if FBA is no longer the only option, third-party sellers may be forced to absorb higher shipping costs and face longer delivery windows, said Nick Shields, a senior analyst with Third Bridge who covers the retail sector.

FBA "is what attracts so many sellers to the platform because they can go to Amazon, get a lot of exposure for their products and then also take care of all of their fulfillment needs," Shields said. Walmart Inc. and Target Corp., Shields said, have similar fulfillment services, but they are not nearly as mature as FBA.

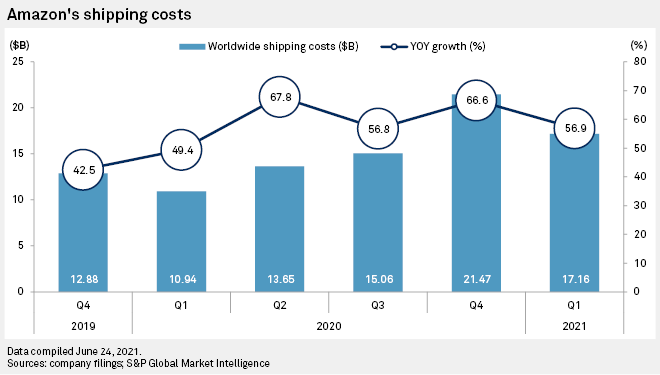

Amazon has poured billions of dollars into building out the logistics capacity, including warehouses and fulfillment centers worldwide, that it has today. Amazon spent $17.16 billion on shipping costs in the first quarter, up 56.9% year over year. In the fourth quarter of 2020, during the peak holiday shopping season, the company spent $21.47 billion on shipping, up 66.6%.

"There is just no guarantee that [alternative shipping methods are] going to be as cheap and as efficient in terms of speed," Shields said.

Amazon sellers could end up paying more for shipping with alternate delivery companies, which would ultimately hurt the customer, said Nicole Reich, co-founder and vice president of sales and marketing at Retail Bloom, a Michigan-based e-commerce agency that helps sellers grow on Amazon and other marketplaces such as Walmart. Deliverr's starting fulfillment prices, for example, are currently advertised at $3.99 per unit, versus a $2.16 starting fulfillment fee per unit at FBA.

"They are able to give us very very competitive rates," Reich said of Amazon's FBA program.

Boyce, of Avenue7Media, believes the higher prices will only create short-term pain for sellers as more delivery players enter the fray and ultimately drive shipping expenses down.

"They could all compete on a more level playing field, which will improve efficiencies, performance and/or lower price, and that's good for sellers long term," Boyce said.