Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 1 Mar, 2021

By Luka Vidovic

Highlights

Navigating credit risk in COVID-19 times.

COVID-19 pandemic shockwaves continue to reverberate through the global economy, and forecasts for 2021 are particularly gloomy for the Cruise, Hotels & Resorts sector. Continued high levels of infections, ongoing travel restrictions, and possible changes in consumer demand make this sector particularly vulnerable, and also highly sensitive to the wider availability of effective COVID-19 vaccines.[1]

Since recovery to pre-pandemic levels in this sector is not projected until 2023, or possibly beyond, further credit risk deterioration is likely. To dig deeper into the impact of COVID-19 on economic conditions, we have leveraged RiskGauge from S&P Global Market Intelligence, a statistical credit risk model that combines a company’s financials with macroeconomic risk factors and market-implied information. This provides a comprehensive credit risk assessment to help users better navigate these challenging credit risk trends.

A Deep Look at Credit Risk with S&P Global RiskGauge

The S&P Global RiskGauge model optimally combines the outputs of three standalone credit risk models – CreditModel™ (CM), Probability of Default (PD) Model Fundamentals (PDFN), and PD Model Market Signals (PDMS) – into an overall credit risk score.[2] The integration is tailored to simultaneously leverage the strengths of each of the three standalone models – CM’s long-term and stable credit quality, PDFN’s sensitivity to changes in a company’s fundamentals, and PDMS’s responsiveness to market-implied information. This enables the RiskGauge model to provide an aggregated, well-round, and timely view of a counterparty's creditworthiness. You can read more about this model in “Gauging Credit Risk Through A Multidimensional Lens”.

Royal Caribbean – A Rough Voyage

Royal Caribbean Group (“Royal Caribbean”) is the second-largest cruise operator worldwide.[4] The company recently extended the suspension of sailings for their global fleet for all sailings scheduled through April 2021.[5] This reflects a high degree of uncertainty about the recovery path for Royal Caribbean and indicates a possible further straining of the company’s financial standing.

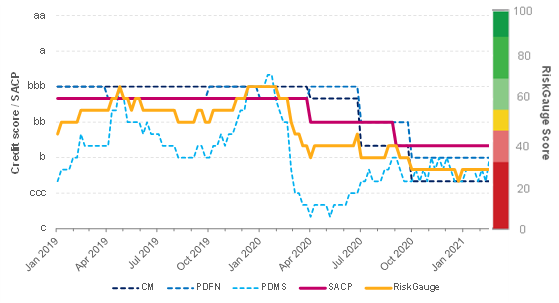

Figure 1 shows the evolution of credit risk for Royal Caribbean from January 2019 to February 2021. Throughout 2019, Royal Caribbean’s creditworthiness was relatively stable. S&P Global Ratings’ stand- alone credit profile (SACP)[6] was at ‘bbb-’. In parallel, the S&P Global RiskGauge score score fluctuated between ‘bbb’ and ‘bb’.[7]

Figure 1: Historical Evolution of Credit Risk for Royal Caribbean Group

Source: S&P Global Market Intelligence. As of February 18, 2021. For illustrative purposes only.

As the pandemic swept across the world at the beginning of 2020, many cruise operators found themselves vulnerable. Forced to cease operations, Royal Caribbean’s revenues evaporated, profitability eroded, and its debt burden increased significantly.

The S&P Global RiskGauge score, driven by PDMS’s early-warning characteristics, promptly reacted to these adverse market conditions and indicated a distressed outlook, resulting in a multiple notch deterioration. As each subsequent quarterly financial statement for the company showed progressively weaker financial fundamentals, the S&P Global RiskGauge score deteriorated further, leveling off at ‘b-’ by the end of 2020. Throughout 2020, S&P Global Ratings’ SACP was also downgraded multiple times, ending 2020 at ‘b+’. It was placed on CreditWatch negative, reflecting a heightened likelihood of further downgrade within the next few months.[8] Here we also note that the S&P Global RiskGauge score deteriorated a few weeks prior to the consecutive changes in the S&P Global Ratings SACP, providing a timely early warning signal of elevated credit risk.

As vaccines start to become more widely available and travel restrictions loosen, Royal Caribbean will be able to start to resume its operations, and its creditworthiness could start to gradually improve. The market-implied PDMS has already recovered from its lowest point recorded in April 2020, reflecting this positive market outlook for recovery in the post-COVID-19 world. However, the company’s financial fundamentals remain stressed, and the S&P Global RiskGauge score continues to show highly-elevated credit risk overall.

Credit Risk Radar – Green Shoots

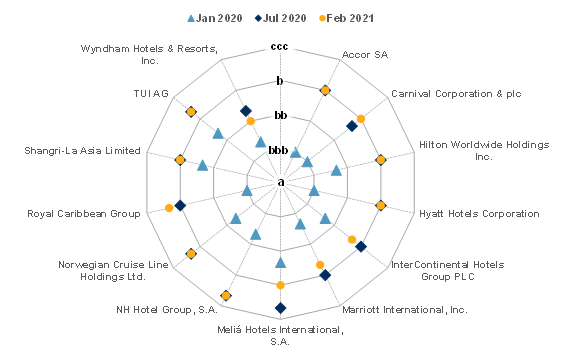

Looking at the broader Cruise, Hotels & Resorts sector, the fallout of the COVID-19 pandemic is similar to the example of Royal Caribbean. Figure 2 shows an evolution of credit risk for a selected set of larger corporations in this sector.

Figure 2: S&P Global RiskGauge Score - Cruise, Hotels & Resorts Sector

Source: S&P Global Market Intelligence. As of February 8, 2021. For illustrative purposes only.

At the beginning of 2020, the S&P Global RiskGauge scores for the majority of companies in the sample congregated in the lower investment-grade, higher speculative-grade space. However, the global nature of the pandemic, accompanied by government-imposed restrictions, severely impacted creditworthiness in this sector. By July 2020, S&P Global RiskGauge scores of the selected companies deteriorated substantially towards an average score of ‘b’, reflecting the breadth and depth of the COVID-19 impacts. In the second half of 2020, companies mostly managed to shore up their financials, limiting further deteriorations in credit scores. Some large hotel chains, such as Meliá Hotels International, S.A., Marriott International, Inc., and InterContinental Hotels Group PLC, are already seeing tentative signs of recovery and small improvements in their credit scores. However, an overall still weak credit risk profile points to high sensitivity to further prolonged operational disruptions and a long way ahead to get back to smooth sailing.

Parting Thoughts

Royal Caribbean, as well as other companies in the Cruise, Hotels & Resorts sector, are faced with a difficult financial situation and will need to navigate long-term impacts on their business risk profile. Tracking fast-changing credit conditions highlights the need to consider multiple credit risk metrics simultaneously to obtain an informed view of a company’s creditworthiness. By combining the outputs of the three standalone credit risk models, the S&P Global RiskGauge model brings together market-implied and fundamental-based information to provide a comprehensive and timely assessment of credit risk that help support an informed decision-making process.

Learn more about S&P Global RiskGauge here.

[1] S&P Global Ratings: “Hotels, Gaming, And Leisure - It Will Be Darkest Before The Dawn For Some, Lights Out For Others”, Industry Top Trends 2021, December 2020.

[2] S&P Global Market Intelligence: “RiskGauge Model from S&P Global Market Intelligence”, White Paper, June 2020.

[3] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[4] S&P Global Ratings: “Royal Caribbean Cruises Ltd.”, Full Analysis, August 5, 2019.

[5] Royal Caribbean Group: “Royal Caribbean Announces Global Suspension of Cruising”, Health and Travel Alerts, January 21, 2021.

[6] The SACP is S&P Global Ratings' opinion of an issuer's creditworthiness in the absence of extraordinary support or burden.

[7] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[8] S&P Global Ratings: “Royal Caribbean Cruises Ltd. Ratings Placed On CreditWatch Negative Following Extension Of Suspension Of Cruises”, Research Update, December 8, 2020.

Products & Offerings