S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Jan, 2023

By Karin Rives

| ESG critics allege that financial firms are hurting investors by steering their investments away from fossil fuels, but some see little evidence showing this to be the case. Source: Scout Clean Energy |

This article is the second of a two-part series on efforts to counteract ESG's increasing role in investment policies.

The debate over Wall Street firms using environmental, social and governance criteria to evaluate investments is often cast in political terms, as if a fund can join Team Red or Team Blue.

But at the core of the disputes are fundamental disagreements over the fiduciary responsibilities of pension fund managers and investment firms, and even how to define ESG.

BlackRock Inc., Vanguard, State Street and other firms with trillions in assets under management are required by federal law to meet certain duties as fiduciaries of their clients' investments. As such, they must research and weigh the potential risks and returns of any financial decision while working to meet their clients' long- and short-term goals.

While firms' fiduciary duties have been the same for more than 80 years, per the Investment Advisers Act of 1940, such duties can be interpreted in different ways. Importantly, what qualifies as a "material" investment risk can depend on who sits in the White House and the signals they send to financial regulators.

In 2022, Republican ire toward environmentally and socially minded investing in state pension funds grew as Democrats in Washington worked with the Biden administration to take federal action on climate change. The campaign against ESG investment policies also opposes the U.S. Security and Exchange Commission's pending climate risk disclosure rule.

Previously, the Trump administration had prohibited any ESG screening for retirement plans. That policy raised concern among asset managers and investor advocacy groups concerned with social and environmental risks.

"The fiduciary question is an interesting one because so much of this is about time horizons," Aniket Shah, managing director and global head of ESG for the investment banking firm Jefferies & Co., said in an interview. "It is ultimately a question of judgment around the future of entire industries that are in a transition and at a pace the world has never done before."

Because ESG is complex and poorly defined, it can give people who disagree with certain investment decisions room to cry foul, said Jill Fisch, a professor of business law at the University of Pennsylvania and an international expert on corporate governance and ESG issues.

"We're at a very divided and partisan moment in the United States," Fisch said in an interview. "And I think we're particularly divided on ESG."

What are investor risks?

BlackRock Chief Executive Larry Fink put a stake in the ground when in 2020 he wrote in his annual letter to CEOs that climate change as an investment risk ranks at the top of concerns raised by his firm's clients.

"Will cities, for example, be able to afford their infrastructure needs as climate risk reshapes the market for municipal bonds?" Fink wrote. "What will happen to the 30-year mortgage — a key building block of finance — if lenders can't estimate the impact of climate risk over such a long timeline, and if there is no viable market for flood or fire insurance in impacted areas?"

Not everybody agrees that the impacts of climate change 10-20 years down the road present the most pressing risks for investors.

Over the past year, Texas, West Virginia, Utah, Florida and several other red states took highly publicized steps to bar state entities from doing business with some of the world's largest financial firms because the firms consider climate change and social risks in their investment decisions. The states and the groups driving the campaign argue that ESG is, in fact, distracting from the firms' fiduciary duty to generate strong returns for shareholders.

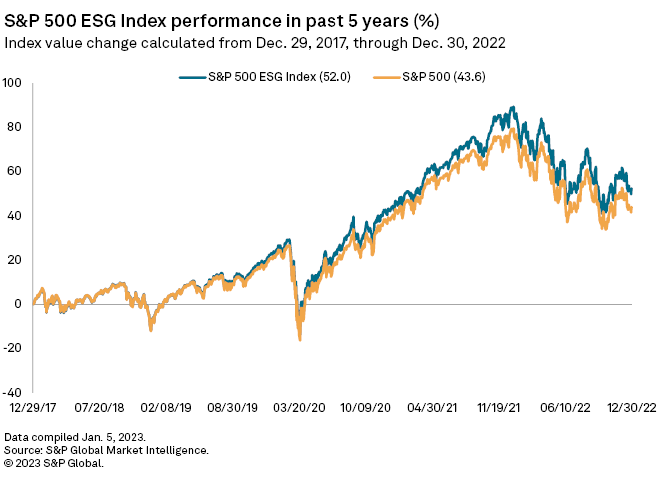

Is that really the case? Some ESG-focused investment funds have declined more than the market overall in the last year. But since its establishment in 2019, the S&P Global 500 ESG Index has roughly tracked the standard S&P 500 index, slightly outperforming it since 2020.

Complicating the discussion around the performance of ESG-focused funds is the lack of a universal agreement on what constitutes an ESG fund — or how to define the concept.

Divesting from tobacco, oil brings 'risk'

Critics of ESG investing point to several decisions to illustrate how they see ESG investment policies hurting investors and their communities. For instance, they often cite studies showing that the California Public Employees Retirement System's decision more than two decades ago to divest from tobacco stocks cost the pension fund an estimated $3.6 billion.

ESG critics also point to the booming oil and gas sector, which racked up record profits in 2022, and note that the top U.S. shale gas stocks outperformed the S&P 500. Divesting from a sector that is performing well would be a mistake on the part of ESG-minded firms and wealthy endowments, they said.

"Harvard and Yale lost from not having oil," said Anson Frericks, co-founder of startup Strive Asset Management, which includes an anti-ESG proxy advisory service among its offerings. "When you start to divest from the energy sector you'll increase your risk."

ESG critics have also argued that such policies have suppressed investment in oil and natural gas projects and may have led to higher fuel prices. But analyses showed that recent price trends, including the spikes in 2022, are largely tied to lighter pandemic restrictions that boosted demand and to the market impacts of the energy crisis in Europe.

Congress may shed more light

The pending SEC climate disclosure rule, along with a separate rulemaking on ESG disclosures, could help better define risk and clarify what is expected of fiduciaries, observers say. The SEC rule is now set to be released by April, according to the agency's regulatory calendar.

Oversight hearings in Congress could also bring more thoughtful conversations about risks and returns for investors, some believe.

"A fiduciary is not supposed to ignore things for random, politically motivated, short-term reasons," Heidi Welsh, executive director of the Sustainable Investments Institute, or Si2, said in an interview. "This is why the air may be leaking out of the anti-ESG balloon."

Ultimately, the debate over ESG must focus on what information players in capital markets need to provide to make such markets function, Daniel Crowley, a partner with K&L Gates LLP, told a December 2022 Bipartisan Policy Center webinar.

"If you look at some of the things coming out in the states, it's clear that we will need to educate people," Crowley said. "One of the benefits of congressional hearings is that we get facts on the record and people starting to look at what the real issues are."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.