S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Dec, 2021

By Jonathan Hemingway

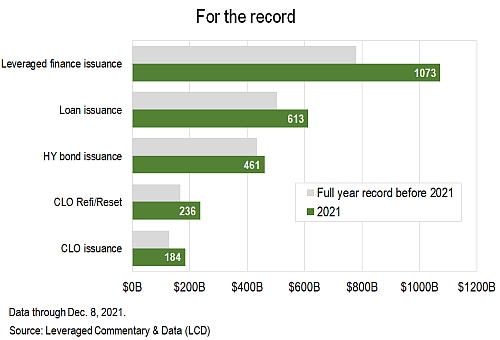

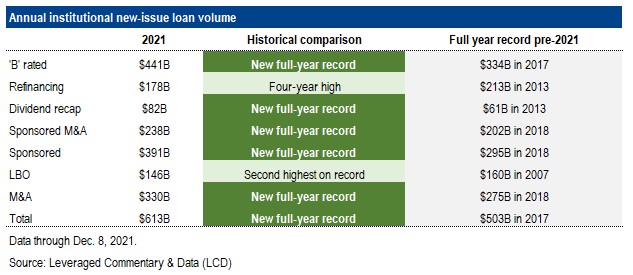

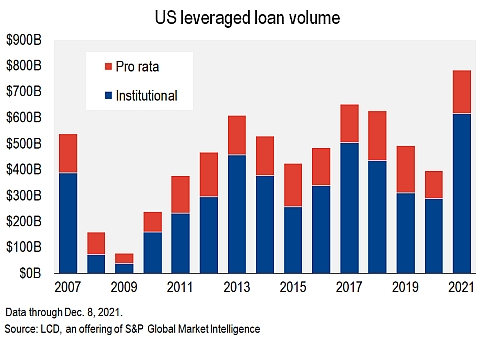

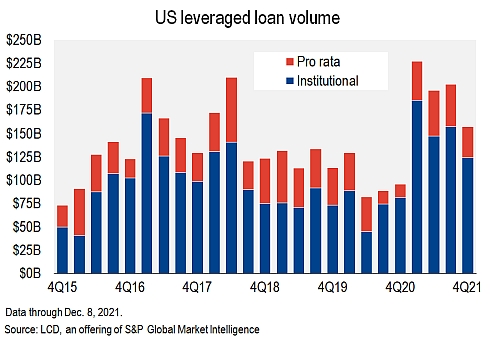

It was a memorable year for the leveraged finance markets as issuance records were felled across the spectrum amid insatiable investor demand in a broad-based rebound from a pandemic-plagued 2020. In the loan market, institutional supply surged to more than $615 billion by year-end, shattering the prior high of $503 billion set in 2017.

The story was the same in the bond market, where high-yield issuance of $464 billion topped 2020's $435 billion, which itself had been a record high. For the first time ever in a calendar year, issuance from speculative-rated companies across the loan and bond markets surpassed $1 trillion.

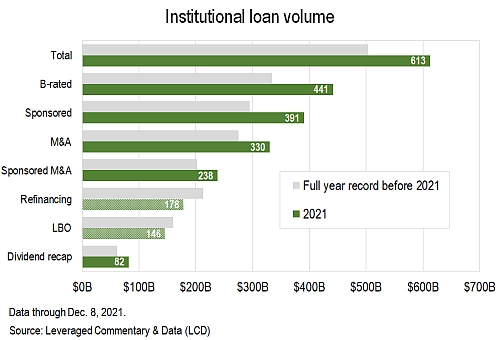

However you slice it, 2021 was a big year in the leveraged loan market. Indeed, with the market awash in liquidity all sorts of records were eclipsed, including for deals supporting M&A, as well as opportunistic endeavors such as dividend recapitalizations.

Even categories that did not make it into record territory were still at multiyear highs: LBO issuance was the second highest, on an annual basis, while refinancing hit a four-year high.

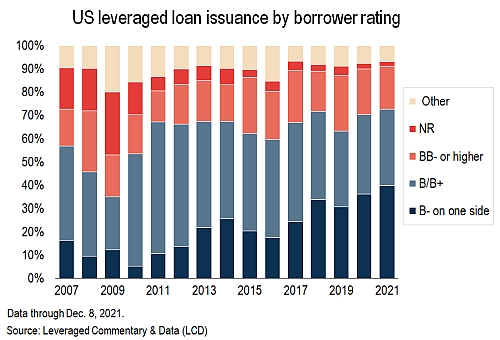

Issuance from single-B rated companies (B+/B/B-), at $440 billion, crushed the prior high water mark of $334 billion. In addition, borrowers rated B-minus by at least one rating agency accounted for a record 40% of total loan issuance in 2021, up from 36% in 2020 and the 23% average since the end of the global financial crisis. In absolute terms, this year's supply from this ratings bucket equates to $244 billion, 66% above the prior annual peak of $147 billion in 2018.

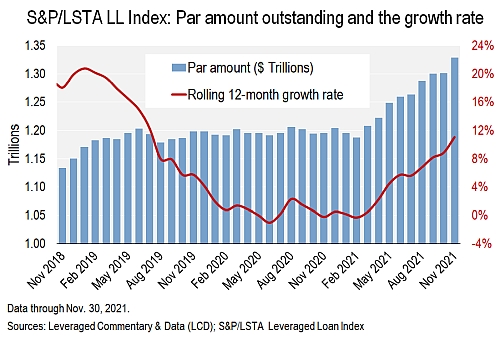

With all the supply, the par amount outstanding tracked by the S&P/LSTA Leveraged Loan Index grew by 11% for the year through Nov. 30, bringing the size of the index to $1.35 trillion, the most ever.

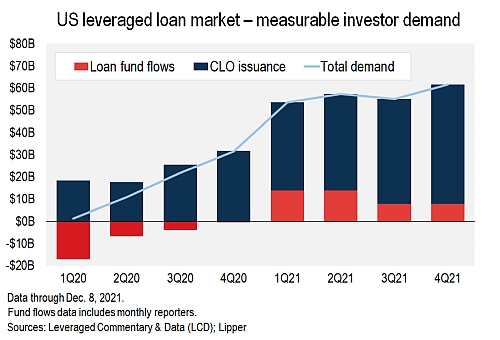

This banner year for issuance was fueled by strong demand from yield-hungry investors. A record-setting run in the CLO market featured issuance of $187 billion, 44% higher than the prior high of $129 billion from 2018. Inflows into loan mutual funds and exchange-traded funds swung to $31.5 billion in 2021, based on Lipper's weekly reporters, from $19.6 billion of outflows in 2020. LCD estimates $44 billion of demand from retail funds this year (including monthly reporters). Combining this with the record-shattering CLO issuance, total measurable demand stands at a whopping $228 billion, the highest reading since LCD began tracking this data 20 years ago. For some perspective, total measurable demand in 2020 was just $65 billion.

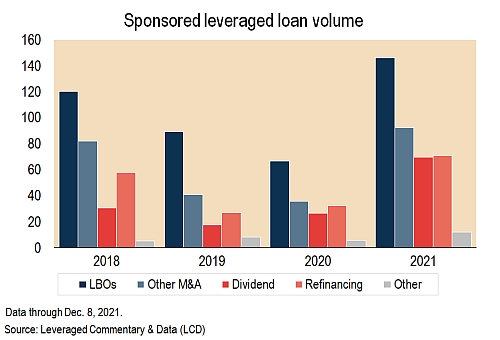

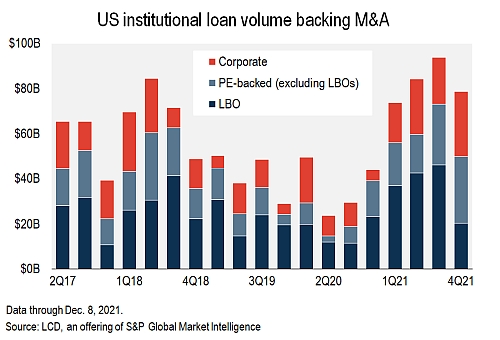

Leveraged loans funding M&A soared to a new high of $330 billion, far outpacing the 2018 full-year record of $275 billion. And with plentiful unspent capital at private equity firms meeting exceptionally low funding costs in 2021 (the average yield-to-maturity of new-issue LBO loans fell below 5% for the first time ever this year), a record $238 billion was driven by sponsored companies. That is 18% higher than the previous record. LBO issuance itself was $146 billion, just 9% shy of the prior high of $160 billion, in 2007.

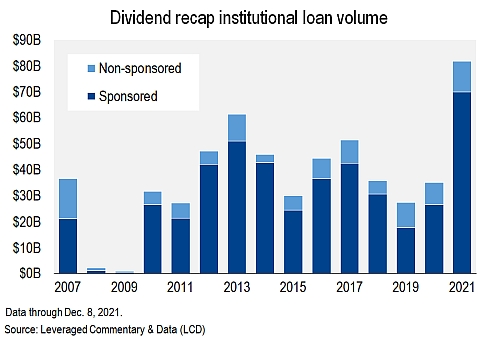

Of course, the surging investor demand opened the door to opportunistic transactions, and borrowers and sponsors did not miss a beat. Dividend recapitalizations rocketed to an all-time high of $81.7 billion in 2021, more than double the $35 billion output from 2020. Sponsored issuers accounted for $69.8 billion of that supply, or 85% of the total.

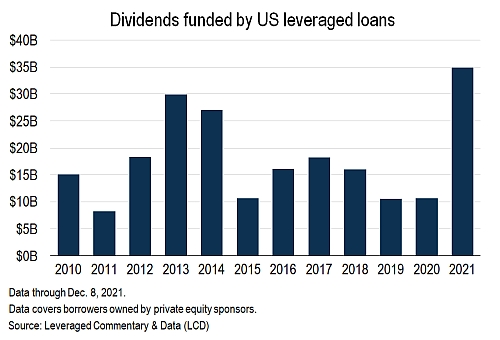

Dividend recapitalizations often include a refinancing of the issuer's existing debt, and that component is included in the volume tally. However, drilling down into the data shows that dividends extracted by private equity-backed companies via leveraged loan transactions in the U.S. were a record $34.9 billion. The prior record was $29.9 billion in 2013.

Regardless of purpose, sponsored issuers were active across the board. From LBOs and M&A to refinancings and recaps, sponsored issuance was either at record levels or at multiyear highs.

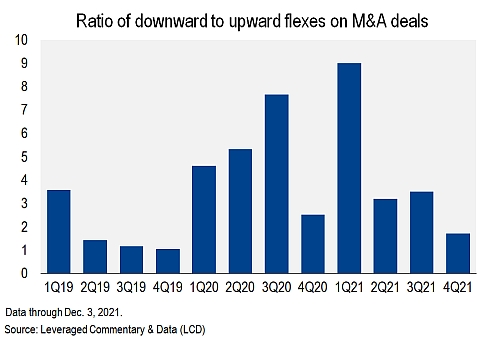

Given the strong demand, it is not surprising to see pricing dynamics tilt decidedly in the favor of borrowers. The ratio of downward to upward price flexes peaked at 9x in the first quarter. That moderated over the following three quarters but still tilted in issuers' favor throughout the year.

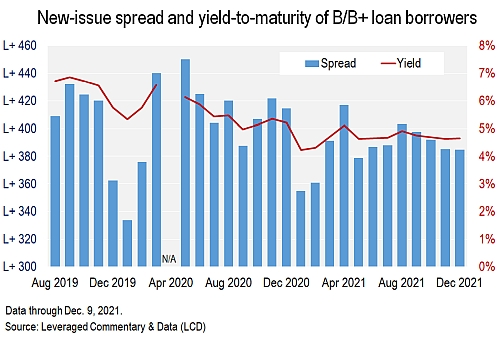

With that, new-issue spreads and yields to maturity remained low throughout the year. The average spread on institutional loans from B/B+ rated issuers held under 400 basis points for most of the year, closing November at 385 bps, and were as low as 355 bps in January. Likewise, the yield-to-maturity for this cohort held under 5% in every month but April.

Looking at the fourth quarter, institutional loan issuance of $124 billion through Dec. 8 marked an easing from the blistering pace set earlier in the year — the $185 billion of issuance in the first quarter set a quarterly record. Still, the fourth-quarter total was higher than any quarterly sum in 2019 or 2020. Deals have been launching well into December, as borrowers and arrangers look to maximize the favorable conditions before books close heading into year-end.

Acquisition-related activity ebbed in the fourth quarter due to a deceleration of LBO supply to $20.4 billion, from $46.1 billion in the third quarter, but private equity-backed companies remained active. Acquisition financing from sponsored borrowers hit a 3.5-year high, at $29.4 billion. Corporate M&A was also strong again, at $28.7 billion, the most ever, with benchmark deals from MKS Instruments Inc. ($4.71 billion), TransUnion ($3.74 billion) and II-VI Inc. ($2.8 billion) accounting for roughly 40% of that total.

Dividend recapitalization volume was also down in the fourth quarter, to $14.5 billion, from $29.6 billion, while refinancings were nearly on par with the prior quarter at $26.8 billion.

Importantly, issuance based on the secured overnight financing rate gathered momentum in the fourth quarter in the institutional loan market. Since the first print of a TLB with pricing pegged to the Sofr benchmark out of the gates, for Walker & Dunlop in October, arrangers have ushered $14.2 billion of deals priced off the Libor alternative. Banks will no longer be able to price new loan originations off Libor as of Jan. 1, although pre-existing loans will have until June 30, 2023, to make the switch.

This story was updated on Jan. 3 to reflect year-end 2021 leveraged loan and high yield bond totals.