Content availability and ease of use were common themes at the StreamTV Show in Denver, June 6-8, but panelists from four major TV manufacturers, LG, VIZIO, Sony and Samsung stressed that, as Katherine Pond, Vice President of Business Development at VIZIO, said platforms and services want "as much control as a part in that experience as they can have." Susan Agliata, Director of Business Development, OTT Partnerships at Samsung, laid out the situation that users are "frustrated because they can't find what they want to watch," but the problem will likely remain unresolved since services still tend toward a walled garden approach. So, while these platforms strive to offer up the content users want regardless of the source, all four have a free ad-supported TV, or FAST, service they undoubtably want consumers to use over their competition’s offerings.

Dedicated smart TV FAST services have some advantages over the competition, such as voice search, home screen content placement and direct user data. Pond called attention to the user data, saying that VIZIO is "not looking to get into the originals game," but rather it is securing exclusive premiers and partnerships for "the content we know [our device users] want." Despite these advantages, smart TV streaming services have an uphill battle for drawing in users.

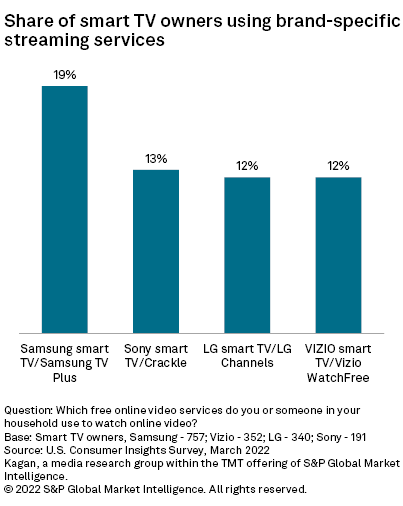

According to data from Kagan's U.S. Consumer Insights survey, conducted in March, only 19% of Samsung smart TV owners indicated they used the Samsung TV Plus streaming service exclusive to that ecosystem. LG and VIZIO smart TV owners were even less likely to use the corresponding services at 12% for both LG Channels and VIZIO WatchFree. According to the survey, 13% of Sony smart TV owners use Crackle, which is co-owned by Sony and unlike the other services is available outside the Sony ecosystem.

A drawback for device-specific streaming services is that consumers mix and match their TV. Results from the survey also indicated that only 37% of households with multiple smart TVs stick to just one brand. Another hurdle to access for these services is that many consumers are using streaming media devices instead of directly connecting their TV to the internet.

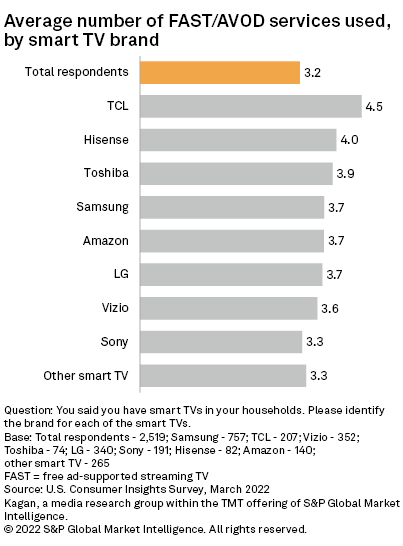

Dedicated smart TV streaming services also have the challenge of drawing in users, as the average smart TV owner is already using multiple FAST/AVOD services. TCL owners used the highest number of these services on average at 4.5, however, owners of other brands were more in line with total respondents at 3.2 FAST/AVOD services on average. This presents two scenarios: Either smart TV owners are open to using new services, or these device-specific services will have trouble standing out for consumers already using a handful of other services.

Data presented in this article was collected from Kagan's Q1'22 U.S. Consumer Insights survey conducted in March 2022. The survey totaled 2,519 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded to the nearest whole number.