S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 29 Aug, 2024

Climate and sustainability risks have necessitated that banks evaluate the impact of climate risk on counterparties, such as borrowers, issuers, and supply chain partners. Scenario Analysis has emerged as a strategic tool to envision plausible pathways and assess the resilience of existing business models amidst these scenarios. Recognizing the vulnerabilities the climate transition poses to the financial system, regulators around the globe are conducting climate-related stress tests with banks within their jurisdictions.

Earlier this year, S&P Global Sustainable1 hosted a Spanish edition of its Compass Series in Madrid, a program of events held across Europe to provide attendees with essential sustainability information and practical knowledge. This session with S&P Global specialists and sustainability leaders focused on the growing importance of climate risk to Spanish banks, the latest approaches to managing exposure, and the requirements formulated by the European Central Bank (ECB) for the assessment of these risks.

The session delved into the challenges banks face to develop a robust and comprehensive view of climate risk and incorporate this into their stress testing frameworks, including:

This blog summarizes the main highlights of the session and is organized into four sections:

1. The Evolving Climate Regulation Landscape

The Green Asset Ratio (GAR)

The GAR is the ratio of a bank’s loans and securities meeting the EU environmental taxonomy (including European green bonds) to most on-balance sheet banking book assets. Used as part of a broader set of tools, the GAR will eventually serve as a useful metric to determine which institutions are likely to be outperformers or laggards in the green finance arena.[1]

While the GAR is a positive step toward greater transparency and may encourage growth of sustainable financing, the design appears to particularly penalize certain banks due to their business models or asset allocation. For example, banks with significant non-EU nonfinancial corporate (NFC) exposures and/or small- and medium-sized enterprise (SME) exposures are likely to report relatively lower GARs, since these assets are excluded from the GAR numerator but included in the denominator. Beyond that, the lack of harmonization on energy performance certificates (EPC) labeling of mortgages will likely cause significant differences across banks' reported GARs. Over time, several legislative changes should address these challenges and make GARs gradually more comparable.[2]

Climate Stress Tests

Many jurisdictions around the world are developing climate stress tests, with the European Central Bank’s (ECB) Climate Stress Test (CST) being one of the most comprehensive[3]. The ECB is required to carry out annual stress tests on supervised entities in the context of its Supervisory Review and Evaluation Process and, in 2022, undertook a CST among EU institutions. The test was described as a joint learning exercise with pioneering characteristics aimed at enhancing capacity to assess climate risk, both for banks and regulators.

The 2022 exercise found that over 85% of banks had at least basic practices in place for most of the areas addressed by the ECB’s expectations. Banks had made progress in the materiality assessment (i.e., identifying issues most important to the business), but strategic responses were still at an early stage of development, the approaches lacked methodological sophistication and, in most cases, the work was qualitative.

The ECB expects institutions to be fully aligned with all supervisory expectations by the end of 2024 at the latest. Those not aligned will be required to submit an implementation plan to address the weaknesses identified.[4]

Climate-related and environmental (C&E) disclosure

According to the ECB 2022 findings, most significant institutions were disclosing at least basic information on C&E risk. However, the level of disclosure was considered insufficient for about 75% of the institutions, although they outperformed global peers. In addition, only 35% of the banks disclosed information on their exposure to other environmental risks, most often biodiversity loss.[5]

The European Banking Authority (EBA) has numerous quantitative templates on climate transition and physical risks that require banks to disclose:[6]

They must also provide Key Performance Indicators (KPIs) on financing activities that are environmentally sustainable according to the EU taxonomy (i.e., the Green Asset Ratio (GAR) and the Banking Book Taxonomy Alignment Ratio (BTAR)).

Materiality

The ECB sees banks’ materiality assessments as a crucial precondition for managing climate and environmental risks.

Overall, the ECB says materiality assessments are becoming more robust, with most banks now submitting a meaningful overview of material C&E risk exposures for each risk category and across different time horizons to their management bodies.[7] However, there are still gaps, such as:

Looking ahead

Looking ahead, the EBA is consulting the draft guidelines on the management of Environmental, Social and Governance (ESG) risks for the following months and will be finalized by end of 2024.

The ECB expects all banks under their supervision to be fully aligned with all their supervisory expectations on the sound management of C&E risks by end of 2024.

To help banks advance their C&E risk management, the ECB has published the good practices observed in both the climate stress test and the thematic review, and they will also be closely monitoring progress towards meeting the supervisory deadlines. And, if necessary, the ECB will use all the measures in their toolkit to ensure the sound management of C&E risks, including imposing periodic penalty payments but also setting Pillar 2 capital requirements as part of the annual Supervisory Review and Evaluation Process if necessary to cover not properly managed risks.

2. Physical risks in Spain

Physical risks can be acute (driven by an event such as a flood or storm) or chronic (arising from longer-term shifts in climate patterns), presenting increasing financial risks, including damage to assets, interruption of operations and disruption to supply chains.

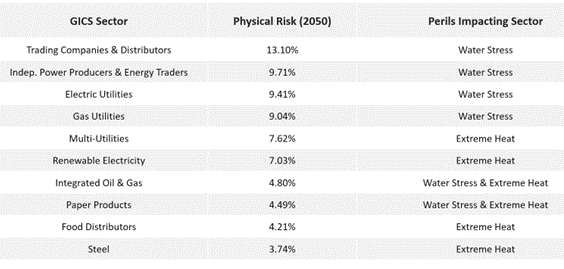

Risks vary by location and industry. Figure 1 shows the most at risk industries and impacts within the country.

Figure 1: Most at-risk industries in Spain

Source: S&P Global, March 2024. For illustrative purposes only.

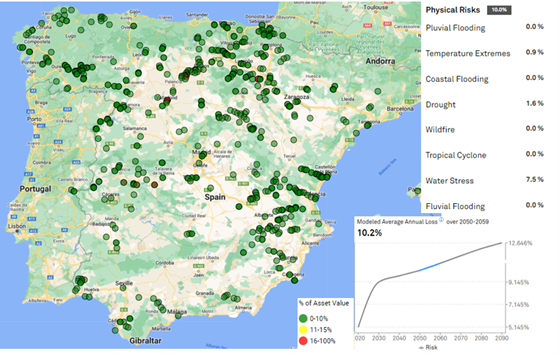

Figure 2: A large electric company’s asset exposure

Source: S&P Global, Climanomics Platform, March 2024. For illustrative purposes only.

The figure illustrates the percentage of each asset's value at risk from Physical Risk for a Spanish Utility company, as determined by S&P's Modelled Average Annual Loss metric. This metric quantifies an asset's vulnerability to physical risk hazards. The potential asset value at risk is categorized by the magnitude of impact on the asset, up to 100% of its total value.

Banks are involved with a wide array of companies spanning various sectors, requiring an in-depth assessment of the impact posed by climate-induced risks on both lending and investment portfolios.

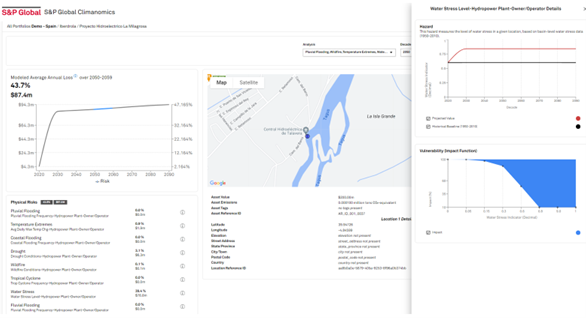

The Climanomics platform has a growing library of proprietary impact functions that model the vulnerability of 280+ different asset types to climate-related hazards, based on a wide range of factors specific to each one.[8] For example, the impact to a vineyard from temperature extremes will be different than the impact to a data center. Figure 3 below zooms in on the electric company’s plant in Toledo, Spain. The bottom left-hand corner shows the exposure to different physical risks. The top right-hand corner presents an impact function (i.e., the expected vulnerability).

Figure 3: Utility company’s hydroelectric plant in Toledo, Spain

Source: S&P Global Climanomics Platform, March 2024. For illustrative purposes only.

3. Climate Scenario-Adjusted Corporate Financial Impacts

The ECB’s 2022 exercise found that climate risk factors had not yet been fully considered. Specifically: (i) the sectoral dimension was often not properly reflected in banks’ credit risk models, (ii) climate risk variables were mostly captured using proxies (e.g., with respect to emissions), the quality of which was highly variable across institutions, and (iii) with carbon prices often being the only climate-related explanatory variable, the existing credit risk models were not incorporating all relevant climate risk channels.[9]

Banks, face challenges regarding how to model loss projections over a 30-year time horizon, characterize extreme weather events and anticipate changes in customers’ behaviors, which is one of the main triggers of transition risk. It is also crucial to be able to identify possible opportunities given a company’s transition plan or adoption of a technology.

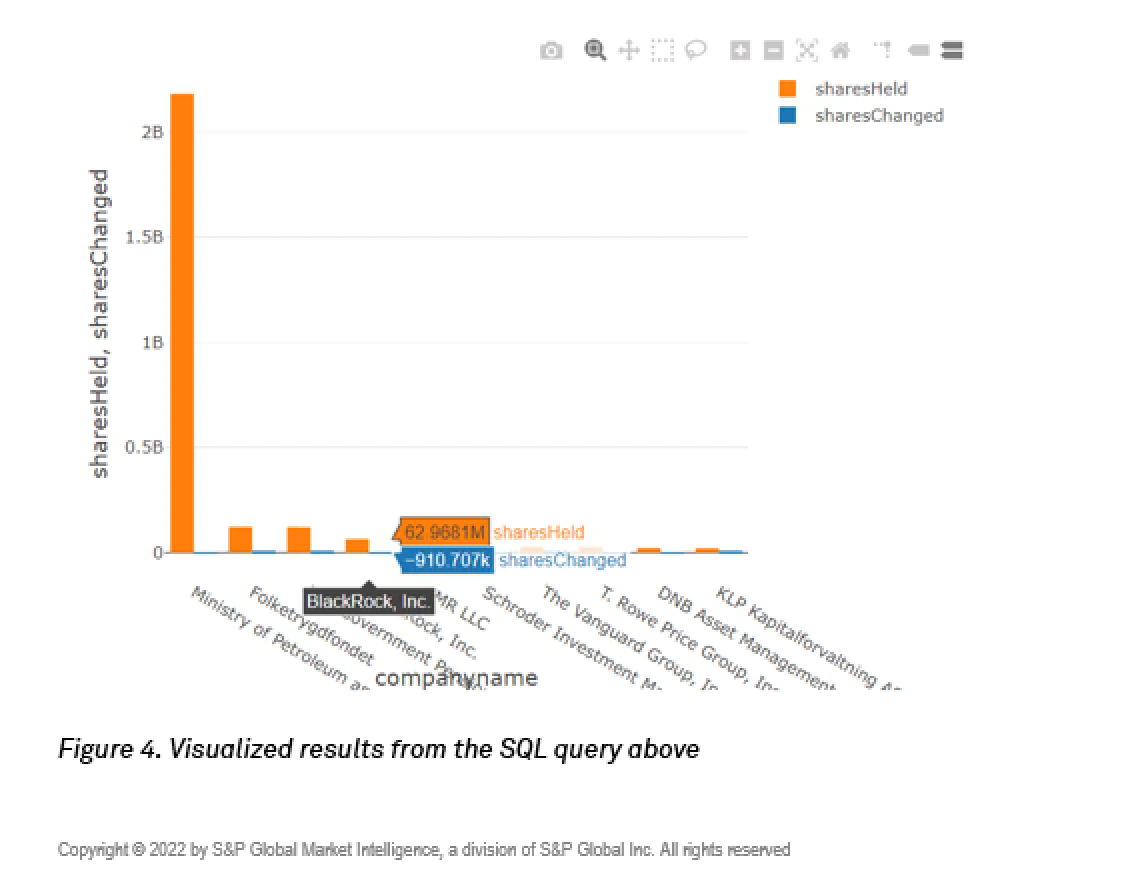

In response, S&P Global Market Intelligence and Oliver Wyman[10] developed Climate Credit Analytics, a climate scenario analysis and credit analytics model suite. Climate Credit Analytics translates climate scenarios into drivers of financial performance tailored to an industry, such as production volumes, fuel costs, and capex spending. These climate analytics drivers are then used to forecast complete company financial statements under various climate scenarios.

Climate Credit Analytics covers high-carbon emitting sectors, such as oil and gas, power generation, metals and mining and airlines. In addition, an emissions-based approach is available for construction, agriculture and other non-financial sectors. Figure 4 shows how Climate Credit Analytics works.

Figure 4: Considering sector-level specificity

Source: S&P Global, March 2024. For illustrative purposes only.

Climate scenarios are expected to impact all drivers of financial performance for power generation companies. Figure 5 looks at the revenue and profitability projections for a Spanish electricity producer under different scenarios. This company benefits from a strong renewable share (52%) in its production, which makes it less sensitive to the energy transition, whatever the scenario. Nevertheless, revenues in Net Zero 2050 are slightly higher due to higher volumes in that scenario (i.e., stronger electrification of the economy and demand for renewables). The EBITDA margin impact is largely due to physical risk from 2030. As a function of both the scenario and asset location, the impact is greatest in Net Zero 2050.

Figure 5:Climate scenario adjusted projections of revenues and profitability

Source: S&P Global, March 2024. For illustrative purposes only.

4. Key takeaways

Spanish and other European banks are vulnerable to climate-related credit risks. Climate stress tests will continue to become more important and may have a more direct impact on capital requirements in the future.

In January 2024, the ECB announced that it will expand its work on climate change, identifying three focus areas that will guide its activities in 2024 and 2025:[11]

As the regulatory and reporting landscape evolves, it becomes increasingly important for companies to measure and manage their climate risks.

[1] Your Three Minutes In Climate Disclosure: Benefits And Limitations Of The Green Asset Ratio For EU Banks,

https://www.capitaliq.spglobal.com/web/client#ratingsdirect/creditResearch?rid=3151380

[2] Defined as the share of assets included in the GAR numerator relative to all GAR assets. Source: Bank disclosures, S&P Global Ratings

https://www.capitaliq.spglobal.com/web/client#ratingsdirect/creditResearch?rid=3151380

[3] Presentation used ECB Thematic Review November 2022

https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.thematicreviewcercompendiumgoodpractices112022~b474fb8ed0.en.pdf

[4] ECB report on good practices for climate stress testing,

https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202212_ECBreport_on_good_practices_for_CST~539227e0c1.en.pdf

[5] Good practices for climate related and environmental risk management,

https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.thematicreviewcercompendiumgoodpractices112022~b474fb8ed0.en.pdf

[6] Final draft implementing technical standards on prudential disclosures on ESG risks in accordance with Article 449a CRR,

https://www.eba.europa.eu/sites/default/files/document_library/Publications/Draft%20Technical%20Standards/2022/1026171/EBA%20draft%20ITS%20on%20Pillar%203%20disclosures%20on%20ESG%20risks.pdf

[7] You have to know your risks to manage them – banks’ materiality assessments as a crucial precondition for managing climate and environmental risks,

https://www.bankingsupervision.europa.eu/press/blog/2024/html/ssm.blog080524~d4ed83af2c.en.html

[8] S&P Global, Climanomics Platform. Data as of August 2024

[9] Presentation used ECB Thematic Review November 2022

https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.thematicreviewcercompendiumgoodpractices112022~b474fb8ed0.en.pdf

[10] This is an independent consulting firm and is not affiliated with S&P Global or any of its divisions.

[11] Good practices for climate related and environmental risk management,

https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.thematicreviewcercompendiumgoodpractices112022~b474fb8ed0.en.pdf